[ad_1]

Last week’s rally in Binance Coin (BNB) selling price was rejected from a descending trendline. However, a latest information mentioned that Binance coin has rolled out its initially quarterly Automatic recording assistance BNB traders. Automatic recording prospects to eliminated a complete of one,684,387.eleven BNB from its circulation, like the 6296,305493 BNB that was burned for the duration of the Pioneer Program Burn.

Main technical factors:

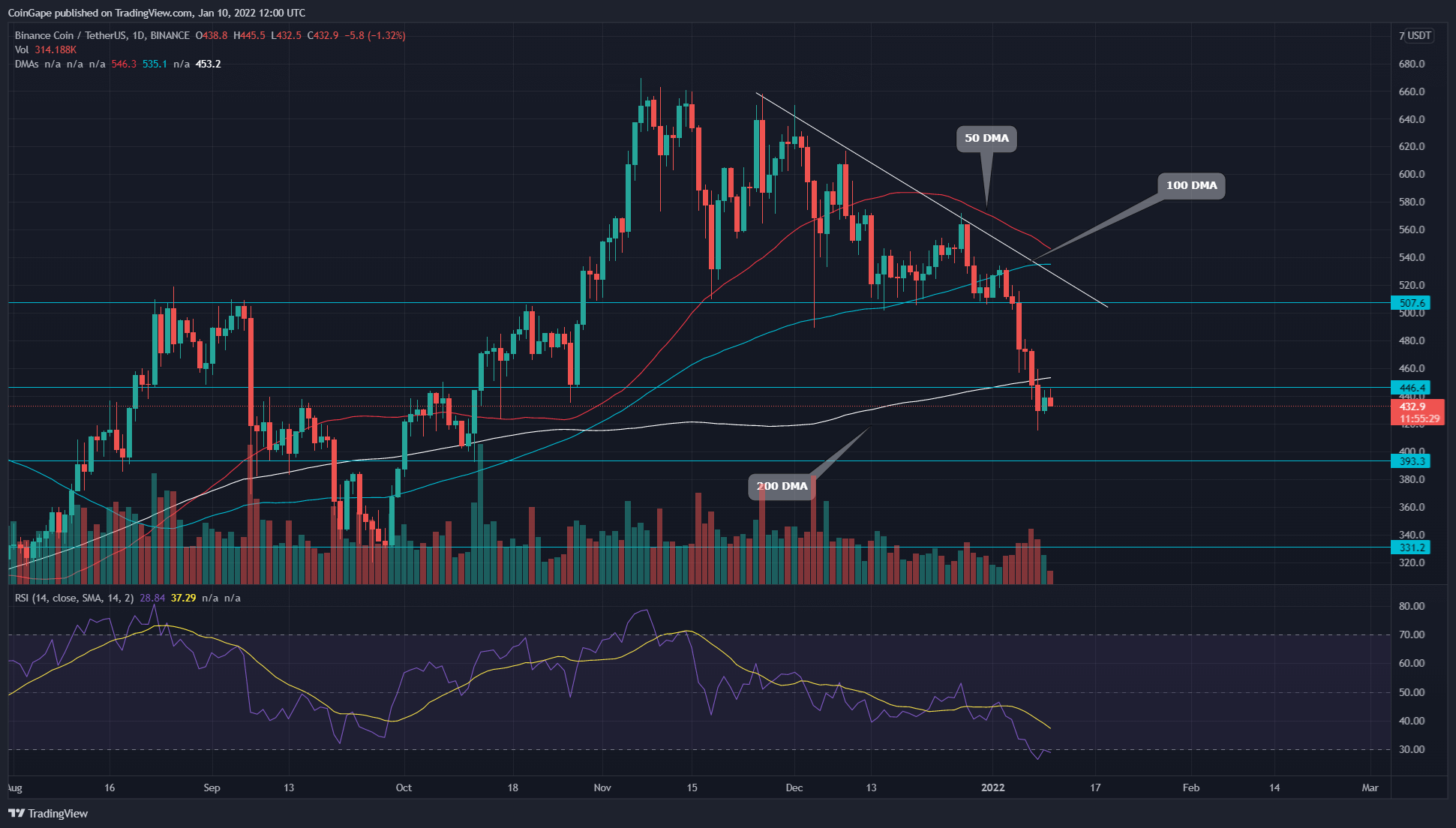

- BNB funds bears threaten to sink 200-day SMA

- Daily RSI is not coming into bullish zone

- The 24-hour trading volume on Binance Coin is $two.twelve billion, displaying a seven.five% enhance.

Recently when we covered an report about Binance Coin, the BNB/USD pair bounced back from the .618 Fibonacci assistance and commenced a V-shaped recovery in its chart. However, the selling price failed to break over the mixed resistance of the vital $500 resistance degree and the descending trend line.

This resistance trendline has interrupted any upside try considering that the correction started in December 2021. Until this trendline is intact. costs will proceed to go down.

On January five, an extreme promote-off in the crypto markets brought on a drop from the important assistance region. The BNB selling price chart exhibits 4 consecutive red candles, leading to the selling price to drop 15.five%.

With marketing underway, BNB has reverted to a retest of the 200 SMA. If the currency sustains assistance of this EMA, the selling price could retrace the dynamic resistance trendline for a bullish breakout.

The slope of this day by day Relative Strength Index (41) has rejected from neutral (50) and dropped back into oversold territory.

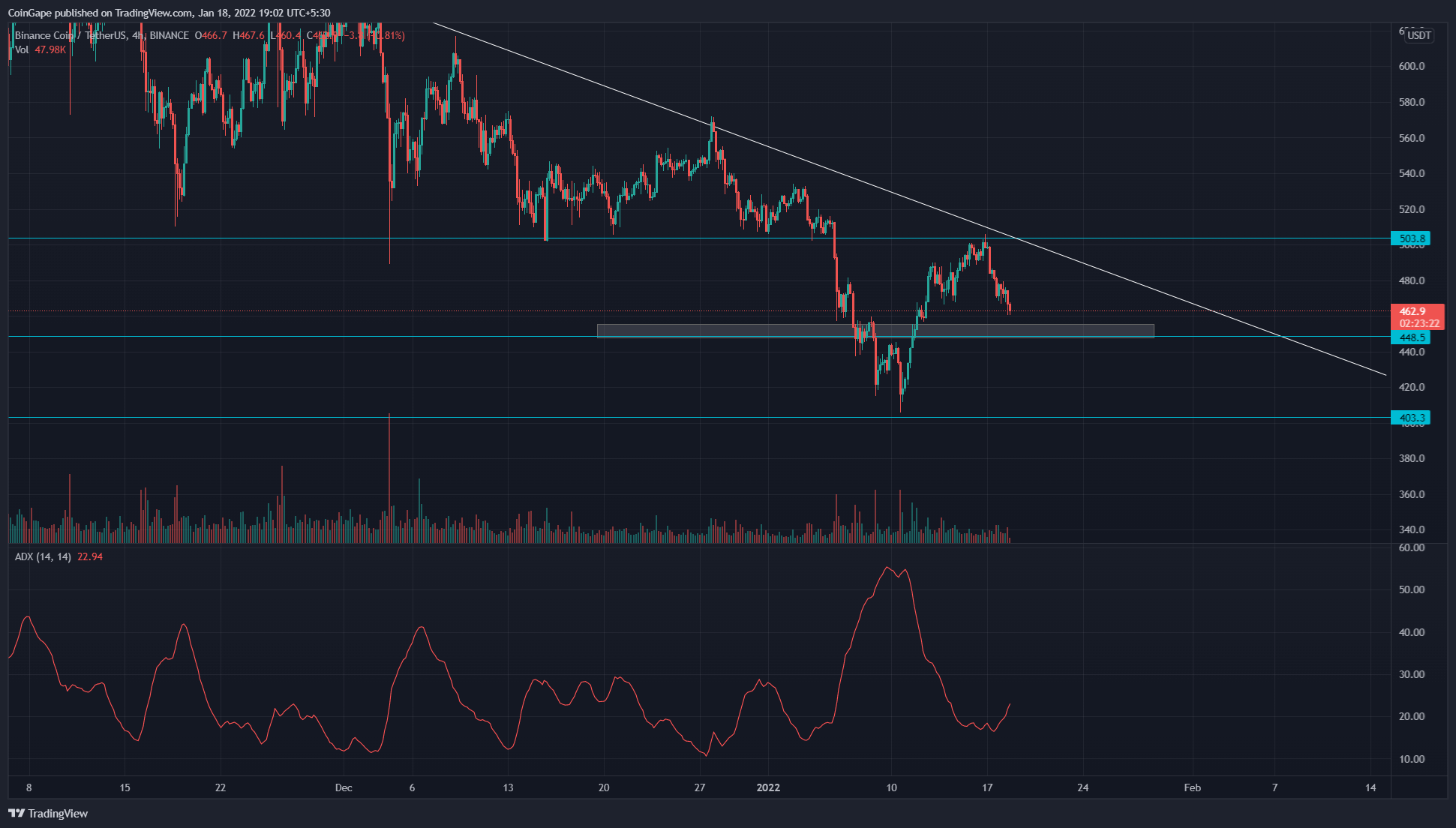

BNB selling price is striving to sustain over $450 . mark

Before this downward rally can attain the latest reduced assistance of $400, BNB selling price faces a confluence assistance of .five FIB and $450 amounts. Violation of this powerful region of interest, selling price action will supply even more confirmation to lengthen its correction phase

The Average Directional Momentum Index (23) exhibits considerable downside momentum due to the latest rally. However, the slope has commenced to enhance once more as coin costs proceed to fall once more.

- Resistance: $500, $570

- Support Level: $450, $400

[ad_2]