Bitcoin miners have been aggressively selling off their assets in recent weeks as the coin’s price remains hovering below the key psychological mark of $100,000. At the time of writing, Bitcoin trades at $98,535, registering a 1% decline from its all-time high of $99,860 recorded during Friday’s trading session.

As the BTC market begins to flatten, miners may be motivated to reduce their holdings to make a profit or to offset rising mining costs.

Bitcoin Miners Sell Off Their Holdings

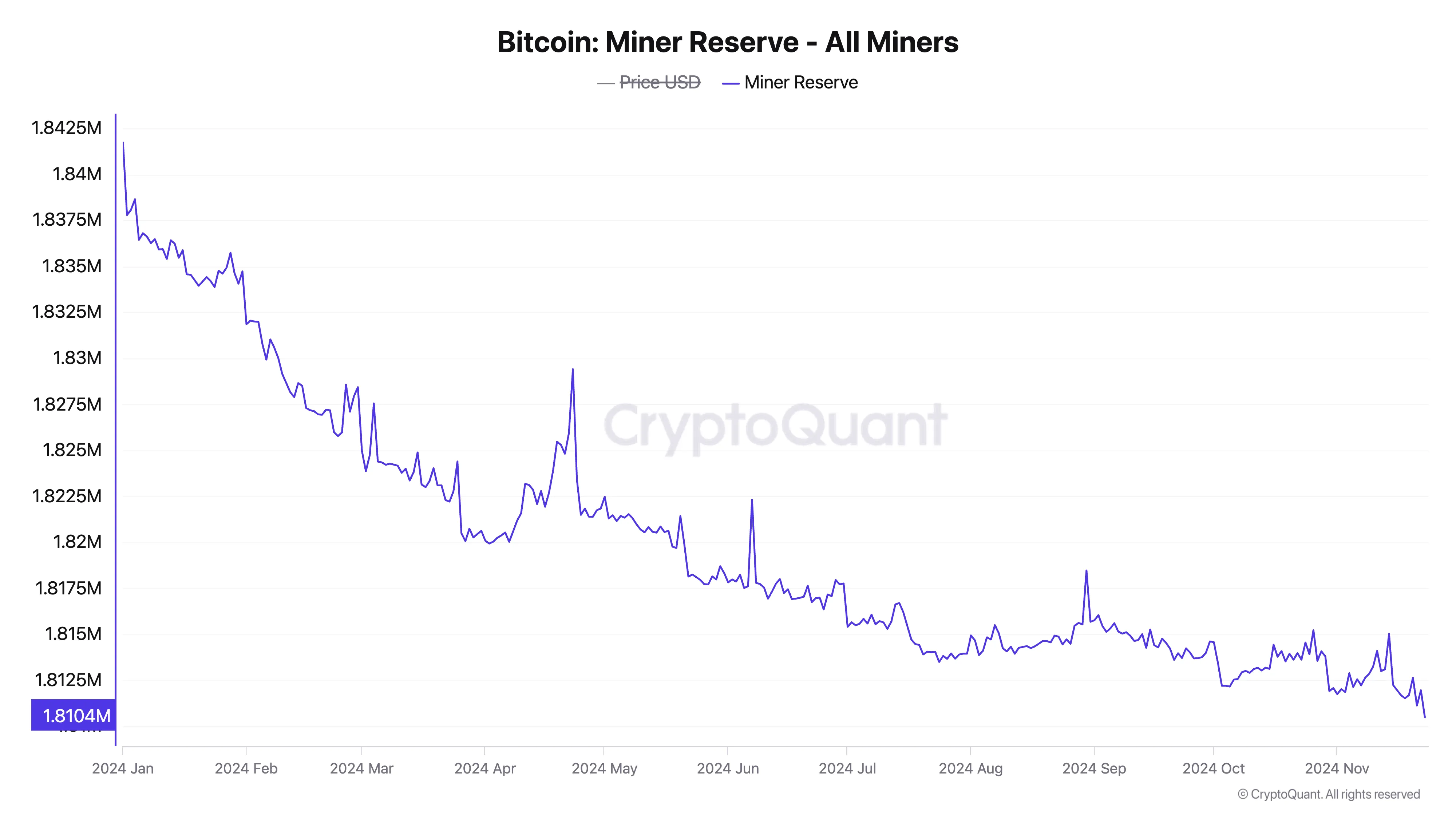

According to CryptoQuant data, the volume of Bitcoin miners’ reserves has dropped to its lowest level since the beginning of the year. As of now, this volume stands at 1.81 million BTC.

This index tracks the number of coins held in miners’ wallets. It represents the amount of coins that miners have yet to sell. The drop in BTC miner reserves indicates that miners on the Bitcoin network are distributing their coins to make a profit or cover the costs associated with mining.

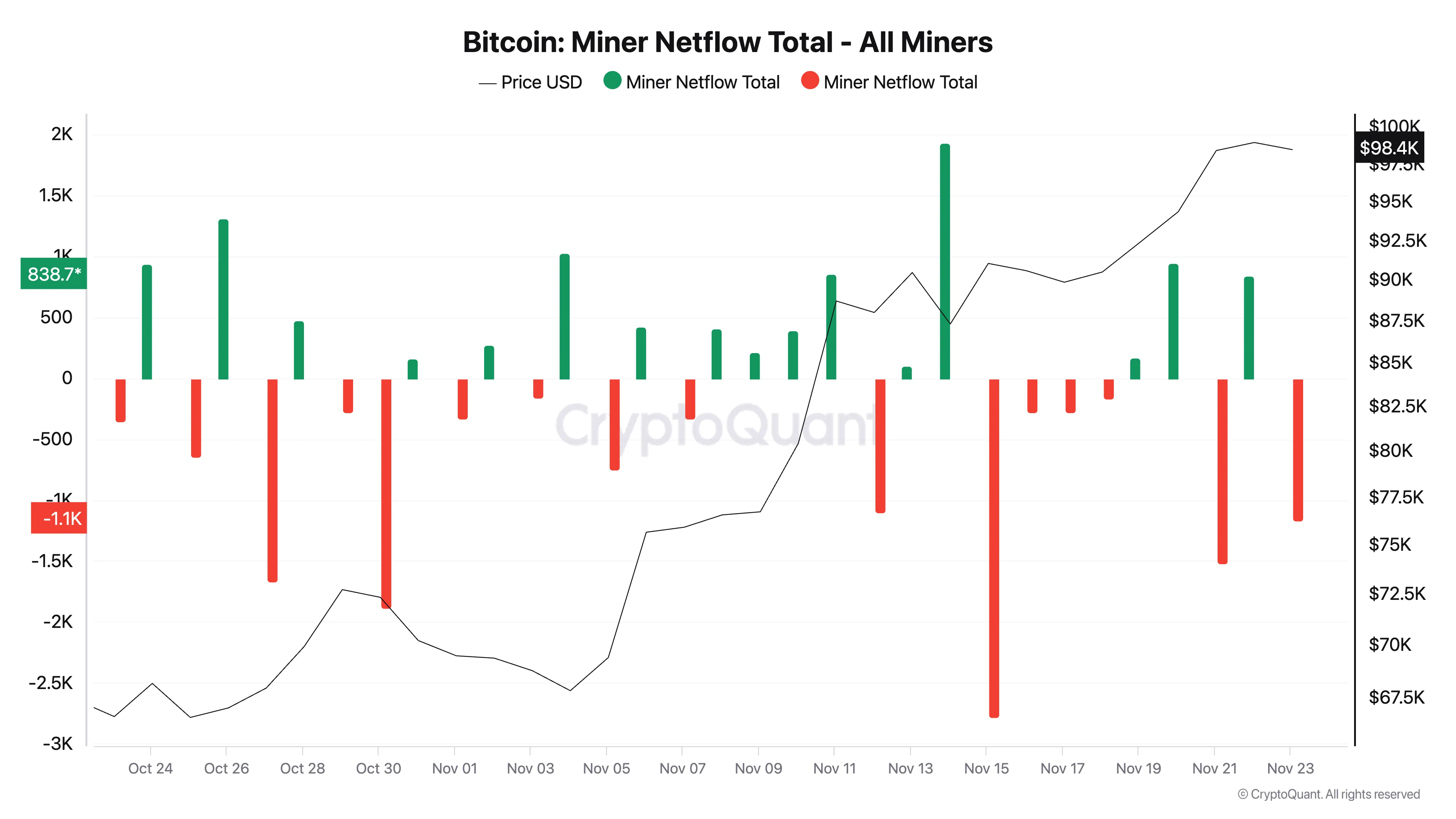

Furthermore, BTC miner net flow metrics confirm the daily selling trend of miners on the network. At the time of writing, the value of this index is negative 1,172 BTC.

Net miner flow refers to the amount of Bitcoin that miners are buying or selling. It is calculated by subtracting the amount of Bitcoin miners are selling from the amount they are buying. When it is negative, it indicates that miners are selling more than buying. This is usually a negative signal and can predict a short-term downtrend in the price of this cryptocurrency.

BTC Price Forecast: Uptrend Still Dominates

Although BTC miners have increased selling pressure over the past few weeks, the uptrend remains significant for the major coin. This is reflected in the positions of the points that make up the Parabolic Stop and Reverse (SAR) indicator. As of now, these points are still below the price of BTC.

Parabolic SAR identifies trend direction and potential reversal points of an asset. When its points are below the asset’s price, it indicates an uptrend. Traders interpret this as a signal to buy long and exit short positions.

If this trend continues, BTC price will reclaim its all-time high price of $99,860 and could surpass the psychological threshold of $100,000. On the contrary, if profit-taking increases sharply, this bullish scenario will be invalidated. If buying pressure weakens, BTC price could drop to $88,986.