BlackRock’s Bitcoin Spot ETF (IBIT) surpassed $1 billion in inflows in the first two hours of trading today. This came despite record capital outflows earlier in the month, demonstrating a remarkable recovery for the product.

Bitcoin ETFs remain significantly ahead of Ethereum-based products, and analysts believe they will continue to dominate even if the SEC approves more altcoin ETFs.

BlackRock’s IBIT Rebounds Strongly

IBIT, BlackRock’s Bitcoin ETF, has had stellar performance over the past six months. Although it temporarily encountered record capital outflows this January, it is now on a strong recovery path.

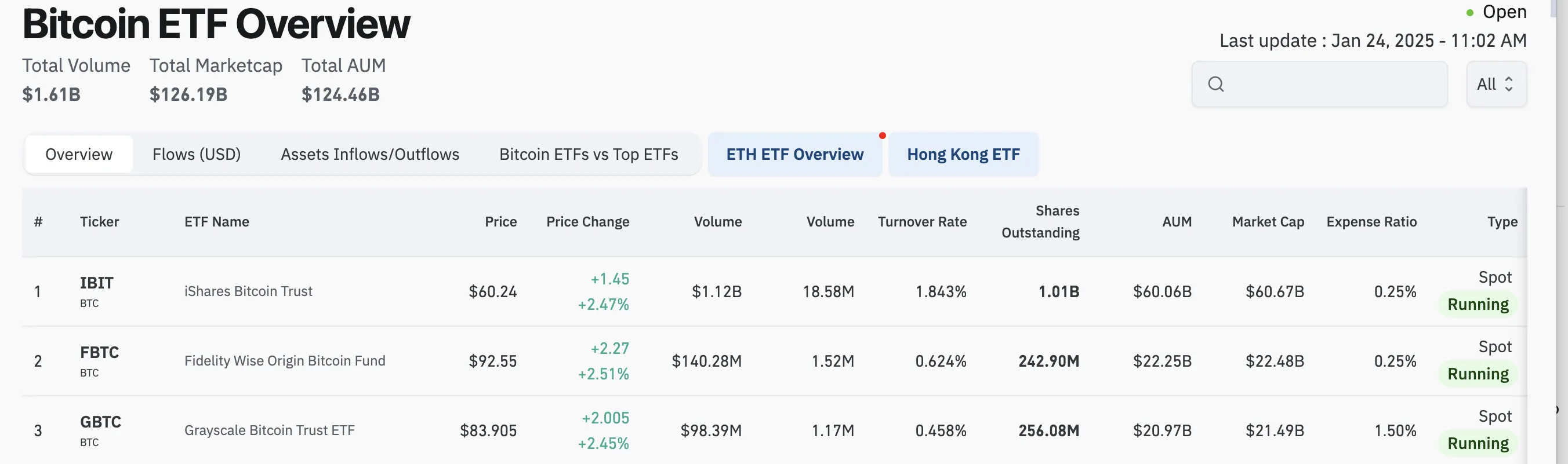

According to data by Coinglass, this ETF saw over $1 billion in trading volume in just the first two hours of today.

The above data shows that this increase is not just for BlackRock or IBIT. Instead, all Bitcoin ETFs are doing well, possibly because BTC has found solid support at the $105K USD mark.

There were several regulatory developments in favor of cryptocurrencies in the United States yesterday. Most notably, the SEC rejected the controversial SAB 121 bulletin, which allowed banks to custody Bitcoin without hindrance. This positive move is likely to have prompted retail investors to pile into the ETF market today.

Furthermore, BlackRock CEO Larry Fink believes that institutional adoption will push its value as high as $700,000. ETF analyst Eric Balchunas has explain Differences between Bitcoin and all other cryptocurrency products:

“Spot Bitcoin ETFs are quietly on fire to start the year, with inflows of $4.2 billion, accounting for 6% of total ETF inflows. Now +$40B net since launch with AUM reaching $121B and 127% profitability. In this context, Ether ETFs look +130 million USD YTD, not bad, but for this reason, BTC is on another level and will completely dominate this category,” he asserted.

Data of Arkham Intelligence also revealed that BlackRock bought over $600 million in Bitcoin yesterday, helping create more IBIT shares.

The ETF issuance team continuously buys large amounts of Bitcoin. However, BlackRock clearly outperforms them in every category.

After all, IBIT’s trading volume is just one factor in BlackRock’s current ETF success. The company recently released the Canadian version of IBIT. Additionally, NASDAQ ISE recently lobbied the SEC to raise options trading limits on IBIT.

Either way, BlackRock proves once again that IBIT is one of the most successful ETFs ever, and not just in the crypto space. Bitcoin ETFs have brought massive amounts of capital to the cryptocurrency space, changing the industry forever.

What may happen in the future remains unclear, but BlackRock has all the tools to deal with many never-before-seen market factors.