[ad_1]

In the last seven days, the price of Cardano (ADA) has increased by almost 80%, making it the 2nd best performing asset among the top ten cryptocurrencies. This rally has fueled speculation that the altcoin could return to its peak in 2021.

However, after touching $0.62 on November 11, ADA price corrected to $0.60. For some, this sale may mark the end of this impressive growth streak. However, on-chain analysis shows the opposite.

Cardano attracts the attention of the crowd

Cardano’s run began around November 6, shortly after all indicators pointed to Donald Trump’s victory in the US election. Previously, ADA price was at around 0.33 USD, but after a week, the Token increased to 0.62 USD before falling to 0.60 USD.

Using data from IntoTheBlock, the average transaction size, which provides insight into the activity of “whales” and retail users on the block chain, suggests that the correction may not last long. . When this index increases, it means that institutional players are engaging in more speculative activity.

Conversely, a decline in the index suggests that retail investors are doing most of the trading. As of this writing, the average deal size has increased to $171,588 over the past seven days, indicating that large investors are playing a key role in ADA’s recent rise.

Historically, when this happens, Cardano price continues to increase although it may face small corrections. For example, in March, when the index spiked, ADA climbed to $0.74. Therefore, if this persists, ADA could retest the $0.62 level and possibly move higher.

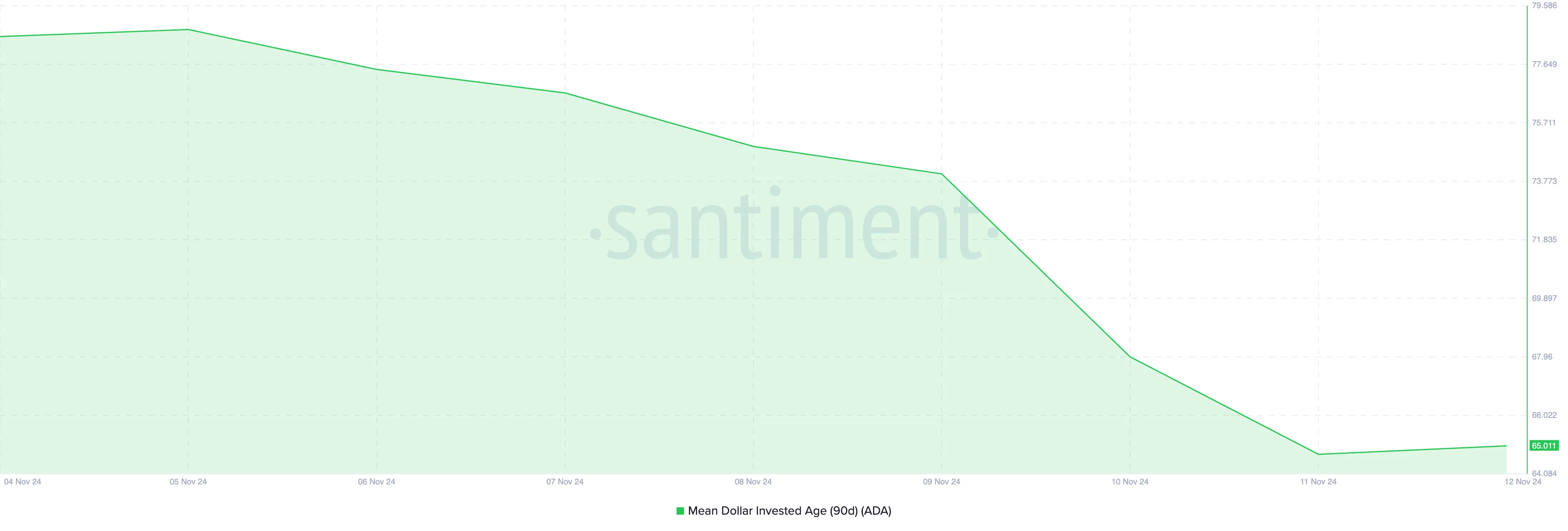

Another indicator that Cardano’s race is not over is the average dollar investment age (MDIA). MDIA is the average age of each dollar invested in a cryptocurrency.

A rising MDIA indicates that investment is becoming more stagnant, with old coins remaining in wallets. Conversely, a falling MDIA indicates that investment is returning to active circulation, indicating increased network activity.

From a historical perspective, the flow of ADA Tokens back into circulation is a positive sign. Therefore, if MDIA continues to decline, this altcoin could increase in price from its current value.

ADA price forecast: 0.70 USD first, over 1 USD later?

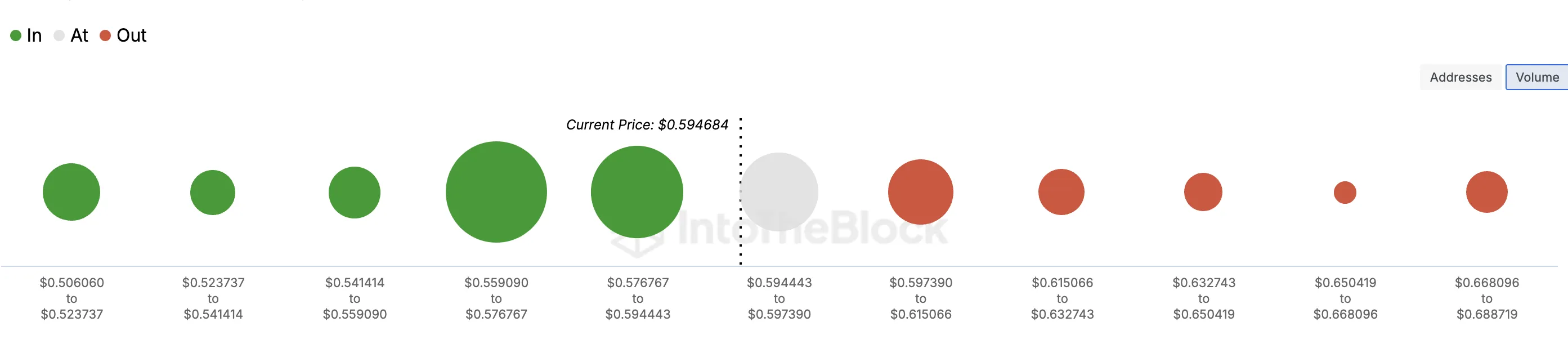

From an on-chain perspective, the In/Out of Money Around Price (IOMAP) index shows that ADA is trading at a point where thousands of addresses have accumulated 1.24 billion tokens. IOMAP classifies addresses based on purchase price and shows whether the address has unrealized profits or losses.

Furthermore, this indicator is important for determining support and resistance. Typically, the larger the volume or cluster, the stronger the support or resistance. As seen below, this altcoin appears to have strong support at $0.59, where 87,950 addresses purchased approximately 1.79 billion ADA.

This amount is greater than the buying volume between $0.61 and $0.69. Therefore, according to the laws stated above, ADA could surpass these levels and climb to $0.70 in the short term.

In addition, the technical perspective also seems to support this move. This time, TinTucBitcoin analyzes the weekly chart to evaluate the long-term potential.

On the ADA/USD weekly chart, the altcoin broke out of a descending triangle. A descending triangle is a bearish pattern characterized by a downward sloping upper resistance and flatter, horizontal lower resistance.

Once the price breaks below the lower resistance, a further correction is possible. But in the case of ADA, the price rose above the downward slope resistance, suggesting that the altcoin’s value could move higher.

If that holds true, then Cardano’s bull cycle could extend into next year, with the price potentially rising nearly 127% to $1.34. Conversely, if selling pressure strengthens before then, the ADA price forecast may not come true. Instead, the value of crypto could fall further.

General Bitcoin News

[ad_2]