Cardano (ADA) has had a rough month, down more than 20% in the past 30 days, but remains in the top 10 cryptocurrencies by market capitalization. Technical indicators, including ADX, point to a weak momentum trend since December 24, suggesting the decline is not strong enough to produce significant price movements.

Currently, ADA is trading between the $0.78 support and $0.87 resistance levels. Its next direction depends on whether these levels hold, with potential scenarios including a sharp correction or a rally towards $1.04.

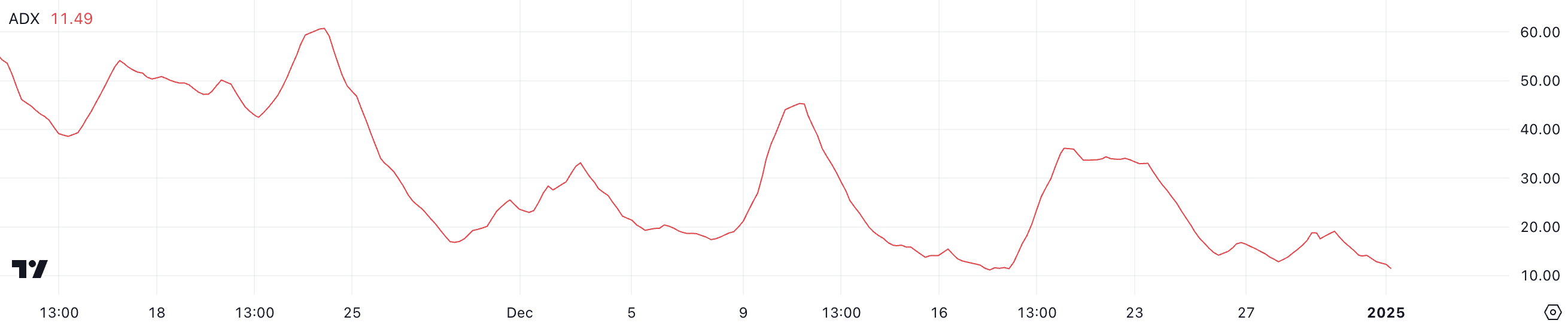

ADA’s ADX Shows That Downtrend Is No Longer Strong

Cardano’s ADX index is currently at 11.49, reflecting weak trend strength as it has remained below 20 since December 24. This low ADX index shows that the current downtrend is not strong enough, which implies that although ADA remains under selling pressure, the selling force behind the price decline has abated.

This could signal the possibility of a short-term consolidation period, as trend strength remains insufficient to drive significant price movements.

The Average Directional Index (ADX) measures the strength of a trend, whether bullish or bearish, on a scale of 0 to 100. Values above 25 indicate a strong trend, while readings below 20, like ADA currently 11.49, indicating a weak or non-existent trend.

Amid a downtrend, this low ADX reading means bearish forces are not well established to continue, which could limit price decline unless selling pressure increases. Without an increase in ADX to confirm stronger trend moves, ADA’s price may continue to move sideways or only see small fluctuations in the short term.

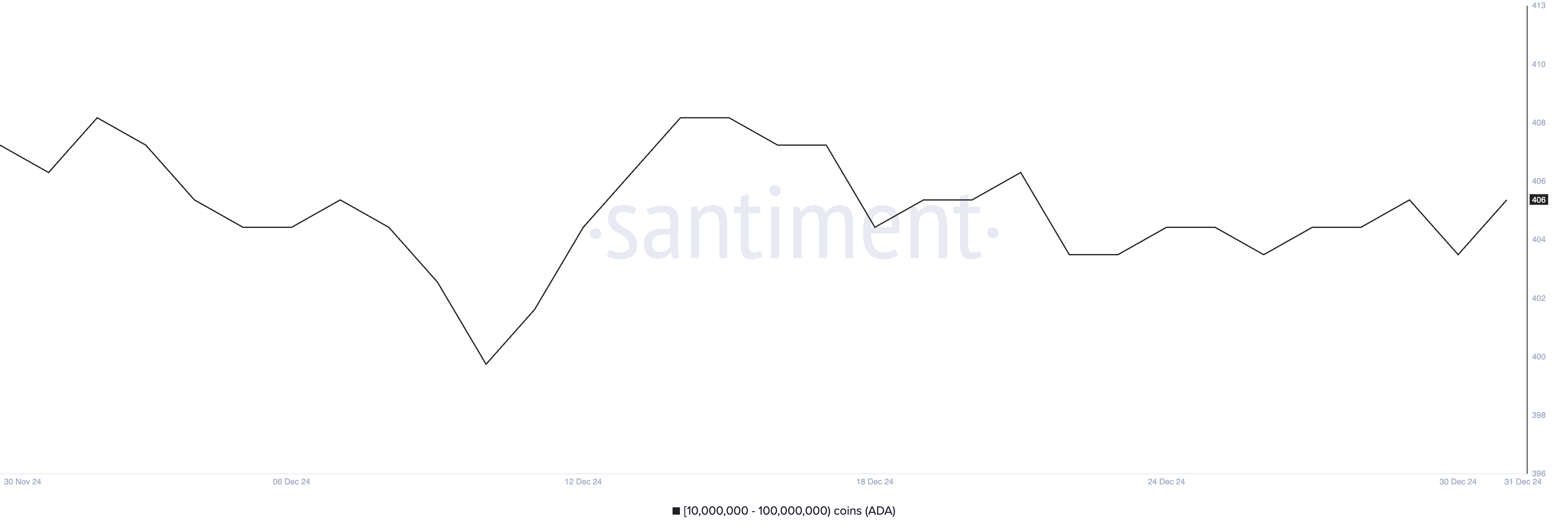

Cardano Whales Are Less Active

The number of addresses holding between 10 million and 100 million ADA has remained stable since December 18, fluctuating slightly between 407 and 404. This followed a significant increase from December 10 to 14, when These addresses increased from 400 to 409, signaling whales bought Cardano during that period.

Since then, the stabilization in whale activity suggests that major investors are not actively buying or selling positions, reflecting a sense of caution.

Monitoring whale activity is crucial as large holders often have significant influence in the market. Their accumulation often signals confidence in the asset and can push prices up, while distribution often creates selling pressure.

The current stability in the number of ADA whales points to a neutral attitude among these investors, which could mean limited volatility in the short term. Unless whale activity shifts towards significant accumulation or distribution, ADA price may remain in a range or witness only minor fluctuations in the coming days.

Cardano Price Prediction: Can ADA Return to $1?

Currently, Cardano price is trading between resistance at $0.87 and support at $0.78. If the $0.78 support fails to hold, ADA’s price could experience a sharp correction, possibly falling lower to $0.519, representing a 38% drop.

Conversely, if ADA price successfully breaks above the $0.87 resistance level, this could signal a change towards bullish momentum. In this case, the price could rise to test the next resistance at $1.04, providing a 23.8% upside opportunity.