As the Bitcoin marketplace faces turmoil surrounding the probable bankruptcy of Genesis Trading and Digital Currency Group (DCG), chatter is frequently emerging that Michael Saylor and MicroStrategy’s Bitcoin bet may perhaps be in jeopardy. threat if costs carry on to fall.

The elephant in this space was investigated by Will Clemente of Reflexivity Research and Sam Martin of Blockworks Research. In their report, they examine the queries of whether or not MicroStrategy has a Bitcoin liquidation selling price, how substantial that selling price is, and how the company’s debt is structured.

MicroStrategy has the greatest Bitcoin holdings of any firm listed on the exchange, amounting to 130,000 BTC. In the previous, the firm has even taken out new loans to raise its Bitcoin holdings.

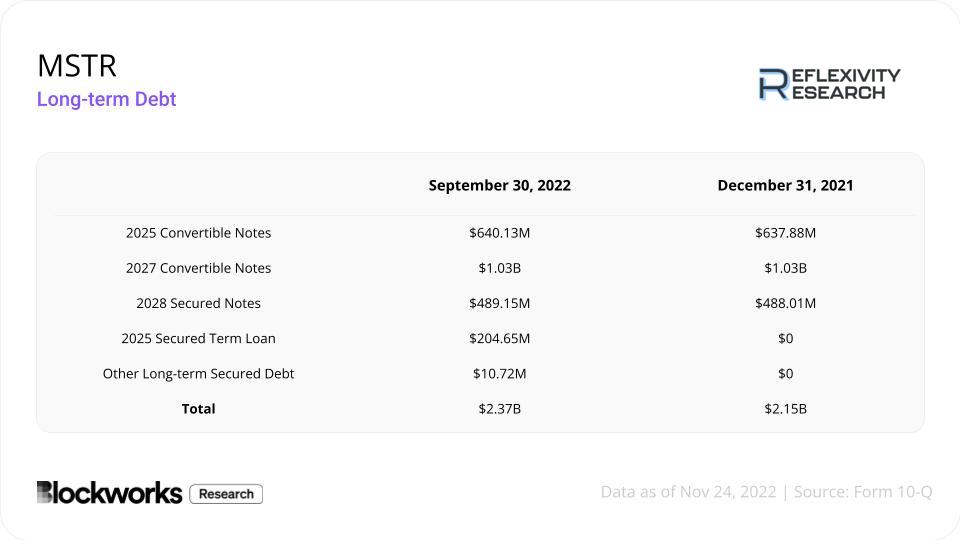

Specifically, MicroStrategy borrowed $two.37 billion to get its Bitcoins at an common selling price of about $thirty,000 per BTC. Saylor’s corporate debt record can be uncovered in the table under.

Is MicroStrategy and Saylor Leveraged Bitcoin Staking Risky?

According to the analysis report, convertible notes incur minimum curiosity fees to MicroStrategy, simply because notes are issued with a extremely favorable MSTR conversion price.

In addition, the conversion to shares can’t take place right up until June 15, 2025 and as early as August 15, 2026, except if the firm undergoes a “fundamental change”.

According to Reflexivity Research, this is a situation of a NASDAQ or NYSE delisting, a merger or acquisition of MicroStrategy, or a transform in vast majority ownership of the firm.

Since Michael Saylor owns 67.seven% of the voting rights, the latter situation is extremely unlikely, producing the convertible not a significant threat.

On the other hand, 2028 premium warranties are not great for a amount of good reasons, in accordance to the report. These consist of substantial fixed curiosity prices, which account for eleven.five% of BTC holdings and can lead to issues if the maturity date is triggered.

“However, it does not pose an immediate threat to MicroStrategy,” Blockworks Research stated.

For Silvergate’s $205 million secured loan in 2025, with around 85,000 BTC of liquidity, Saylor’s liquidation selling price for that loan is reached at a Bitcoin spot selling price of $three,561. So this also does not pose an instant threat. Reflection research says:

While the aforementioned hazards to MicroStrategy and its BTC reserves are reasonably far from getting an instant concern, the greater concern lies in its means to spend curiosity on exceptional debt. firm accounting.

MicroStrategy’s working benefits from its software package company demonstrate a substantial drop in income, and a probable financial downturn could have much more of an influence on working benefits.

In its hottest ten-Q report, the firm itself warned that it could endure a reduction in company in the close to phrase. At the similar time, Saylor’s company holds virtually $67 million in liquid assets, which will act as a buffer for the up coming six-twelve months.

Additionally, the firm has about 85,000 BTC of liquidity on its stability sheet to back up collateral if Bitcoin falls under $13,500 and pushes the loan-to-worth ratio of the Silvergate loan over 50%.

“However, the software business needs to evolve to avoid a forced BTC sale in 2024,” concluded Blockworks Research. For now, nonetheless, MicroStrategy’s Bitcoin bet is practically nothing for traders to stress about.

At the time of creating, BTC selling price was after yet again rejected from the important resistance at $sixteen,600.