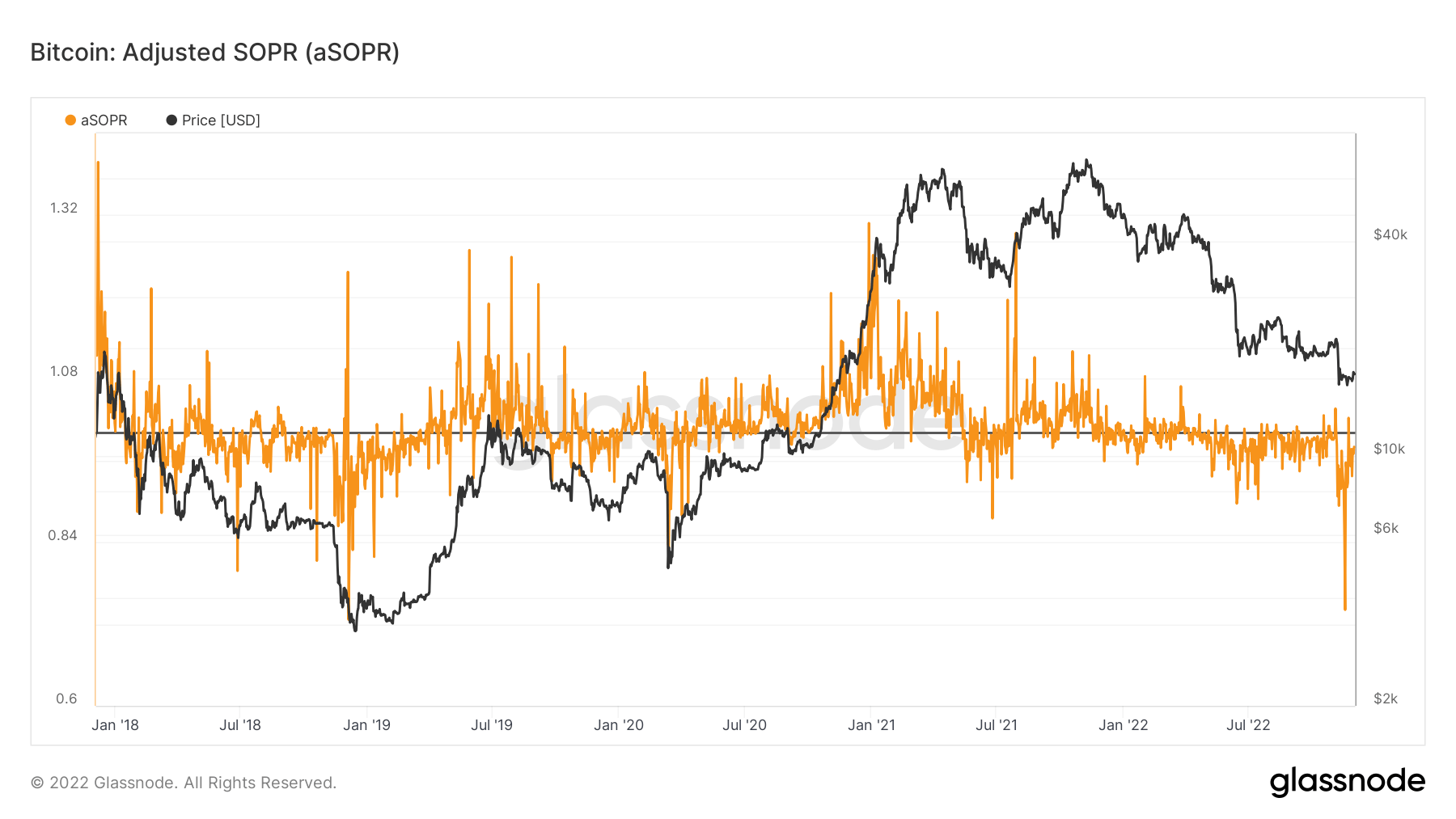

Adjusted Spended Output Return (aSOPR), an indicator of irrespective of whether holders are promoting at a revenue or reduction, has recorded a downward trajectory beneath one, which suggests that traders traders are promoting their positions at massive losses.

Based on CryptoSlate analytically, aSOPR powered by Glassnode usually signals a transition to a bull industry when traders see higher losses in a bear industry. Holders give up on the present situations at this stage and the surrender deepens. Thus opens the door to acquiring opportunists who are driving sizeable accumulation, regardless of the BTC industry witnessing one particular of the most sizeable capitulation occasions in four many years.

As depicted in the chart beneath, the trend in Bitcoin’s aSOPR demonstrates a latest downward trajectory beneath one. As a outcome, the worth of the indicator at this time sits at ranges final witnessed in 2018 when Bearish cycle bottomed out.

Fluctuating aSOPR ranges indicate that traders break even, and the indicator trending over one signifies revenue taking, which ordinarily precedes a bear industry. For instance, Bitcoin’s $21k cost stage was an exciting location to revenue in October, as indicated by aSOPR at the time.

However, the cost continued to fall in November amid the FTX crash that stored holders promoting at a reduction.

As insolvent FTX continues to wreak havoc on the industry and include chaos to the 12 months-extended bear cycle, holders carry on to get on extra losses therefore adjusting aSOPR to signal capitulation. of BTC on a massive scale.

Additionally, aSOPR has moved to historic lows final viewed just before the 2018 bear industry turned bullish, which could indicate that the present cycle is nearing a bottom.

The only big difference now is that the 2018 bottom has reduced lows than the present bottom. Therefore, it stays uncertain irrespective of whether the industry has last but not least reached the turning stage.