[ad_1]

The price of BRETT has faced heavy pressure after the official Twitter account was hacked, posting suspicious links related to the airdrop. The attack caused panic among investors, and BRETT price has dropped more than 10% in the last 24 hours.

Despite this obstacle, BRETT remains the largest Meme Coin coin in the Base ecosystem, attracting significant attention and large market share. Although technical indicators suggest a possible correction in the downtrend, the coin’s dominance in the ecosystem could help it overcome this difficulty and regain growth momentum.

Attack on BRETT’s Twitter Account Stimulates Sharp Correction

BRETT’s Twitter account started posting a strange link related to the airdrop a few hours ago. It continued to repost, and the tweet was fixed on the account’s profile. After the market realized the possibility of an attack, BRETT price began to decline.

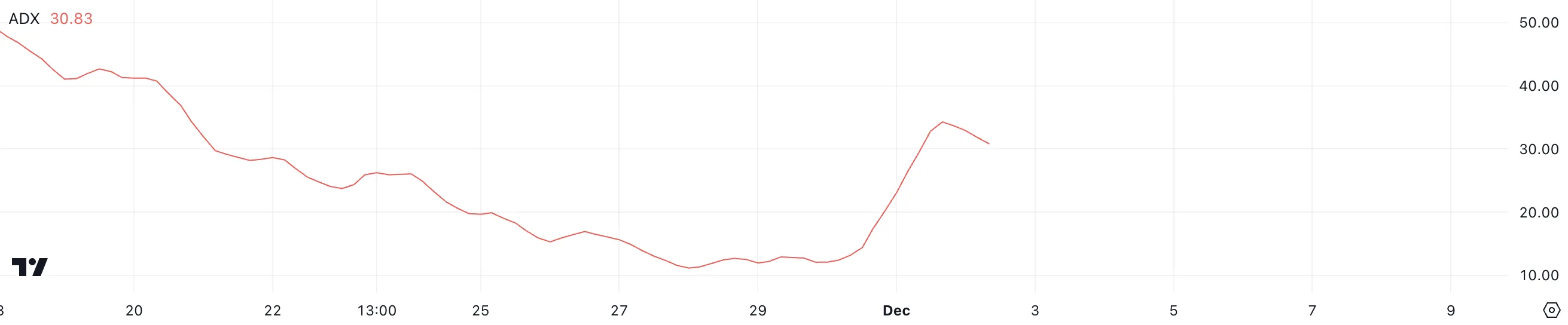

This price drop has strongly affected BRETT indices. BRETT’s Average Directional Index (ADX) fell from 34 to 30.8, pointing to a potential change in trend strength.

ADX measures the strength of market trends, helping traders understand whether an asset is experiencing a strong move in a certain direction or is in an accumulation phase.

The ADX index ranges from 0 to 100, with important thresholds for different interpretations. A level above 25 indicates a strong trend, while a value between 25-50 indicates a solid trend. BRETT’s current ADX index of 30.8, while still signaling a strong trend, has weakened slightly from 34.

This slight weakening could point to the possibility of a correction within the current downtrend, suggesting the correction may lose some of its momentum while maintaining significant directional strength.

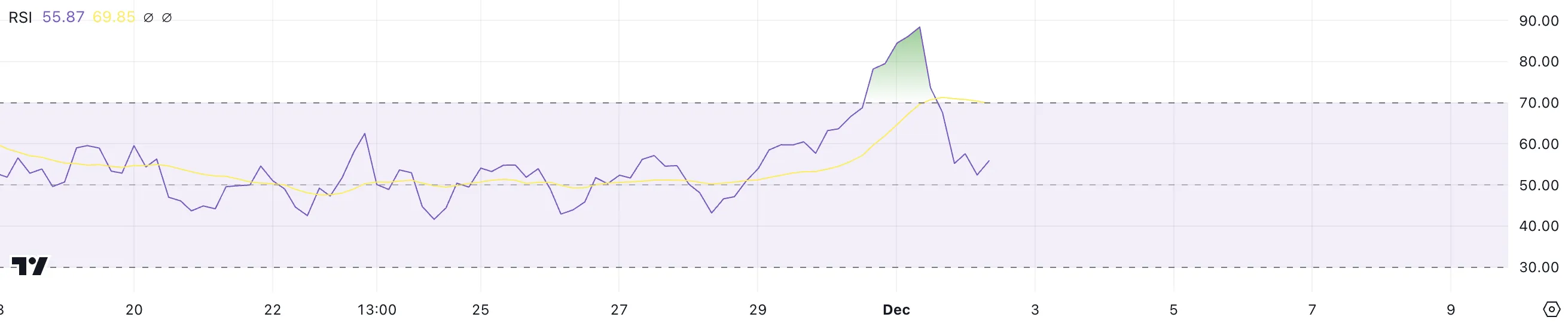

BRETT No Longer in Overbought Zone

BRETT’s Relative Strength Index (RSI) has plummeted from nearly 90 to around 55 in just 24 hours. This sharp drop coincided with a price drop of more than 10%.

RSI is a momentum indicator that measures the magnitude of recent price changes to assess overbought or oversold conditions of a trading asset.

RSI typically ranges from 0 to 100, with important thresholds at 30 and 70. RSI below 30 indicates the asset may be oversold and could rebound, while RSI above 70 indicates upside potential. too high.

At 55, BRETT’s RSI shows the asset is moving towards more neutral territory after having been considered overbought for some time.

BRETT Price Prediction: Recovery After Recent Slump?

BRETT technical indicators suggest a potentially bearish situation. If the price falls below the shortest Exponential Moving Average (EMA) while the short-term EMAs remain above the long-term ones, this could signal further bearish momentum.

If the current downtrend continues, the potential support at $0.158 could be tested, hinting at a more severe market correction. However, even after the recent price drop, BRETT is still the largest Meme Coin coin in the Base ecosystem.

While there may be recent negative sentiment sparked by news of the attack, BRETT price could quickly recover. Market resilience could allow the asset to rebound and test resistance at $0.236 once again.

General Bitcoin News

[ad_2]