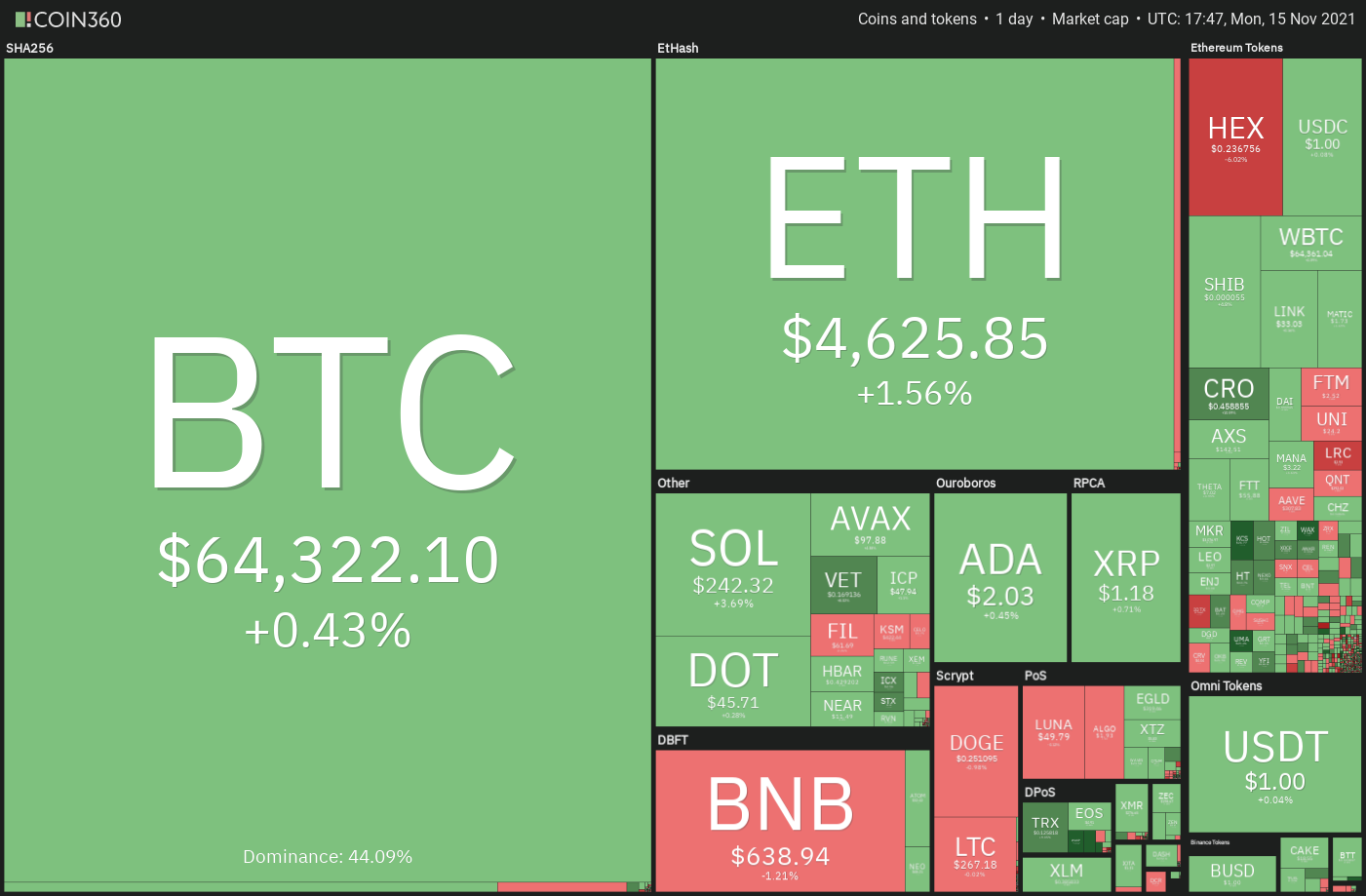

Bitcoin (BTC)’s failure to keep its momentum and failure to guide earnings as the US trading industry starts the week, could recommend that the bears have not offered up nonetheless.

PlanB, creator of the well-liked BTC stock motion pattern, would seem undisturbed by the boring cost action of the previous handful of days. The analyst believes his worst-situation predictions of $98,000 on December one and $135,000 on January one continue to be.

However, prolonged-phrase holders are unlikely to wait for larger highs and have begun reserving earnings, in accordance to analyst William Clemente, who cited Glassnode information. According to Clemente, “the distribution of the bull market has begun.”

Not everybody is bullish on Bitcoin. Billionaire fund manager Kyle Bass advised Investor’s Podcast Network that building revenue from Bitcoin will be “really difficult” in contrast to present ranges for the reason that of the rigid US Government rules.

Could reduced ranges appeal to shopping for by the bulls or will traders proceed to consider earnings? Let’s research the charts of the top rated ten cryptocurrencies to come across out.

BTC / USDT

Bitcoin bounced off the twenty-day exponential moving regular ($63,232) on November twelve, but the bears are posing a difficult challenge at the overhead resistance location of $67,000 to $69,000.

The Relative Strength Index (RSI) has formed a adverse divergence suggesting that bullish momentum may well be waning. The BTC/USDT pair has formed a increasing and falling wedge pattern, which will finish on a break and near beneath the assistance line.

If that comes about, it will display that traders are actively reserving earnings and that could lead to a slide down to the 50-day basic moving regular ($58,396). The pattern target of the increasing wedge is $53.770.

Contrary to this assumption, if the cost turns up from the present ranges and breaks over $67,000, the following prevent could be at $69,000. A break and near over the resistance line of the wedge could open the door for a achievable rally to $75,000.

ETH / USDT

Ether (ETH) dipped beneath the ascending channel assistance line on Feb. 14 but the prolonged tail on the day’s candlestick exhibits robust shopping for at reduced ranges. The bulls have attempted to resume the uptrend right now but the prolonged wick on the candlestick exhibits promoting close to $four,800.

The bears will now make a single far more try to sink and sustain the cost beneath the assistance line of the channel and the twenty-day EMA ($four,491). If they do well, it will recommend a alter in brief-phrase trend. After that, the ETH/USDT pair can drop to the 50-day SMA ($three,980).

Conversely, if the cost as soon as once more bounces off the assistance line, it exhibits that the bulls are actively defending this degree. The customers will then try to conquer the hurdle at $four,868 and push the pair to the psychological mark at $five,000. The upside momentum can proceed to improve if the bulls push the cost over the channel.

BNB / USDT

Binance Coin (BNB) is trying to break over the Nov. seven substantial at $669.thirty but the bears are in no mood to ease. They are defending the overhead resistances aggressively.

The BNB/USDT pair formed a Doji candlestick pattern on November 14, signaling indecision in between the bulls and the bears. If this uncertainty resolves to the downside, the pair can slide to the twenty-day EMA ($593).

The bears will have to drag the cost beneath $573 for a deeper correction to the 61.eight% Fibonacci retracement degree at $524.70.

On the other hand, if the cost turns up towards the present ranges or the twenty-day EMA, it will indicate that sentiment is even now constructive and traders are shopping for on the downside. A break over $669.thirty can lead to a retest of the all-time substantial of $691.80. The upside momentum could choose up if customers push and sustain the pair over this degree.

SOL / USDT

Solana (SOL) rebounded off the assistance line of the ascending channel on November 13, displaying that the bulls proceed to obtain on the downside. The bulls will now try to push the cost over the overhead resistance at $248 and challenge the all-time substantial of $259.90.

The upward sloping moving averages and the RSI in the constructive zone recommend that the path of least resistance is to the upside. If the bulls push the cost over the all-time substantial, the SOL/USDT pair can rally to the resistance line of the ascending channel.

This constructive see will be invalidated if the cost turns down from the present ranges and breaks beneath the assistance line of the channel. That could clear the way for a achievable drop to the 50-day SMA ($189).

ADA / USDT

Cardano (ADA) has been trading beneath the twenty-day EMA ($two.06) for the previous 3 days but the bears have not been ready to capitalize on this and dragged the cost to the robust assistance at $one.87.

The flat twenty-day EMA and the RSI just beneath the midpoint recommend a selection-bound action in the close to phrase.

If the bulls push the cost over the downtrend line, it will display that the bears may well be shedding their grip. After that, the ADA/USDT pair can rally to the overhead resistance of $two.47, exactly where the bears can as soon as once more produce stiff resistance.

Alternatively, if the cost turns down from the present ranges, the pair can drop to $one.87. The bears will have to drag the cost beneath this assistance to signal the start off of the downtrend.

XRP / USDT

XRP has maintained over the twenty-day EMA ($one.17) for the previous handful of days but the bulls are struggling to push the cost over the overhead resistance of $one.24. The prolonged wick on today’s candlestick exhibits that the bears are promoting at larger ranges.

The inability to push the cost over $one.24 could prompt revenue-taking from brief-phrase traders. That can drag the cost down to the 50-day SMA ($one.ten). If this assistance also cracks, the bears can sniff out an possibility and try to push the XRP/USDT pair beneath $one.

Conversely, if the cost recovers from the present ranges and breaks as a result of the $one.24 degree, it will display that the customers have overpowered the bears. That could clear the way for a probable rally to $one.41. The bulls will have to conquer this hurdle to attain the upper hand.

DOT / USDT

Polkadot (DOT) broke beneath the twenty-day EMA ($47.15) on November ten but the bears have been unable to create this benefit and pushed the cost down to the 50-day SMA ($41.33). This exhibits that traders are shopping for at reduced ranges.

The DOT/USDT pair has been clinging to the twenty-day EMA for the previous handful of days, escalating the prospect of a breakout over it. If that comes about, the pair can rally to $49.78 and then challenge the all-time substantial of $fifty five.09.

Conversely, if the cost turns down from the present ranges and breaks beneath $44.04, the pair can slide to the 50-day SMA. The bears will have to drag the cost beneath the robust assistance at $forty to attain the upper hand.

Related: Litecoin grapples with ‘double top’ possibility immediately after LTC cost surges 37% in November

DOGE / USDT

Dogecoin (DOGE) has been trading in between the moving averages for the previous handful of days. The bulls pushed the cost over the twenty-day EMA ($.26) on November 14 but the prolonged wick on the candlestick exhibits that the bears are actively defending the downtrend line.

The twenty-day EMA has flattened out and the RSI is close to the center, displaying an equilibrium in between the bulls and the bears.

A breakout and near over the downtrend line will be the initially indication that promoting strain may well be easing. The DOGE/USDT pair can then rally to $.thirty and then to the overhead resistance at $.34.

Conversely, promoting may improve if the bears push the cost beneath the 50-day SMA. The pair can then drop to $.22 and following to the robust assistance of $.19.

SHIB / USDT

SHIBA INU (SHIB) has been oscillating over and beneath the twenty-day EMA ($.00053) for the previous handful of days, displaying a clear lack of path.

The flat twenty-day EMA and the RSI close to the midpoint recommend a stability in between provide and demand. If customers push the cost over $.000057, the SHIB/USDT pair can try to rally to the overhead resistance of $.000065.

On the other hand, a break beneath $.000048 could open the door to a achievable decline in direction of the robust assistance at $.000043. The following trend move could start off on a break over $.000065 or on a break beneath $.000043.

LUNA / USDT

Terra’s LUNA token recovered from the twenty-day EMA ($48.23) on November 13, displaying that bulls proceed to obtain on a drop to this assistance. The increasing moving averages and the RSI in the constructive zone recommend that customers have the upper hand.

The LUNA/USDT pair formed an intraday candlestick pattern on November 14, displaying indecision in between the bulls and the bears.

If the bulls propel the cost over $53.43, the pair can retest the all-time substantial at $54.95 and then recover up to the resistance line of the wedge. The upside momentum could choose up if customers push the cost over the resistance line.

This bullish see will be invalidated if the cost turns down and breaks beneath the assistance line of the wedge. That can drag the cost down to the 50-day SMA ($43.26).

The views and opinions expressed right here are solely individuals of the writer and do not automatically reflect individuals of Cointelegraph. Every investment and trading move includes possibility. You ought to perform your personal study when building a determination.

Market information presented by HitBTC exchange.

.