The cryptocurrency market place on the morning of September 22, 2022 fell drastically just after the Fed announced its most current price hike.

As talked about by Coinlive in the vital occasions to observe out for in September 2022, at dawn on September 22, the Fed announced the federal money price adjustment. This is the price at which banking institutions lend to each and every other above a time period of a single day (overnight loans) to get specifically the very same volume of cash as the expected reserve necessity of the Fed.

The Fed has constantly raised the federal money price by .75% in the previous two meetings, bringing this curiosity price to two.25 – two.five%. This is the Fed’s quickest price of rise in brief-phrase curiosity costs considering that the United States employed the federal money price as a benchmark in the early 1990s.

In reality, Fed Chairman Jerome Powell previously mentioned the Fed stays “hawkish”, preserving curiosity price hikes to meet the two% inflation target by the finish of the 12 months. Therefore, the expectation of the market place and analysts is that the Fed will even further maximize .75% in this adjustment.

According to the most current information launched, the Fed has announced the adjustment curiosity price enhanced by .75% it rose to three.25%, in line with the degree anticipated by monetary analysts. This is a response to the August inflation in the US, though the total degree has fallen, but client products have even now risen, demonstrating that the Fed has not truly stopped the escalation of commodity rates. The Fed even now has two much more curiosity price changes this 12 months in November and December.

The over data, whilst unsurprising, even now negatively impacted the cryptocurrency market place simply because it was impacted by US equities. Not to mention the macro fluctuations with Russia just lately orderly partial mobilization to intensify tensions in the conflict with Ukraine.

Over the previous handful of hrs, Bitcoin (BTC) has dropped heavily from a higher of $ 19,556 when the Fed announced new curiosity costs to just $ 18,125, the lowest worth considering that the minimal of $ 17,622 in mid-June.

Ethereum (ETH) corrected to $ one,220, ranges not noticed considering that mid-July.

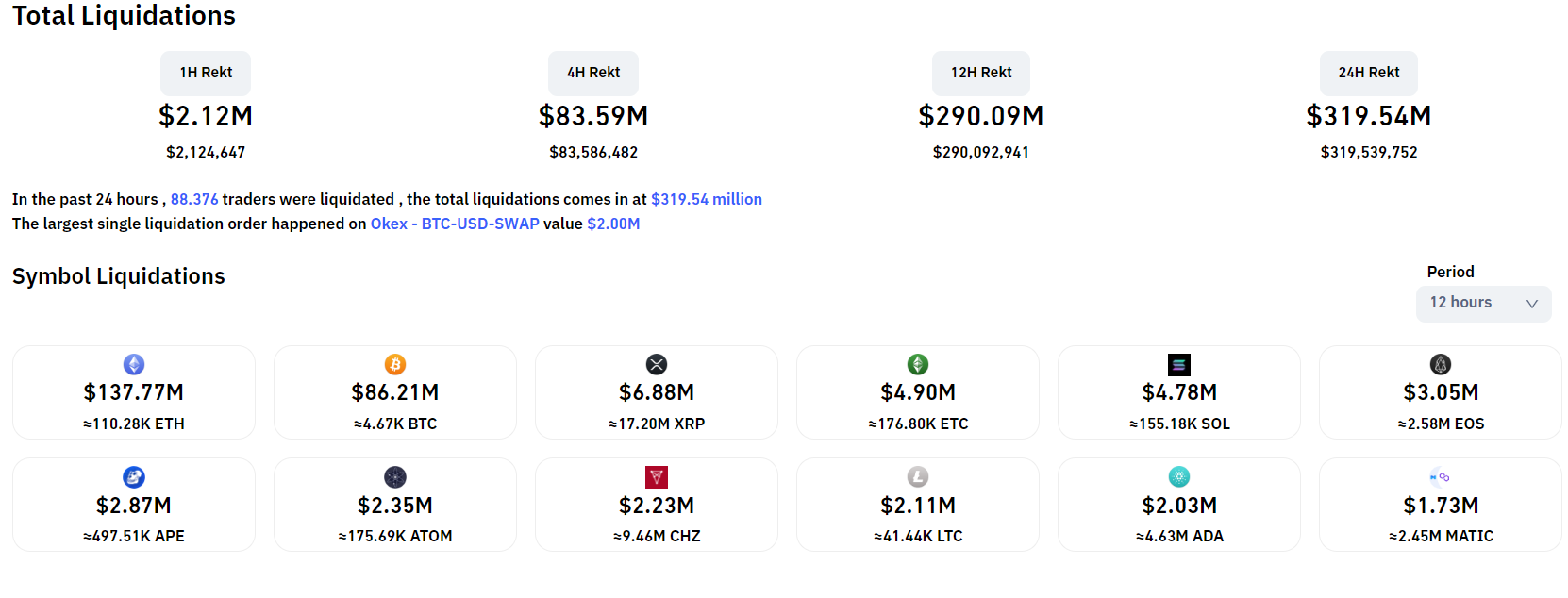

The complete of derivatives orders settled in the final twelve hrs exceeds 290 million bucks, largely in ETH and BTC.

Earlier on September 13, just after the information on US inflation in August 2022 with not also good signals, the cryptocurrency market place also noticed a sharp drop in rates.

Synthetic currency 68

Maybe you are interested: