BONK is up 12% in the past 24 hours, thanks to renewed investor interest after REX Shares filed for an ETF.

This news has stimulated demand for BONK, suggesting the possibility of sustained price increases.

BONK Price Increases After ETF Application

On Tuesday, asset management firm Rex Shares filed for ETFs for several on-trend coins, including TRUMP, DOGE and BONK. Since then, BONK has seen a resurgence in investor interest, with prices up 12% in the past 24 hours.

A review of the one-day BONK/USD chart shows that this double-digit rally has pushed the coin’s price above its 20-day exponential moving average (EMA), which now forms dynamic support.

The 20-day EMA calculates the average price of an asset over the past 20 days, prioritizing the most recent data. When the price crosses above the 20-day EMA, this signals an uptrend, confirming that buying is in control. This is generally viewed as a positive indicator, encouraging increased buying activity and suggesting the possibility of the uptrend continuing.

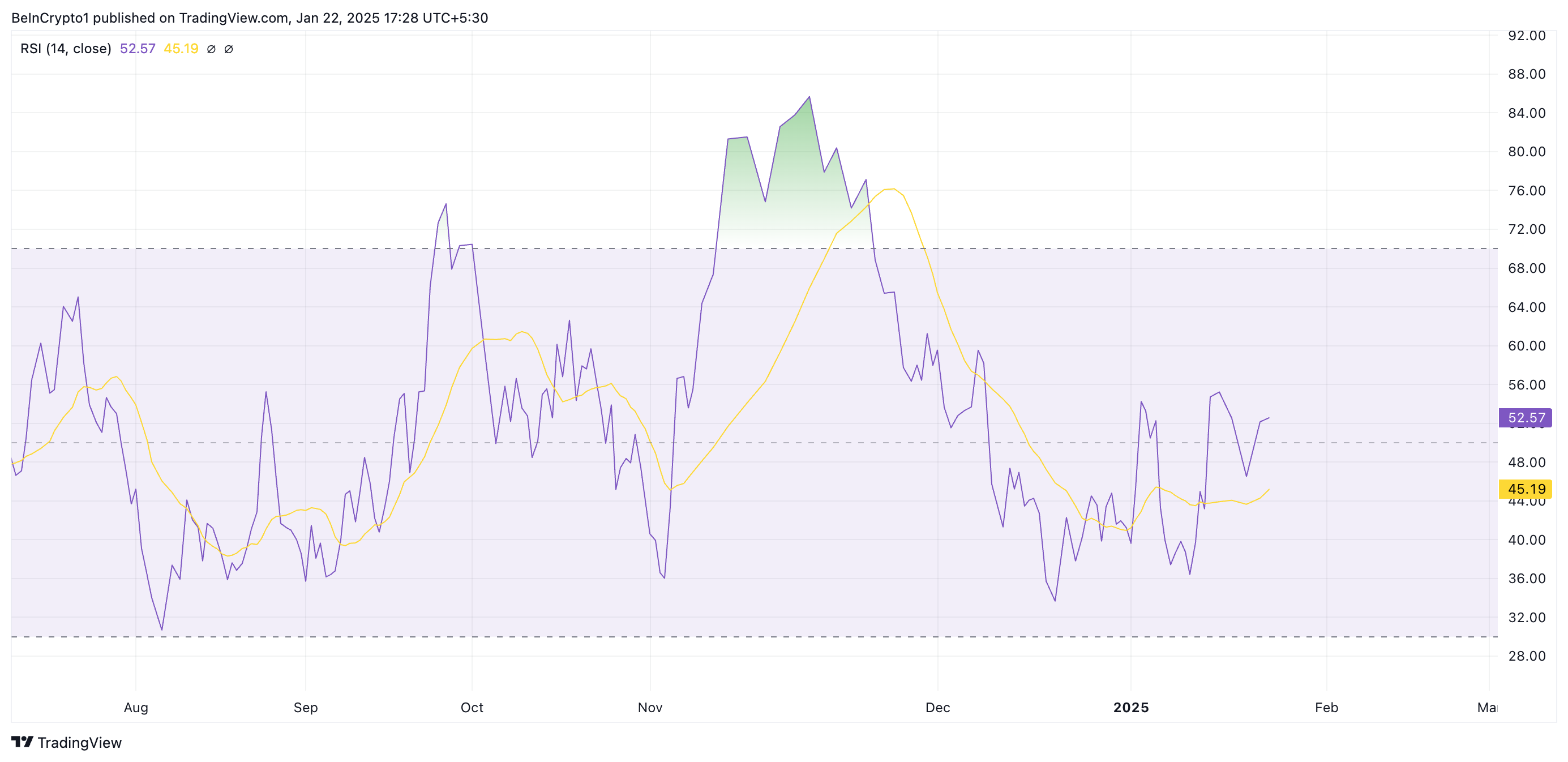

Furthermore, BONK’s rising relative strength index (RSI) supports this optimistic outlook. At the time of writing, RSI is in an uptrend at 52.57.

This momentum indicator monitors the overbought and oversold conditions of the asset. Configured as such, it highlights bullish momentum, suggesting the asset is moving towards strong buying conditions without reaching an overbought state.

BONK Price Prediction: Will the Rally Continue?

If buying pressure is sustained, BONK price could break through the immediate resistance at $0.000033 and rally 17% to $0.000038.

However, if selling resumes, the trend-setting coin could lose recent gains and drop to $0.000025.