Cardano (ADA) price is down 15% in the past seven days, following a spectacular rally that took it to its highest level since 2022. Momentum indicators such as ADX are showing increasing strength selling pressure, signaling that selling pressure is getting stronger in the current downtrend.

Whale activity has also declined recently, reversing previous accumulation and raising short-term concerns about the downtrend. With key support and resistance levels in check, further developments will determine whether ADA continues to correct or finds a path to recovery.

Cardano’s Downtrend Is Strengthening

Currently, Cardano’s ADX reaches 19.96, up sharply from 11 just a day before, signaling a strengthening trend. However, as ADA is in a downtrend, rising ADX shows that bearish momentum is increasing.

This suggests that selling pressure is intensifying, and ADA could face further losses in the short term if buyers fail to stem the growing strength of the downtrend.

ADX (Average Directional Index) measures the strength of a trend without indicating its direction. Values above 25 indicate a strong trend, while values below 20 indicate a weak or no-trend market.

With ADA’s ADX approaching 20 and rising, the downtrend could soon transition into a steeper bearish phase, which could lead to higher price volatility. Unless Cardano price finds support or there is an increase in buying activity, the current trajectory points to continued near-term weakness.

ADA Whales Are Leaving the Market

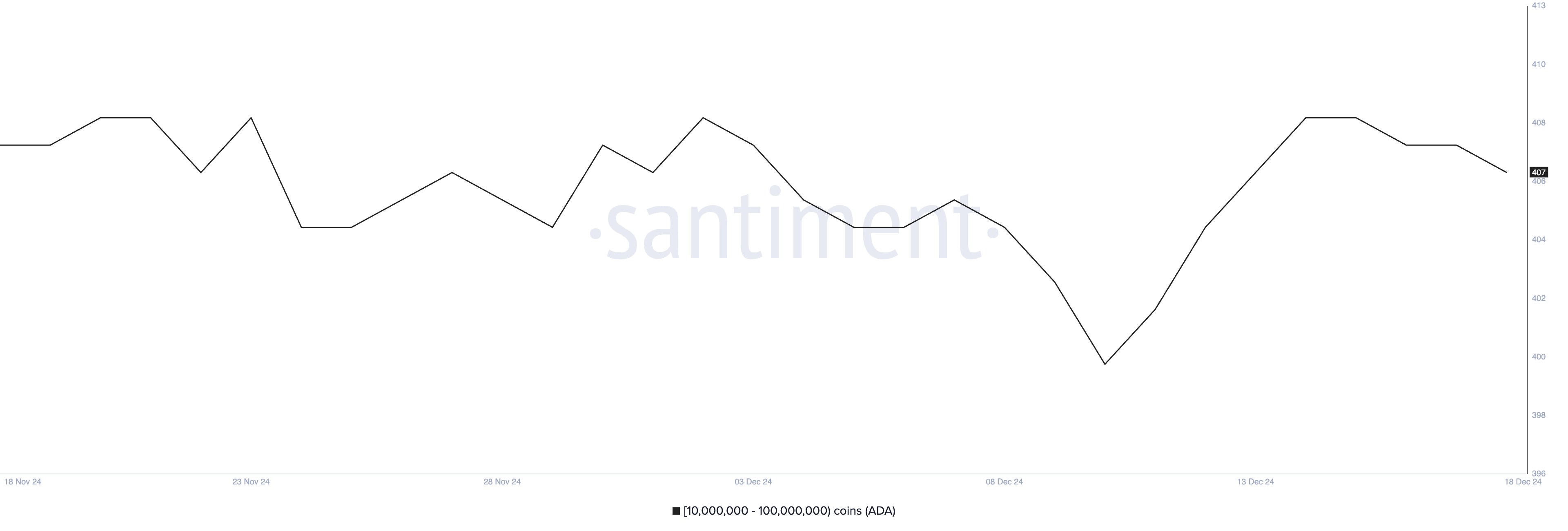

The number of addresses traffic between 10 million and 100 million ADA has decreased to 407, down from 409 five days ago. The decline points to a steady decline in the number of large Holders, or whales, after a sharp increase in early December.

This decrease suggests that some whales may be selling off their positions, which could indicate a decrease in confidence or profit taking.

Monitoring whale activity is important because these large holders significantly influence market trends. Between December 10 and December 14, the number of ADA whales increased from 400 to 409, reflecting strong accumulation during that period.

However, the subsequent decline suggests that this accumulation phase may be reversing, leading to increased selling pressure and a short-term bearish trend for ADA unless renewed buying interest emerges.

Cardano Price Forecast: Could ADA Adjust 46%?

Cardano’s EMAs suggest the possibility of a stronger correction as the short-term EMAs are trending down. The shortest EMA is approaching overlapping below the longest EMA, which would form a ‘death cross’, a bearish signal that typically indicates linear bearish momentum.

If that happens, ADA price could test the immediate support at $0.95, and if that fails, a further drop to $0.65 or even $0.519 is possible.

Conversely, if the trend reverses and buying momentum consolidates, Cardano price could challenge the resistance at $1.03. A successful break above this level could pave the way for further gains, with targets at $1.18 and possibly $1.24.