The rate of Ethereum is reaching new all-time highs, in spite of the corrective hurdles of Bitcoin (BTC), signaling a brilliant opening for the altcoin marketplace.

On December one, Ethereum (ETH) briefly hit the rate of $ four,760, presenting a encounter that entirely outperformed the overall performance of Bitcoin, the marketplace-major cryptocurrency that was topic to consistent corrections for a lot of the 2nd half of November. .

The development of ETH has genuinely energized traders and it must be mentioned that Ether is only two.two% under the ATH of $ four,870 reached twenty days in the past. At press time, ETH is trading all over $ four,751.

Ethereum’s present achievement is the consequence of each cautiously constructed hard work through the starting of 2021. Especially following the London really hard fork occasion and the EIP-1559 update, Ether has progressively develop into quite scarce. When ETH is burned it is higher than the quantity developed. As of now, Ethereum has reached one million ETH burned thanks to EIP-1559, an outstanding milestone prior to getting into the ETH two. era up coming yr.

– See a lot more: On-chain evaluation: does the chain of beacons demonstrate the prospective of Ethereum two.?

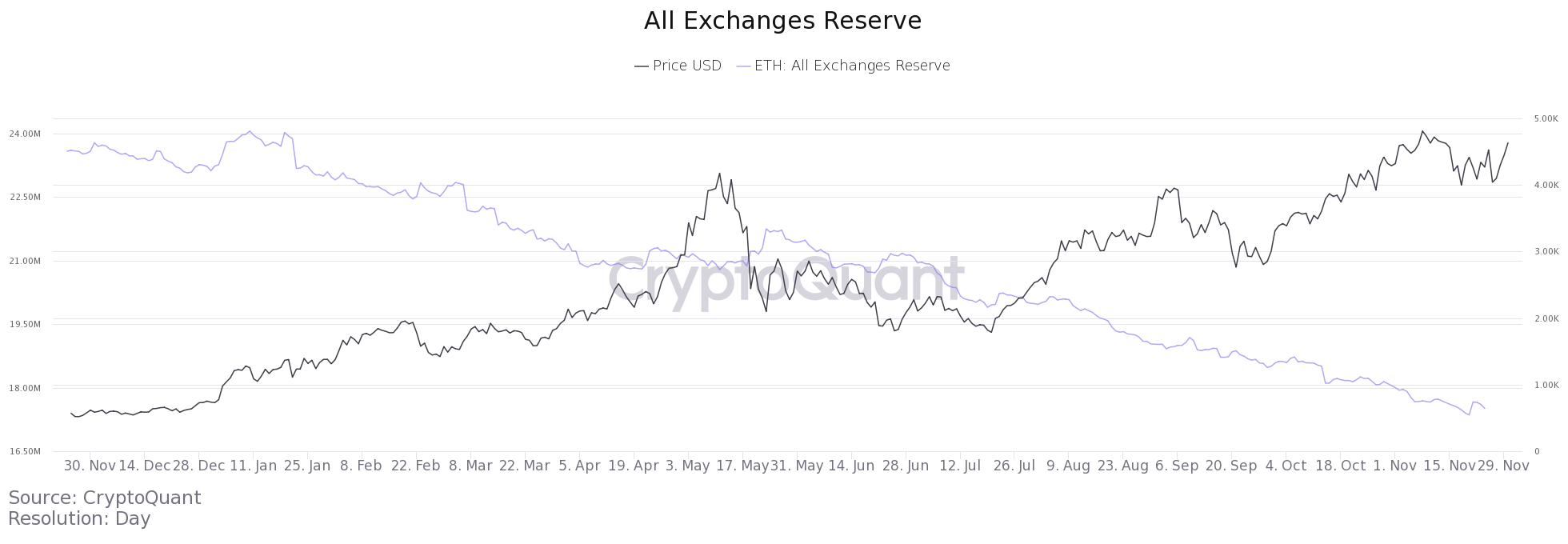

In terms of marketplace sentiment, ETH is also accomplishing quite very well in investor self-confidence. Despite Bitcoin’s significant correction, which bleeds under $ fifty five,000 on information of the COVID-19 mutation, Ethereum’s outflows from exchanges have nevertheless hit a record higher. This implies that the drop in ETH due to BTC’s influence is a major accumulation chance, with only about 17.five million ETH left in reserve on exchanges.

Furthermore, the good response of the ETH rate generally provides a fantastic signal to the altcoin marketplace. Historically, this cycle has occurred often. This yr alone, we noticed two “terrible” rallies of altcoin and ATH in early November, as Bitcoin floated “hesitantly”, all of which share the reality that they are all led by Ethereum. At the very same time, the Ethereum ETF story is nevertheless a prospective hope to reinforce the Ether breakout trend.

However, the spot rate action is fascinating, but let us see what is occurring in the Ethereum derivatives markets. In early December one, commodities and equities took a hit following the Fed acknowledged that inflation was not just a fad and not long ago reconfirmed Fed Chairman Jerome Powell explained that financial policies Bank easing could finish sooner than anticipated.

It appeared that ETH was following Bitcoin from the aforementioned information, but the six.34% maximize in the previous 24 hrs separated the all round unfavorable overall performance of the marketplace. Despite Ether’s 17% rally above the previous 4 days, leading traders in Huobi and OKEx have taken bearish positions.

The move was even a lot more evident on OKEx as the indicator demonstrated a sturdy shift from bullish help at 120% on Nov 25 to a meager thirty% lead 3 days later on. Overall, the information signifies that ETH whales in the derivatives marketplace have lowered their lengthy-phrase publicity, when retail traders continue to be skeptical of the current bull run.

Synthetic Currency 68

Maybe you are interested: