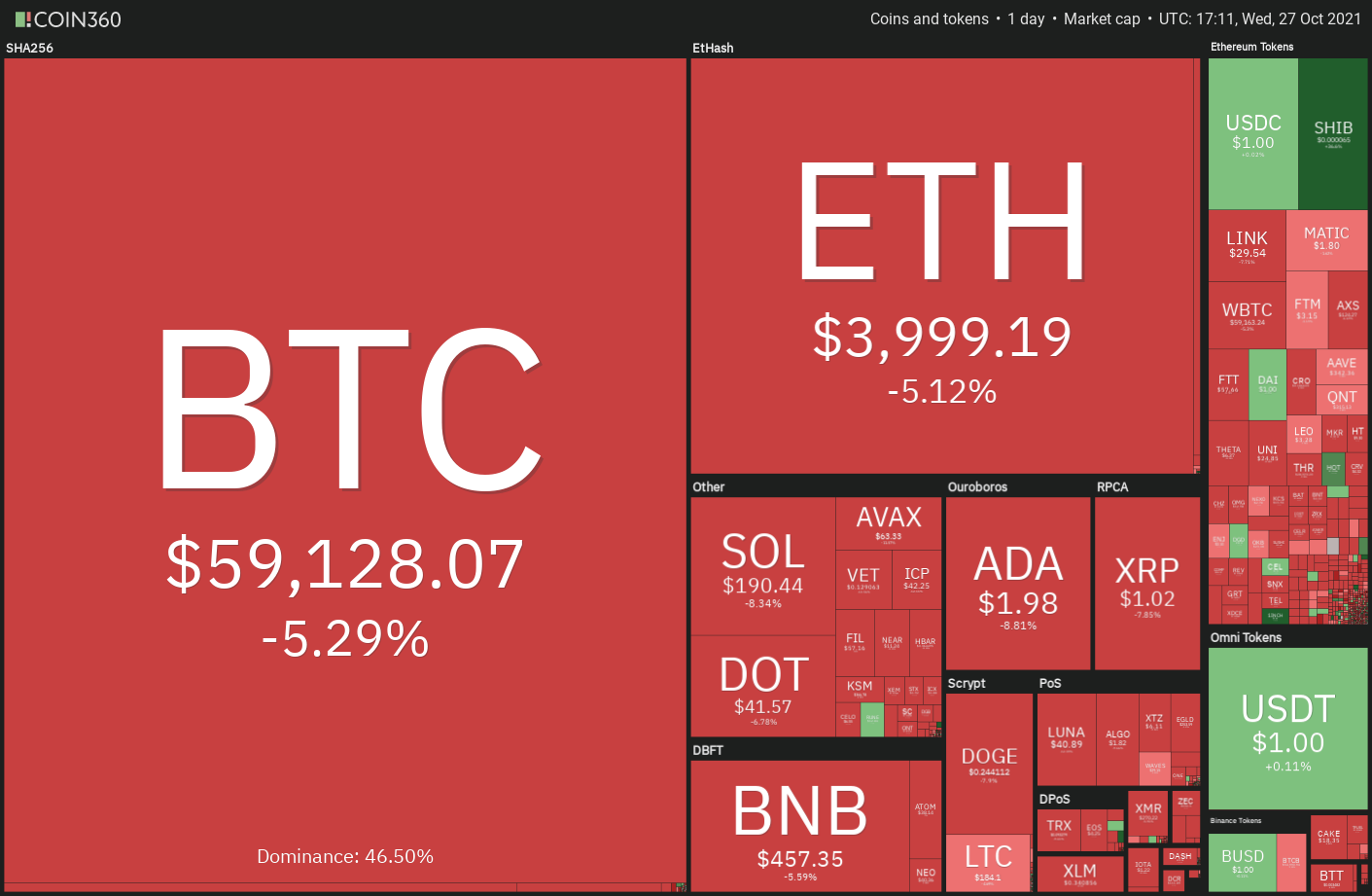

Bitcoin (BTC) has broken back beneath the psychological help at $60,000. While this seems to be detrimental in the quick phrase, the selling price action has continued to reflect its motion in 2017. If the similarity continues for the rest of the 12 months, the bulls Bitcoin can participate.

PlanB, the creator of the well known Bitcoin Stock-to-Flow (S2F) model, lately announced in a tweet that the 2nd phase of the Bitcoin bull marketplace has begun. If Bitcoin’s selling price action continues to comply with the S2F pattern, the analyst believes a rally from $a hundred,000 to $135,000 could occur later on this 12 months.

Although Bitcoin attracts a lot of people’s interest, crypto exchange Okcoin explained in a latest report that institutional investors’ appetite for non-Bitcoin crypto assets is increasing. more and more raising. The report states that 53% of purchases by institutional traders in September have been in altcoins.

Is Bitcoin’s present drop a shopping for possibility or the starting of a deeper correction? How are altcoins anticipated to react? Let’s analyze the charts of the best ten cryptocurrencies to come across out.

BTC / USDT

Bitcoin failed to retest the overhead resistance location of $64.854 to $67,000 on October 25, which could have prompted quick-phrase traders to guide income. That dragged the selling price down to sturdy help at the twenty-day exponential moving typical (EMA) ($58,948).

A break and shut beneath the twenty-day EMA will be the very first signal that bullish momentum could be waning. If the bulls do not speedily regain the degree, offering could accelerate and the BTC/USDT pair could slide to $52,920.

The relative power index (RSI) has dropped to the midpoint and the twenty-day EMA is flattening out, suggesting a stability among provide and demand.

This benefit will tilt to the bears if the pair slides and sustains beneath the 50-day easy moving typical (SMA) ($51.556). On the other hand, a breakout to a new all-time large would propose that the bulls are back in place.

ETH / USDT

The bulls attempted to resume Ether (ETH) uptrend on October 26 and 27 but have been unable to sustain the selling price over $four,200. This displays that the bears are working at a increased degree.

The sellers have dragged the selling price to the twenty-day EMA ($three,869), which is an critical help to view. A sturdy bounce off the twenty-day EMA will display that sentiment stays beneficial and traders are shopping for on the downsides. The bulls will then yet again try to resume the uptrend.

Conversely, if the twenty-day EMA is cracked, it will signal that traders could be reserving income and provide exceeds demand. The bears will then try to drag the selling price to the 50-day SMA ($three,488).

BNB / USDT

Binance Coin (BNB) rejected the overhead resistance and broke beneath the twenty-day EMA ($462) these days. This is the very first signal that bullish sentiment could be waning.

The prolonged tail on today’s bar displays that the bulls are trying to defend the neckline of the inverse head and shoulders pattern.

If they do well, the BNB/USDT pair could yet again try to recover to the overhead resistance of $518.90. A break and shut over this resistance could signal the continuation of the uptrend.

Conversely, a shut beneath the neckline can drag the selling price down to the 50-day SMA ($423). If this help breaks, the up coming halt can be at $392.twenty. The flat moving averages and the RSI close to the midpoint do not give a clear benefit to the bulls or the bears.

ADA / USDT

Cardano (ADA) narrow variety trading among the twenty-day EMA ($two.15) and the help line of the symmetrical triangle resolved to the downside on Oct. 27. This suggests that the The bear has asserted its supremacy.

The sellers dragged the selling price beneath $one.87 on October 27 but the prolonged tail on the candlestick bar displays that the bulls are trying to defend the help. The recovery try is very likely to experience stiff resistance at the twenty-day EMA.

If the selling price turns down from the twenty-day EMA, the bears will yet again try to break the $one.87 help. If that occurs, the ADA/USDT pair can resume the downtrend in the direction of the pattern target at $one.58.

The bulls will have to push and sustain the selling price over the resistance line of the triangle to invalidate the detrimental see.

SOL / USDT

Solana (SOL) broke by way of the overhead resistance of $216 on October 25 but the bulls have been unable to sustain the breakout. This could have attracted revenue bookings by quick-phrase traders, dragging the selling price to the twenty-day EMA ($177).

The prolonged tail on the October 27 candlestick displays that sentiment stays beneficial and the bulls are shopping for on a drop to the twenty-day EMA. Buyers will now yet again try to push the selling price over the overhead resistance.

If they do well, the SOL/USDT pair can resume the uptrend with the up coming target goal of $239.83. Contrary to this assumption, if the bears drag the selling price beneath $171.47, the pair can lengthen the drop to the trendline. A break beneath this help will signal a achievable trend transform.

XRP / USDT

The bulls pushed Ripple (XRP) over the downtrend line on October 26 but failed to sustain the increased highs as observed from the prolonged wick on the intraday candlestick. This could have trapped aggressive bulls, major to a sturdy promote on October 27.

A shut beneath the $one help will total a descending triangle pattern that can drag the selling price down to the sturdy help location at $.88 to $.85. If this zone fails to halt the decline, the XRP/USDT pair can lengthen the slide in the direction of the pattern target at $.77.

The twenty-day EMA ($one.08) is flat but the RSI has dipped into the detrimental territory, displaying that the bears are engaged in a sturdy comeback. This detrimental see will be invalidated if the bulls push and sustain the selling price over the downtrend line. That could clear the way for a achievable rally to $one.24.

DOT / USDT

The failure of Polkadot (DOT) to rise over the overhead resistance of $46.39 on October 26 could have prompted quick-phrase traders’ offering. This dragged the selling price down to the sturdy help at $38.77 on October 27.

The prolonged tail on the October 27 bar displays that the bulls are defending the help location aggressively. If customers push the selling price over $46.39, the DOT/USDT pair can carry on to rise and challenge the all-time large of $49.78.

Alternatively, if the bulls fail to conquer the over hurdle, the pair may well consolidate among $46.39 and $38.77 for a handful of days. A break and shut beneath $38.77 could signal the get started of a deeper correction in the direction of the 50-day SMA ($35.14).

Related: Shiba Inu Can Overtake Dogecoin After SHIB 700% Bullish in October

DOGE / USDT

Dogecoin (DOGE) has dropped from $.28 on October 24, indicating that traders are liquidating positions on recovery. The bulls yet again attempted to push the selling price over the overhead resistance of $.27 on October 26 but failed.

Selling accelerated on October 27 soon after the bears dragged the selling price beneath the twenty-day EMA ($.24). This resulted in a drop shut to the sturdy help location at $.21 to $.19. The prolonged tail on the intraday bar displays that traders carry on to defend the help zone.

The twenty-day EMA has flattened out and the RSI is just beneath the midpoint, suggesting a likelihood of variety-bound action in the close to phrase. The up coming trend move could get started on a break over $.28 or a shut beneath $.19.

SHIB / USDT

SHIBA INU (SHIB) is in a sturdy uptrend. The prolonged wick on the October 24 candlestick displays that the bears managed to halt the upside momentum at $.00004465 but they have been unable to sustain the offering stress. Buying action resumed on October 25, and the meme continued its march north.

The sturdy upward move has pushed the RSI close to the 90 degree, which suggests that the recovery could be overdone in the quick phrase. However, this does not ensure the get started of a correction as the RSI reached over 93 on October six ahead of a pullback occurred.

The bulls pushed the SHIB/USDT pair over the 161.eight% Fibonacci extension at $.00006531. If the selling price sustains over this degree, the up coming halt could be a 200% extension at $.00007586.

Vertical rallies are seldom sustainable, and they frequently finish in a waterfall drop. Therefore, chasing increased charges soon after the latest rally could be risky.

LUNA / USDT

Terra protocol LUNA token broke by way of the overhead resistance of $45.01 on October 26 but the bulls have been unable to sustain the increased ranges as observed from the prolonged wick on the intraday candlestick.

The bears sensed the possibility and dragged the selling price beneath the $39.75 help on October 27, but a smaller beneficial is that the bulls purchased on a drop to the 50-day SMA ($38, sixteen). If the selling price sustains over $39.75, the bulls may well yet again try to push the LUNA/USDT pair in the direction of $45.01.

Conversely, if the selling price breaks beneath the 50-day SMA, the pair can drop to the sturdy help location at $34.86 to $32.50. This is an critical location for the bulls to defend mainly because a break beneath it could accelerate offering.

The views and opinions expressed right here are solely people of the writer and do not automatically reflect people of Cointelegraph. Every investment and trading move entails chance. You must perform your very own exploration when building a choice.

Market information supplied by HitBTC exchange.

.