- Bubblemaps finds U.S. teams clustering wallets.

- Over 50% of teams impacted.

- Significant market crashes in token value.

Bubblemaps has identified over 50% of U.S.-based teams linked to severe price declines in 38 high-profile tokens as of November 2025.

The analysis highlights concentrated ownership risks, with major financial losses and destabilized markets, notably affecting meme and bundled tokens.

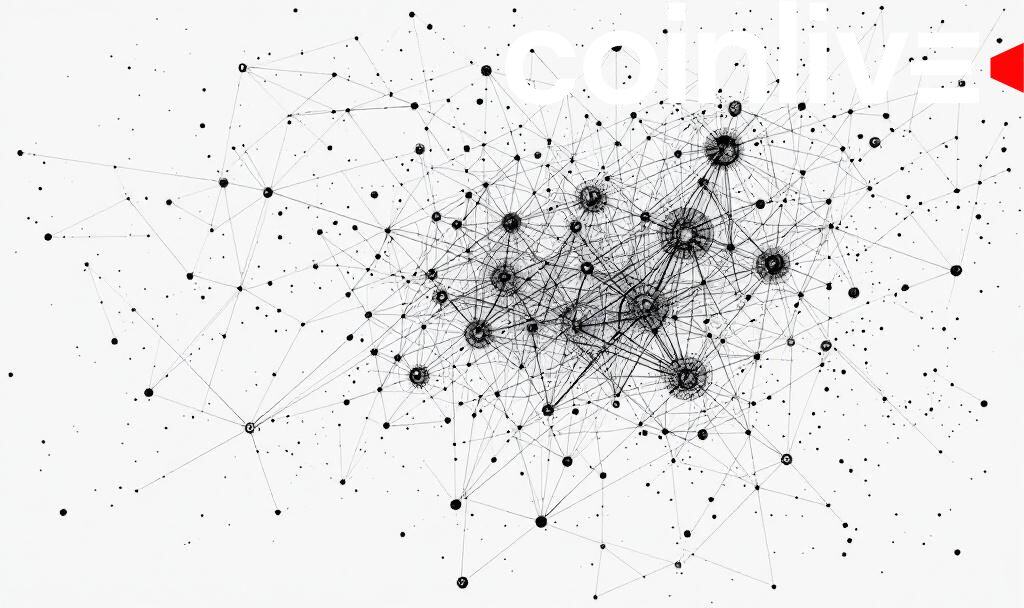

Bubblemaps reveals that over 50% of the 38 previously high-profile tokens are managed by U.S.-based teams, showing significant wallet clustering. These tokens have experienced severe price declines, some as much as 99%, impacting investor confidence. “The wallet clustering phenomenon has led to catastrophic crashes, with over half of these tokens losing about 99% of their market value.”

The analysis points to concentrated wallet ownership behind these tokens, mostly comprising meme coins and bundled tokens. Bubblemaps indicates potential manipulation, though specific leadership details remain undisclosed, contributing to market instability. More details can be found in the official tweet.

The wallet clustering has led to catastrophic financial losses for token holders, with liquidity issues. Many tokens once considered high-profile have severely declined, affecting market dynamics and investor sentiment.

Financial implications include a massive 99% decrease in value for over half of the tokens, disrupting the DeFi and bundled token markets. Liquidity depletion and diminished total value locked are observed amongst these tokens, as noted in this Phemex news update.

Bubblemaps launched its own token, $BMT, seeing oversubscription in an IDO. The success indicates investor interest despite broader skepticism toward similar tokens. Regulatory bodies continue monitoring potential manipulations.

The ongoing scrutiny by Bubblemaps into wallet concentration highlights potential regulatory interest and compliance actions. Previous historical trends show significant risks with concentrated wallet behaviors, encouraging calls for more transparent tokenomics.