[ad_1]

Bitcoin value misplaced a critical $44,000 degree on Wednesday just after reviews emerged that the December FOMC meeting of the Federal Reserve is set to reconfirm ideas to lower its stability sheet and increase curiosity costs. in 2022.

Following these information, the stock industry corrected as did the crypto industry with Bitcoin dropping $330 from its industry worth in just thirty minutes.

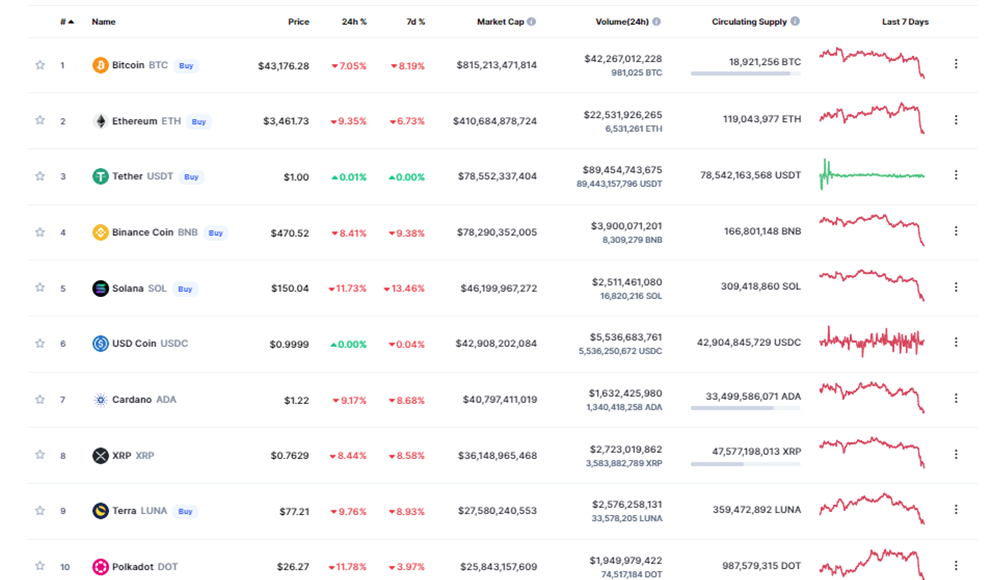

All the best ten cryptocurrencies are in deep red, except for the stablecoins (USDT and USDC) in accordance to information from CoinMarketCap.

This confirms the bears’ outlook that we could encounter a bear crypto industry throughout the greater instances of 2022.

However, the brief-phrase outlook for the main cryptocurrency suggests a deeper close to-phrase correction.

Bitcoin Price Could Drop a different seven.five% to $forty,000

Wednesday’s crypto industry crash noticed BTC value drop under the horizontal assistance line of the descending triangle as proven on the four-hour chart.

The reduction of the aforementioned assistance at $45.645 is critical for the bears as the value of the pioneering cryptocurrency breaks out of the confines of the management chart pattern.

The target of the descending triangle chart pattern is $forty.011. Therefore, if the present Bitcoin value correction continues, it will drop more to mark the target of the chart pattern just over $forty,000.

If this occurs, BTC/USD value will drop about seven.57% from the present value about $43,308.

BTC/USD Four Hour Chart

Note that the entry of the Moving Average Convergence Divergence (MACD) into the detrimental zone confirms this bearish outlook. Additionally, the MACD sent a get in touch with to promote Bitcoin yesterday as the twelve-hour 4-hour exponential moving regular (EMA) reduce under the 26 EMA indicating that industry momentum has turned red.

Additionally, the RSI getting into the oversold zone is a indicator that bears are now in manage of BTC value, incorporating credence to the bearish outlook.

Looking above the fence

On the other hand, the oversold RSI is a indicator that the marketing stress could quickly disappear, primary to a reversal in value action in the close to potential.

If this occurs, Bitcoin could rally to reclaim the $44,000 assistance, which could prompt the bulls to undo yesterday’s losses.

[ad_2]