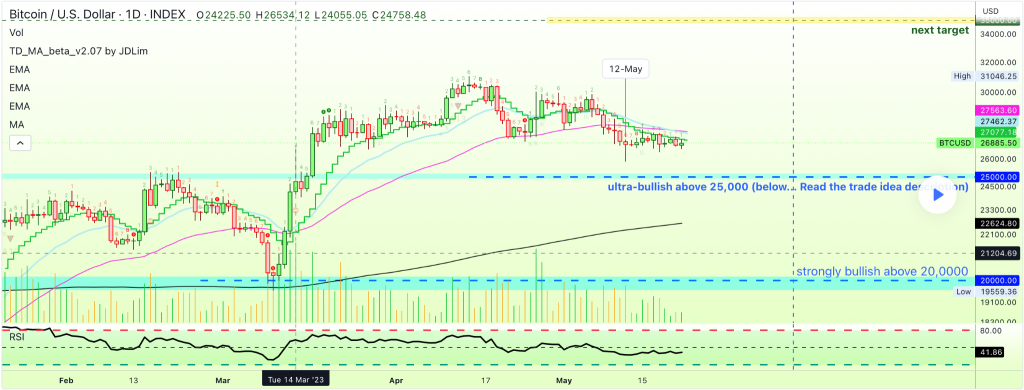

Bitcoin cost has consolidated in a really narrow array in excess of the previous week, followed by a rejection at $thirty,000 and a subsequent break of the 50-day MA at about $29,000. Until the final trading day, the downside target is set at about $25,000, but the current bounce has shed light on the probability of a retest of the 50-day MA amounts.

BTC bulls look to have dominated the market place with sturdy momentum as they regained handle just after a sharp drop. While preserving the similar momentum, the bulls are at the moment trying to push the cost in direction of the following resistance at $28,000. If they do well, it could be a indicator of a strong bounce back, which could be a indicator of an extended Bitcoin bull run.

However, the rally could final for yet another three months as the following bull run is predicted anytime in the following two weeks.

Source: Tradingview

Looking at the weekly chart, it is really clear that BTC cost is trading over some sturdy assistance amounts, over the EMA-21, EMA-50 and MA-200 with a sturdy RSI of fifty five.five. Therefore, the consolidation, in a beneficial course, could carry on for yet another one.five to three months until finally the following breakout happens.

Furthermore, the day-to-day chart displays some various cost action as BTC cost formed a bullish hammer a handful of days in the past. Furthermore, the cost continues to trade under this hammer, which forces the cost to consolidate additional for a breakout. Until BTC cost trades over $25,000, it is viewed as bullish and if it does, a sharp drop under $twenty,000 is imminent.

Coinpedia