Famous US financial services company Cantor Fitzgerald is expanding its cooperation with Tether, an important name in the digital asset industry and the world’s largest stablecoin issuer.

According to the source, the company has agreed to acquire a 5% stake in Tether as part of a broader partnership, including Bitcoin-backed lending initiatives.

Tether Increases Issuance of 13 Billion USDT As Cantor Fitzgerald Expands Relationship

The acquisition talks, said to be completed in 2023, value the 5% stake at around $600 million. This partnership puts Tether in a position of strategic advantage, especially as Cantor Fitzgerald CEO Howard Lutnick takes on a new role as Secretary of Commerce under President-elect Donald Trump.

Market observers say the nomination is likely to raise regulatory support for Tether, which has come under scrutiny over possible violations of sanctions and anti-money laundering regulations – an allegation that The company denied it. However, Lutnick has pledged to relinquish his positions at Cantor if confirmed by the Senate.

Going beyond ownership stakes, Tether is expected to support Cantor Fitzgerald’s Bitcoin lending program, a multi-billion dollar initiative. The program plans to offer Bitcoin-collateralized loans, initially funded with $2 billion, with plans to expand significantly in the future.

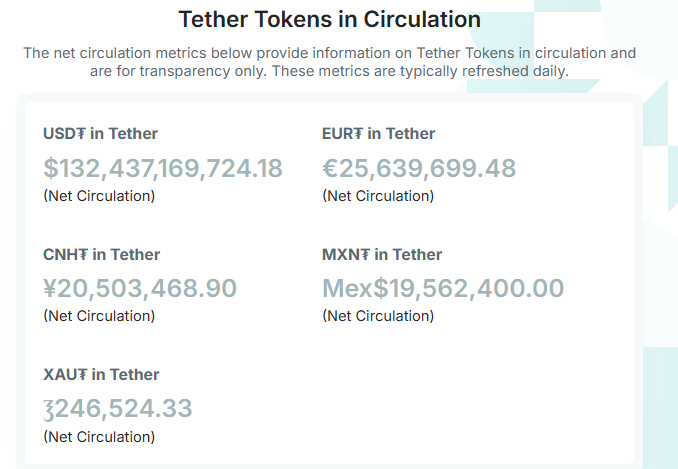

At the same time, Cantor Fitzgerald has been a key partner of Tether, reportedly holding a significant portion of the stablecoin issuer’s $134 billion in reserves in US Treasury bonds.

As Cantor Fitzgerald increased its involvement with Tether, the company has continued to issue strong Tokens. November 24, Lookonchain blockchain analytics platform report that the stablecoin company issued an additional 3 billion USDT, bringing the total issuance from November 8 to 13 billion, pushing the total supply of USDT to about 132 billion USD.

The increase in USDT supply may reflect growing demand for stablecoins, which are often used to hedge market positions or facilitate cryptocurrency transactions without converting to fiat currency. This influx of liquidity can reduce volatility and enhance price stability in digital asset markets.

This increase in USDT supply coincides with a broader market rally led by Bitcoin and other assets such as Dogecoin and Solana, marking a return of investor confidence in the crypto ecosystem.