The BNB price is just 10% away from its previous all-time high, up 181.79% this year as it continues to display a strong market performance. However, recent indicators, including ADX and Ichimoku Cloud, suggest that the current uptrend may be losing steam.

While the bullish structure remains intact with key resistance levels at hand, momentum will need to consolidate for BNB to surpass its previous highs.

BNB’s Current Uptrend May Not Sustain

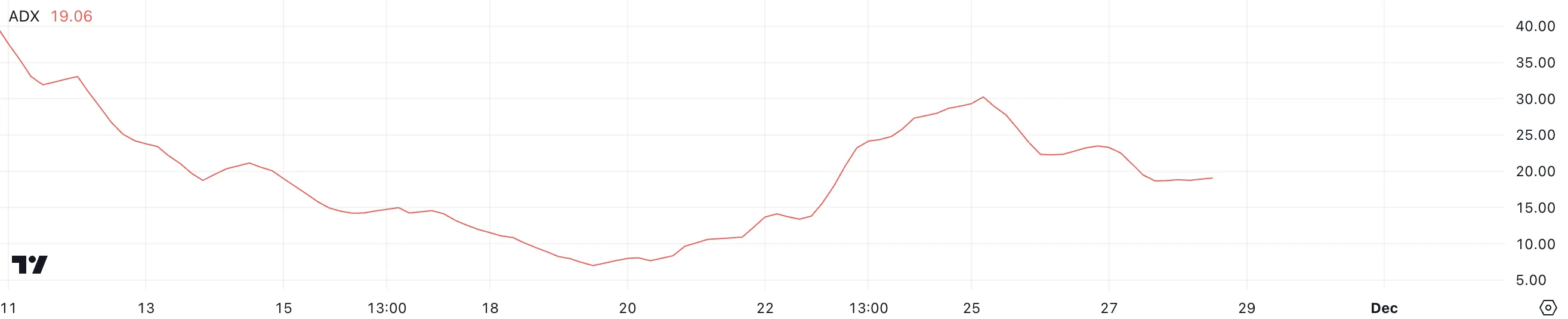

BNB’s ADX index is currently at 19, down from above 30 just two days ago, signaling a weakening trend. ADX, or Average Directional Index, measures the strength of a trend on a scale of 0 to 100 without specifying its direction.

Values above 25 indicate a strong trend, while values below 20 indicate a weak or no trend. The decline in ADX suggests that, although the BNB price remains in an uptrend, the momentum driving it has weakened significantly.

With ADX at 19, BNB’s current uptrend does not appear to be as strong as it has been in recent days, pointing to a possible period of consolidation or reduced buying pressure.

For the uptrend to regain strength, ADX needs to break above 25, confirming a recovery in momentum. Until then, BNB price could move sideways or face increased resistance in maintaining its bullish trajectory.

BNB’s Ichimoku Cloud Shows Mixed Signals

The Ichimoku Cloud chart for BNB is currently showing a mixed trend. The current price is slightly above Kijun-Sen (orange line) and Tenkan-Sen (blue line), signaling some upside momentum.

However, the price hovers near the edge of the cloud (Senkou Span A and B), indicating that the trend is not really strong yet. The green cloud ahead suggests some medium-term support, but its relative flatness signals limited momentum in both directions.

For BNB price to regain strong bullish momentum, it needs to move above Kijun-Sen and away from the edge of the cloud. If it fails to do so and falls below the cloud, it could signal the start of a bearish trend.

Conversely, maintaining a position above the cloud and seeing Tenkan-Sen surpass Kijun-Sen could consolidate a stronger uptrend.

BNB Price Forecast: Will BNB Rise More Than 10% And Hit A New All-Time High?

BNB’s EMAs currently exhibit a bullish structure, with the short-term EMAs placed above the long-term EMAs. This balance suggests that the current uptrend remains intact, and if BNB price regains momentum, it could break key resistance levels at $667 and $687.

A successful breakout of these levels could push the price towards the previous high of $719.84 and possibly set new records. The EMAs continue to support the bullish sentiment as long as the price remains above them.

However, indicators like ADX and Ichimoku Cloud suggest that the uptrend may be weakening. If a downtrend develops, BNB price could retest the key support levels at $603 or even $593.

A decline below these support levels could signal a deeper correction, weakening the current bullish structure.