[ad_1]

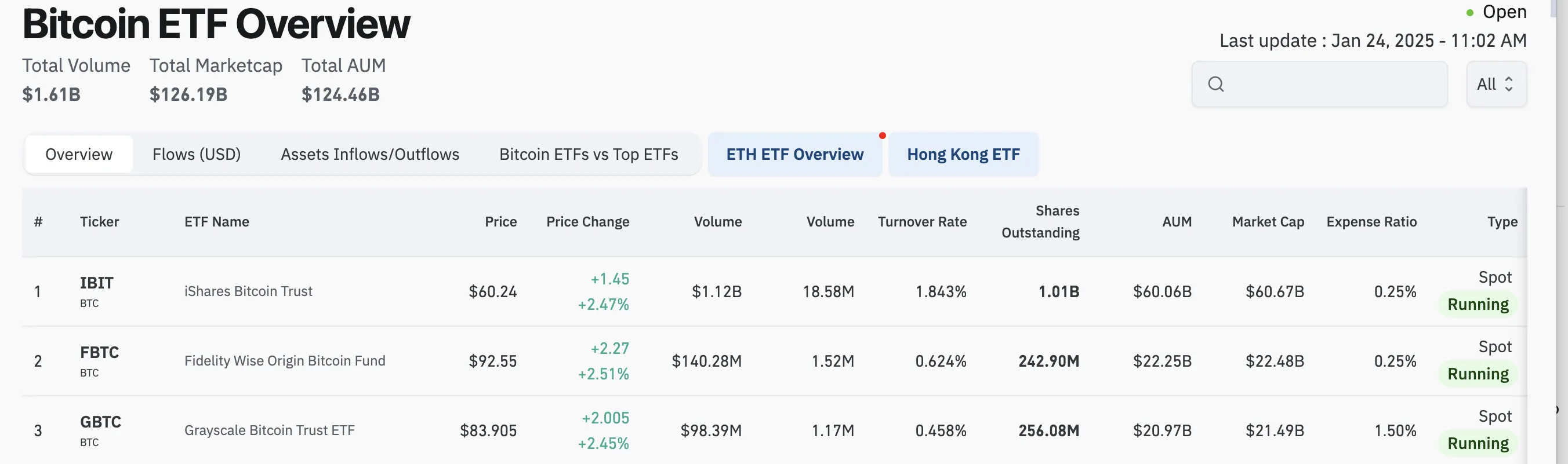

Blackrock’s spot Bitcoin ETF (IBit) has surpassed 1 billion USD of capital flows in the first two hours of trading today. This happens despite the previous record withdrawal of the month in the month, showing the remarkable recovery of this product.

Bitcoin ETFs still lead to significant Ethereum -based products, and analysts believe they will continue to dominate even when the SEC approves more altcoin ETFs.

Blackrock’s ibit is strongly recovered

IBit, Bitcoin ETF of Blackrock, has been outstanding in the past six months. Although temporarily encountered a record capital flow in January, it is now on the way to recover strongly.

According to data Of the coinlass, this ETF witnessed more than 1 billion USD of trading volume in the first two hours of today.

The above data shows that this increase is not only Blackrock or IBit. Instead, all Bitcoin ETFs are working well, maybe because the organizers have found a solid support level at $ 105k.

There are a number of developments that support cryptocurrencies in the United States yesterday. Most notably, SEM rejected the controversial SAB 121 news, allowing banks to be able to deposit Bitcoin without any obstacles. This positive move is likely to motivate retail investors to focus on the ETF market today.

Moreover, the CEO of Blackrock, Larry Fink, believes that the acceptance of organizations will push its value up to $ 700,000. ETF Eric Balchunas analysts explain The difference between Bitcoin and all other cryptocurrencies:

“The spot Bitcoin ETF is silently burning to start the year, with a capital of 4.2 billion USD, accounting for 6% of the total ETF capital flows. Currently, +40 billion USD from the launch with AUM reached 121 billion USD and a profit of 127%. In this context, Ether ETFs seem to be +130 million USD, not bad, but for this reason, BTC is at a different level and will completely dominate in this genre, ”he said.

Data Arkham Intelligence also revealed that Blackrock bought more than $ 600 million Bitcoin yesterday, helping to create more IBit shares.

The ETF release team continuously buys a large amount of Bitcoin. However, Blackrock clearly surpasses them in every category.

After all, IBit’s trading volume is only a factor in BlackRock’s current ETF success. The company has just released the IBit version for the Canadian market. In addition, NASDAQ ISE has recently campaigned SEC to raise the option transaction limit on Ibit.

Anyway, Blackrock once again proves that IBit is one of the most successful ETFs ever, not only in the field of cryptocurrencies. The Bitcoin ETF has brought huge capital to cryptocurrency space, changing this industry forever.

What could happen in the future is still unknown, but Blackrock has all the tools to deal with many market factors that have never been seen before.

[ad_2]