The Bybit exchange destinations fantastic believe in in BitDAO and is committed to supplying periodic contributions to the task as the integration with the Arbitrum layer two protocol gets to be comprehensive.

On January 27, Bybit announced its $ 134 million contribution to the BitDAO reserves of Ethereum (ETH), Tether (USDT) and USD Coin (USDC), as effectively as the completion of the integration of the Extends Ethereum layer two Arbitrum resolution.

Bybit is proud to assistance https://t.co/GPkvYHJvAq. We produced a contribution of around $ 134 million (in $ ETH, $ USDT And $ USDC) to the @BitDAO_official treasury, equivalent to two.five basis factors of futures trading vol. concerning nov. one and dec. thirty-initial.

We guarantee contributions.

– BYBIT (@Bybit_Official) January 27, 2022

Currently, BitDAO is 1 of the tasks with the greatest decentralized reserve in the planet. Recently, BitDAO paid $ 200 million to create the zkSync ecosystem. Bybit’s investment demonstrates their believe in in BitDAO to lead and assistance DeFi tasks.

“Bybit commits 2.5% of the exchange’s future trading volume to be used to support BitDAO as we believe the project’s mission is to support the builders of the DeFi economy and show the potential of the DeFi economy. DAO capabilities.”

Additionally, Bybit’s integration with Arbitrum will permit end users to deposit and withdraw ETH, USDT and USDC on the Arbitrum network. Other positive aspects consist of reduce fuel costs than individuals on Ether, lowered throughput, and lowered core network latency.

📢 We are thrilled to announce that Bybit now supports @refereethe Layer two scaling resolution is meant to deal with the latency and scaling troubles connected with #Ethereum Net.

📲 Deposit and withdraw #ETH, #USDT & #USDC employing promptly @referee!

👉🏻https://t.co/LKIFpmBNFM pic.twitter.com/XoNWp3Nw78

– BYBIT (@Bybit_Official) January 27, 2022

Ben Zhou, co-founder and CEO of Bybit, stated the exchange can provide large-finish items and companies in the long term thanks to Arbitrum’s comprehensive developer-pleasant ecosystem. Since the mainnet’s official launch following the $ 120 million funding round, Arbitrum has turn into the foremost local community-favored Tier two resolution with a variety of combinations with several preferred DeFi protocols this kind of as Uniswap (UNI). , Chainlink (Website link), Balancer Protocol, 1inch Network (1INCH) and Binance exchange.

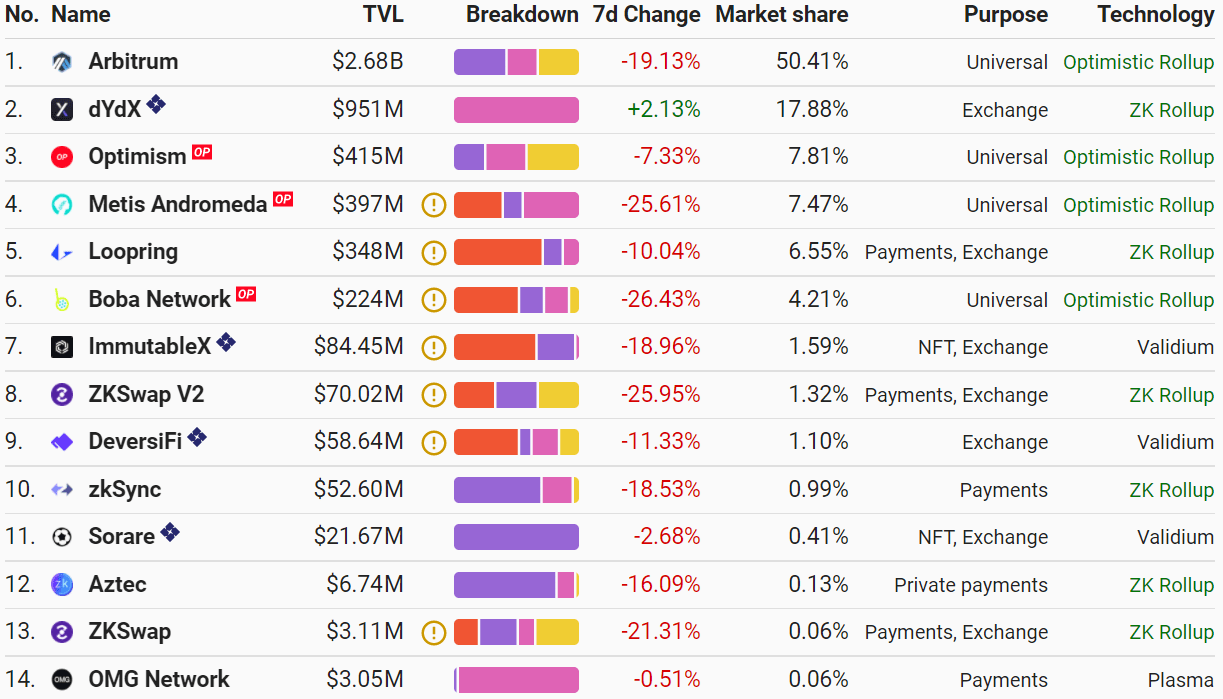

According to L2beat, Aribtrum accounts for much more than 50% of the complete blocked worth (TVL) on Layer two networks at press time, regardless of continuing network operational challenges with the protocol. Arbitrum’s TVL is presently at $ two.68 billion, down 19.13% in excess of the previous 7 days.

Summary of Coinlive

Maybe you are interested: