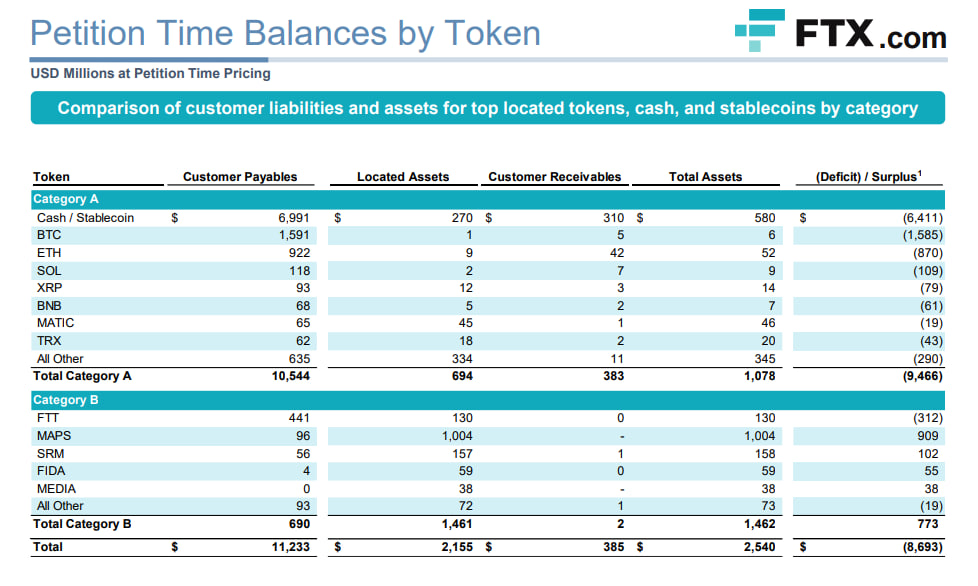

As of currently, of the $two.two billion of assets in FTX.com-connected accounts, only $694 million is “highly liquid.”

In the most up-to-date report sent to interested events on the ongoing bankruptcy proceedings, the new FTX CEO John J. Ray III unveiled the extent of the “huge” shortfalls found in the financial institution accounts and crypto portfolio connected to the FTX exchange and the platform of the US branch is FTX.US.

FTX Debtors Release Second Presentation For Interested Parties New info describes the extent of the deficiencies found at https://t.co/UcxkZgYa2n AND https://t.co/fCVvH9R9wu Exchanges: https://t.co/y7GlwmaSmy

—FTX (@FTX_Official) March 2, 2023

The original report claims that the cryptocurrency exchange founded by Sam Bankman-Fried is missing almost $eight.seven billion in assets to meet purchaser redemption requests.

FTX presently only has about $two.five billion in complete assets. However, only $694 million are “Class A” assets, which are remarkably liquid, which include income, stablecoins, BTC, ETH, and other huge-cap altcoins. The remaining $385 million is in accounts receivable, funds to Alameda Research and other events, and will consider a extended time to shell out off.

Meanwhile, “Class B assets”, which include illiquid tokens in the exchange’s wallet this kind of as FTT, MAPS, SRM, FIDA, have a guide worth as of eleven/eleven/2022 (the time of platform failure) is $one.four billion, but at this level it really is unattainable to ensure they will hold that worth.

If all class B assets are ignored, FTX’s liabilities will be a $9.four billion.

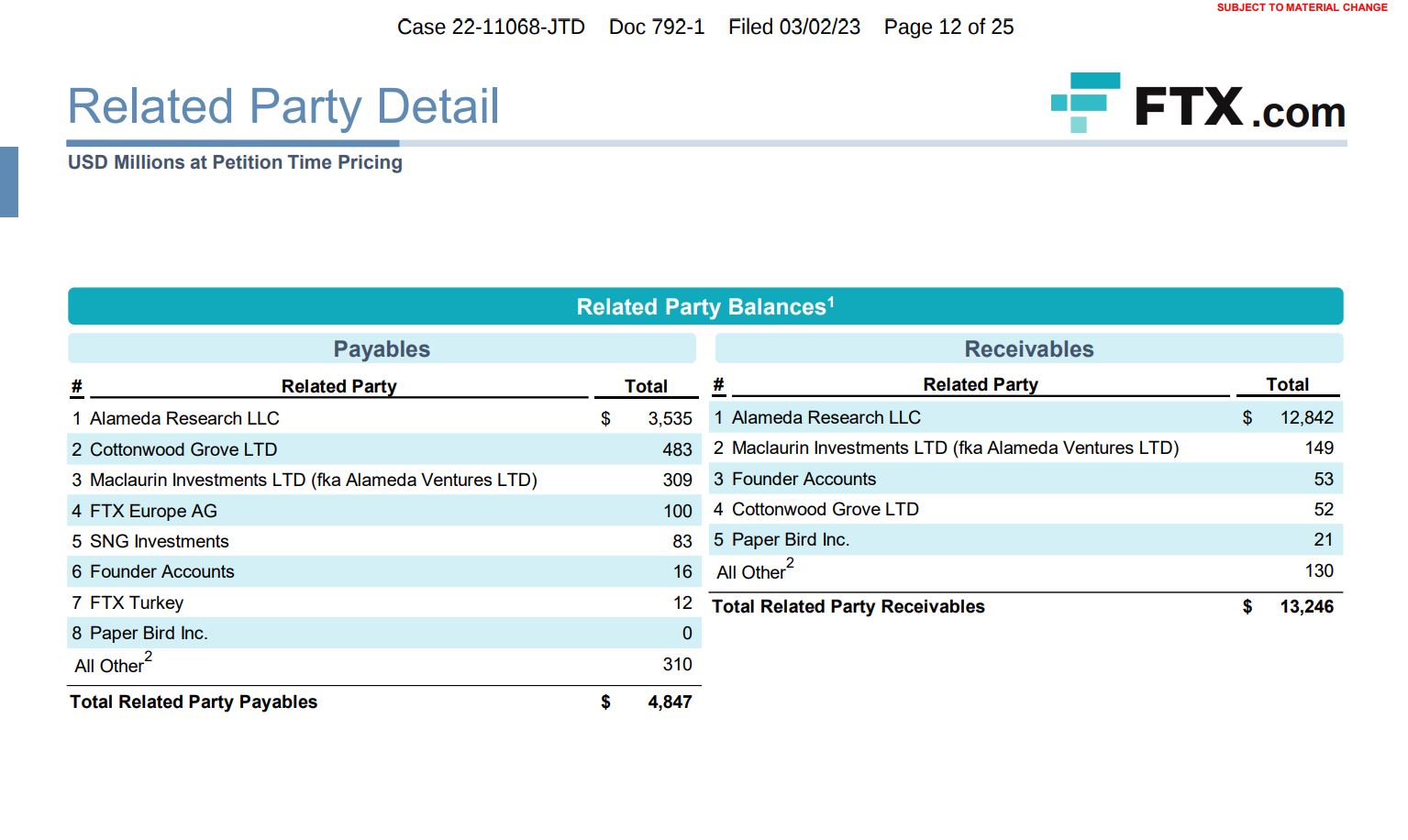

According to the report, the investment fund Alameda Research is the organization that owes the most funds to FTX with $twelve.eight billion, but at the identical time Alameda also lent $three.five billion. Overall, Alameda is obligated to shell out FTX $9.three billion, approximately the volume FTX owes its shoppers and faithful to the allegation that FTX lent funds to Alameda consumers and resulted in a reduction.

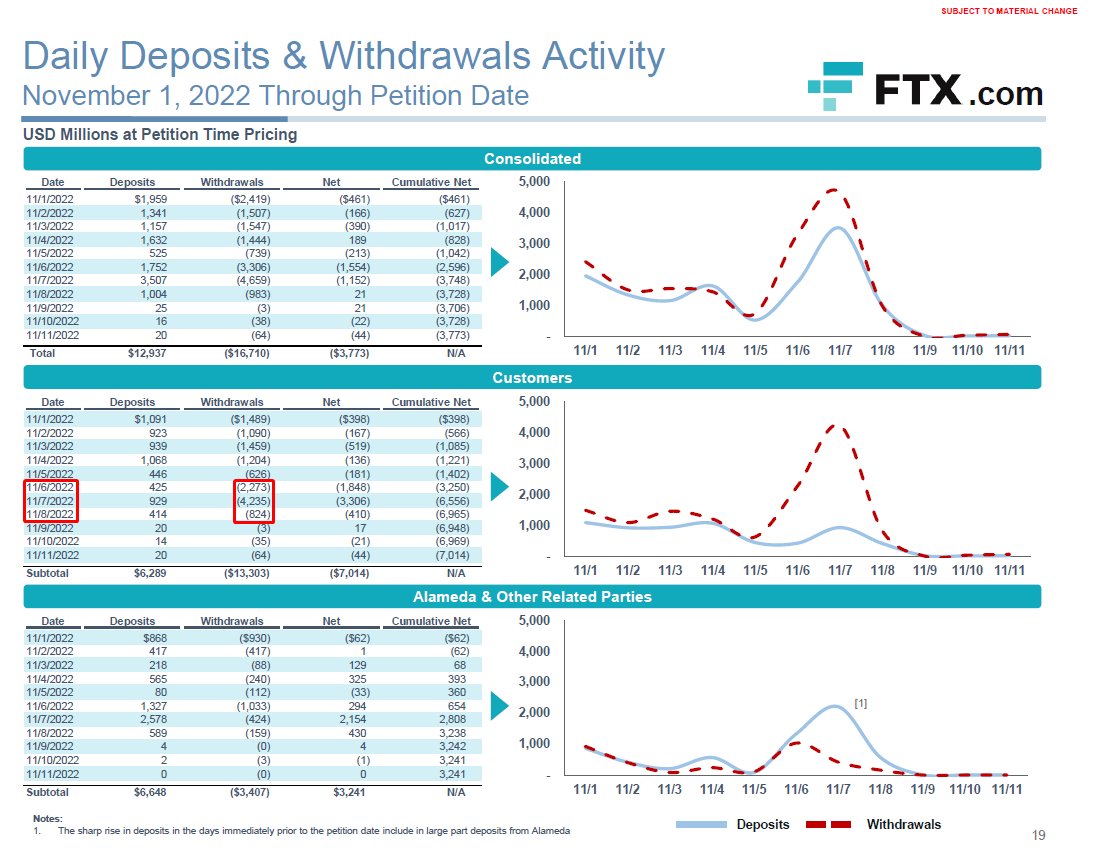

In the week main up to the bankruptcy occasion, FTX shoppers withdrew up to $seven.two billion.

At the identical time, FTX.US also reported a $191 million shortfall in assets in exchange-connected portfolios, $28 million in accounts receivable and $155 million from connected events. Additionally, Alameda Research owes FTX.US $107 million.

CEO Ray after explained that due to the fact taking workplace, he has been unable to obtain any lists or paperwork that entirely record the company’s financial institution accounts, earnings, insurance coverage, and personnel. Therefore, the over figures are preliminary info only and are topic to alter in the potential.

On the other hand, the report also updates the volume of income and income equivalents recovered. The exchange efficiently found and recovered $six.one billion, up from $five.five billion final month. The bankruptcy unit also recovered $202 million held by Alameda, $125 million in stablecoins, and $57 million in cryptocurrencies from its subsidiaries.

Synthetic currency68

Maybe you are interested: