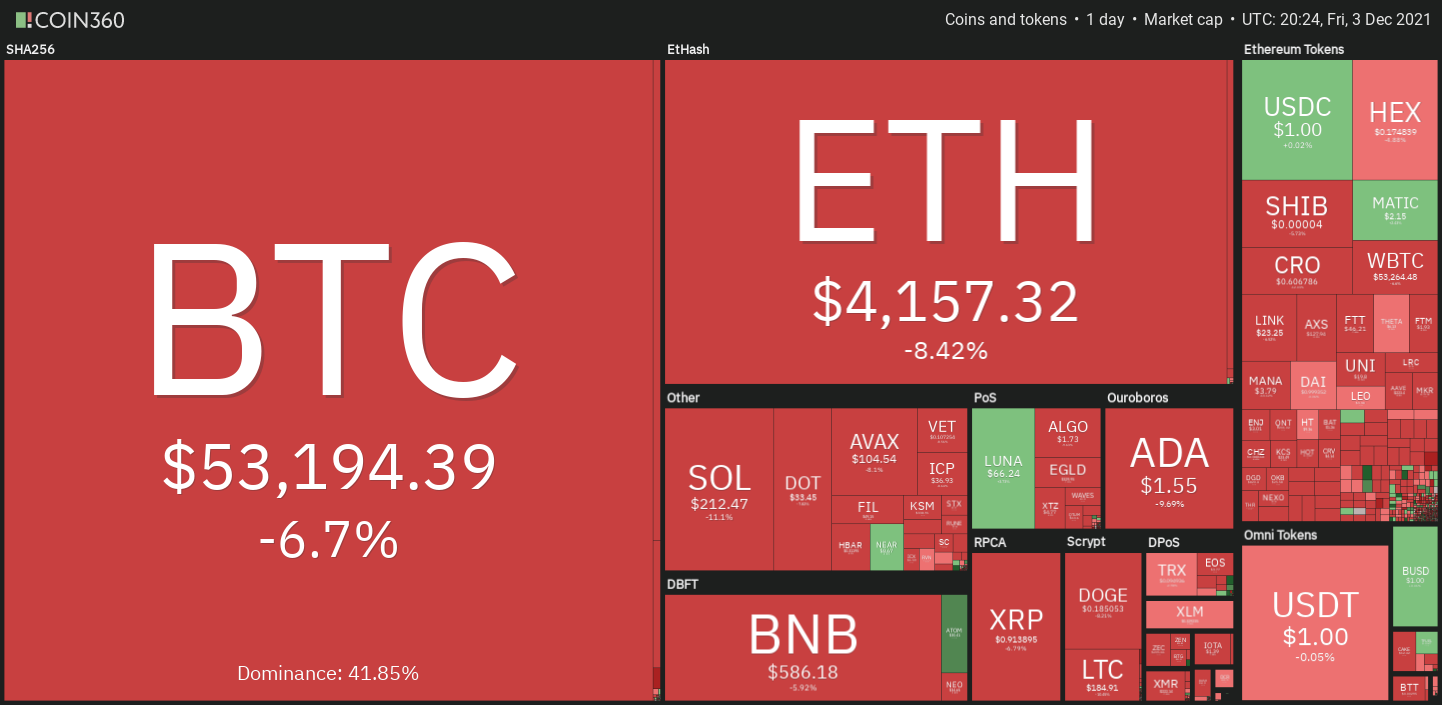

Bitcoin (BTC) and Ether (ETH) have fallen towards their respective overhead resistance ranges, suggesting that the bears proceed to promote on the upside.

New analysis out of Australia exhibits that the Ethereum Improvement Proposal (EIP) 1559 improve has created Ether a superior keep of worth than Bitcoin. The report states that the yearly development charge of Ether provide considering that EIP-1559 is .98% in contrast to a one.99% boost in Bitcoin provide.

Demand for Ether has been on the rise following the expanding recognition of deprecated tokens, decentralized finance, and Metaverse relevant altcoins. Some analysts stay bullish on Ether and predict it will rise in the $six,000 to $ten,000 array.

Online chain examination company Glassnode says that widespread curiosity in the derivatives market place and promoting by extended-phrase holders could prolong Bitcoin’s decline. “Open interest leverage in options and futures is at or new all-time high” could lead to a shift.

Can Bitcoin Correction Drag the Entire Crypto Sector Lower? Let’s review the charts of the leading ten cryptocurrencies to locate out.

BTC / USDT

The bulls failed to sustain Bitcoin selling price over the twenty-day exponential moving regular ($57,905) on Nov. thirty and Dec. one. This suggests that the bears are defending the twenty-day EMA as soon as in a whilst. sturdy way.

The bears will now try to drop and sustain the selling price beneath the one hundred-day easy moving regular ($54,485) and the November 28 minimal at $53,256.64. If they do well, the BTC/USDT pair can plummet to the vital psychological help at $50,000.

This is an crucial help to observe as if it is broken, promoting could choose up momentum and the pair could drop to $forty,000. The bearish twenty-day EMA and the relative power index (RSI) in the detrimental territory propose the path of least resistance is to the downside.

Contrary to this assumption, if the selling price bounces off the one hundred-day SMA and rises over the twenty-day EMA, it will indicate accumulation at reduced ranges. The pair can then rise to the 50-day SMA ($60,750).

ETH / USDT

Ether has dropped from $four,778.75 on December one suggesting that the bears are actively defending the all-time higher of $four,868. The selling price has moved back to the 50-day SMA ($four,319) now.

If the selling price recovers from the existing ranges, it exhibits that sentiment is even now optimistic and traders are obtaining on the downside. The bulls will then make 1 extra move to push the selling price over $four,868.

If they do well, the ETH/USDT pair can resume its uptrend, with the following target target at $five,796. Conversely, if the selling price breaks beneath the 50-day SMA, it will indicate that traders may perhaps be in a hurry to get out. The pair can then drop to the sturdy help at $three,900.

BNB / USDT

The bulls yet again attempted to push Binance Coin (BNB) over the overhead resistance of $669.thirty on Dec. one without having results. This exhibits that the bears proceed to pose a difficult challenge at greater ranges.

The twenty-day EMA ($602) has flattened out and the RSI is close to the midpoint, suggesting a feasible array-bound action in the close to phrase.

If the selling price breaks beneath the twenty-day EMA, the BNB/USDT pair can drop to the 50-day SMA ($564). This is an crucial degree for the bulls to defend as a break beneath it can drag the selling price to the one hundred-day SMA ($494).

Conversely, if the selling price turns up from the existing ranges or the 50-day SMA, the bulls will try to propel the pair over the $669.thirty to $691.80 resistance region.

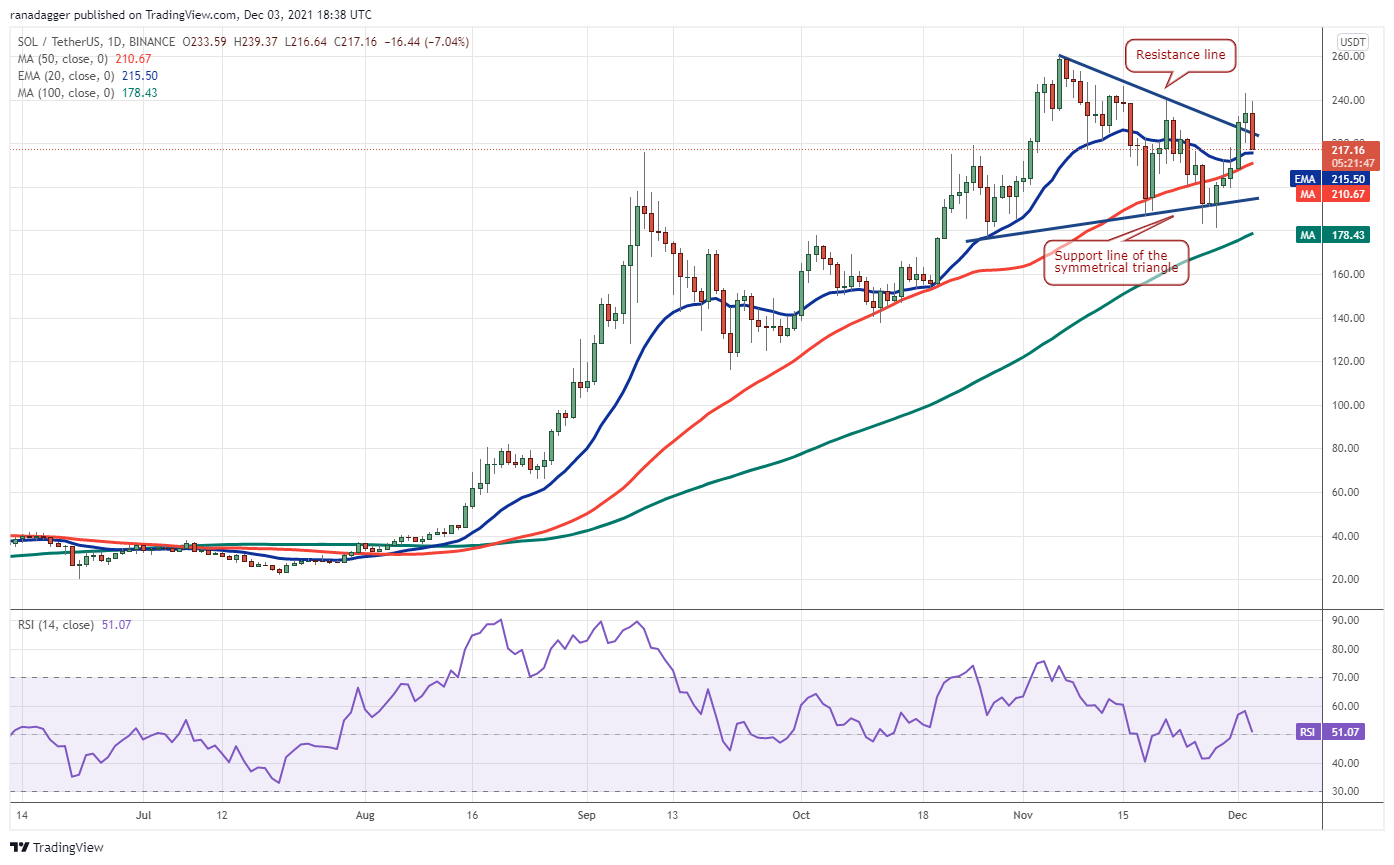

SOL / USDT

Solana (SOL) broke and closed over the resistance line of the symmetrical triangle on Dec one but the bulls have been unable to sustain the greater ranges. The bears pulled the selling price back within the triangle now.

If the selling price recovers from the twenty-day EMA ($215), the bulls will make 1 extra move to initiate the upward move by propelling the SOL/USDT pair over the overhead resistance of $243.twelve.

Contrary to this assumption, if the selling price breaks beneath the 50-day SMA ($210), it will indicate that the current breakout over the resistance line could be a bull trap. The bears will then try to sink the selling price beneath the help line of the triangle.

A break and shut beneath the one hundred-day SMA ($178) could initiate a deeper correction that can attain $140.

ADA / USDT

Cardano (ADA) rebounded sharply on Dec. two but hit the twenty-day EMA ($one.72). The failure of the bulls to clear the over barrier may perhaps have attracted sturdy promoting of the bears.

The sellers will now try to push the selling price down to the sturdy help region at $one.50 to $one.41. This is an crucial help for the bears to defend mainly because if it cracks, promoting could accelerate and the ADA/USDT pair could start out its journey down to $one.

Contrary to this assumption, if the selling price rises from the help region, it will indicate obtaining at reduced ranges. The bulls will then make 1 extra move to push the selling price over the twenty-day EMA. If that takes place, the pair can rally to the 50-day SMA ($one.94).

XRP / USDT

XRP’s inability to break and sustain over the psychological degree at $one exhibits that the bears are promoting heavily in small rallies. The selling price has dropped and the bears will now try to drag the selling price to the sturdy help at $.85.

The declining twenty-day EMA ($one.02) and the RSI beneath 37 propose that sellers are in manage. If the bears flip down and sustain the selling price beneath $.85, the XRP/USDT pair can plummet to the following help at $.70.

On the other hand, if the selling price turns up from the existing degree or the $.85 help and breaks over the twenty-day EMA, it suggests promoting strain may perhaps be easing. The pair can then rise to the 50-day SMA ($one.09).

DOT / USDT

Polkadot (DOT) rejected the breakdown of the H&S pattern at $38.70 on Nov. thirty and broke beneath the one hundred-day SMA ($37). The bears will now try to drag the selling price to the sturdy help at $32.21.

If this degree cracks, promoting may perhaps boost and the DOT/USDT pair can plummet to the following help at $26. The declining twenty-day EMA ($39) and the RSI in the detrimental zone present that the bears have the upper hand.

Conversely, if the selling price turns up from the existing ranges and breaks over the twenty-day EMA, it will indicate that the market place has rejected the reduced ranges. That can trap some aggressive bears, resulting in a brief time period of time. The pair can then rise to the 50-day SMA ($43) and then to $47.50.

Related: NFT music platforms will disrupt Spotify by 2022, Saxo Bank predicts

DOGE / USDT

The bulls have repeatedly failed to push Dogecoin (DOGE) over the twenty-day EMA ($.22) above the previous couple of days, displaying that sentiment stays detrimental and that the bears are promoting on the recovery.

The twenty-day EMA is sloping down and the RSI is beneath 36, suggesting that the path of least resistance is to the downside. If the bears sink the selling price beneath $.19, the DOGE/USDT pair can drop to the vital help at $.15.

On the other hand, if the selling price turns up from existing ranges or bounces back to $.19 and breaks over the twenty-day EMA, it will indicate sturdy accumulation on reduced ranges. The pair can then recover to the 50-day SMA ($.24).

LUNA / USDT

Terra’s LUNA token broke by means of the moving regular on Nov. 28 and picked up momentum. Strong obtaining by the bulls pushed the selling price to a new all-time higher on November thirty, indicating a continuation of the uptrend.

The failure of the bears to halt the rally at the resistance line exhibits that the bulls are obtaining strongly. If the selling price sustains over the channel, the LUNA/USDT pair can rally to $85.07.

Conversely, if the selling price turns down and returns to the sturdy descending channel, it exhibits that traders are reserving income at greater ranges. After that, the pair can drop to the twenty-day EMA ($51).

If the selling price recovers from this degree, it exhibits that sentiment stays optimistic whilst a break beneath the twenty-day EMA can drag the selling price down to the help line of the channel.

AVAX / USDT

Avalanche (AVAX) turned down from 61.eight% Fibonacci retracement degree at $129.26 on Dec. one. This may perhaps have prompted revenue reserving from traders, which has dragged selling price fell beneath the twenty-day EMA ($109) on December two.

The flat twenty-day EMA and the RSI close to the midpoint propose a stability among provide and demand.

If the bulls push and sustain the selling price back over the twenty-day EMA, the AVAX/USDT pair can rally to $129.26. A break and shut over this degree could open the door to a retest of the all-time higher of $147.

Also, if the selling price fails to sustain over the twenty-day EMA, it will present that traders are promoting on small rallies. The bears will then try to drop the selling price beneath the psychological help at $one hundred. If that takes place, the pair can drop to the 50-day SMA ($87).

The views and opinions expressed right here are solely people of the writer and do not automatically reflect people of Cointelegraph. Every investment and trading move entails chance. You must perform your very own analysis when producing a choice.

Market information supplied by HitBTC exchange.