Since the beginning of December, Cardano (ADA) has continuously decreased in price, falling below the 1 USD mark. This prolonged price drop makes investors concerned about ADA’s ability to recover.

Currently, the altcoin’s hopes rest with Long-Term Holders (LTH), who have historically provided stability in difficult market conditions.

Cardano Investor Participation Is Declining

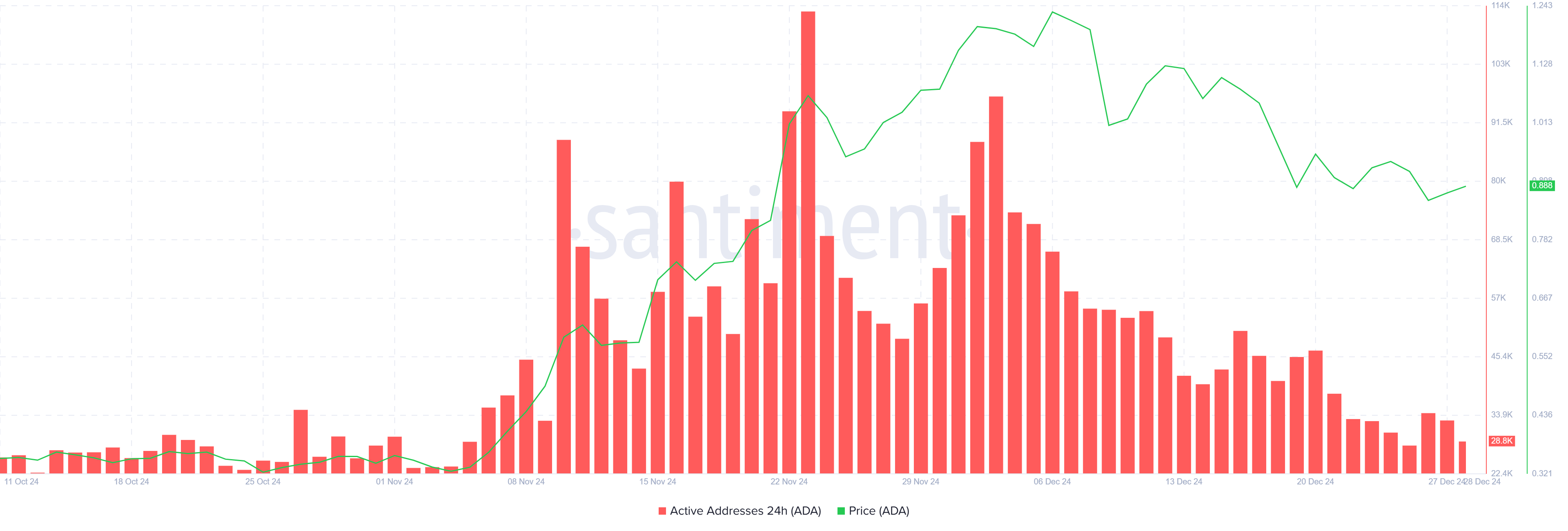

Active addresses on the Cardano network are plummeting, reflecting growing investor skepticism about ADA’s resilience. This decline brings a worrying sign, as the drop in activity suggests that many traders are retreating from the market, leaving the altcoin lacking liquidity.

With liquidity falling, ADA has greater difficulty recovering from current levels. The absence of short-term traders reflects broader market indecision, making a recovery to key price points even more challenging in the near future.

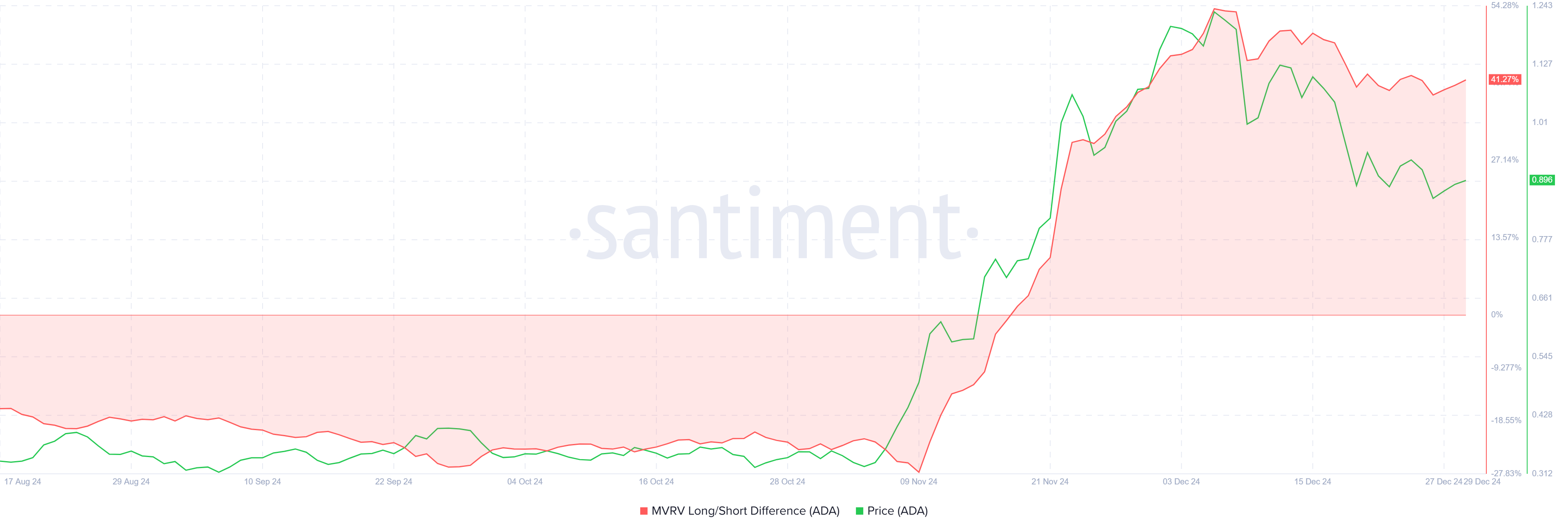

Cardano’s macro momentum offers a glimmer of hope, supported by the MVRV Long/Short difference standing at 41%. This high positive value shows that LTH has superior returns compared to short-term holders (STH), demonstrating the dominance of investors willing to hold for the long term rather than make short-term profits.

The presence of strong LTH often stabilizes asset prices and facilitates recovery. If these investors hold their ground, they can offset the broader market’s caution, keep ADA’s price from plummeting, and possibly help it recover.

ADA Price Prediction: Reversing Losses

Currently, Cardano is priced at $0.89, remaining just above the critical support level at $0.87. Maintaining this support is essential for ADA to regain momentum and aim for the $1.00 mark, a key technical and psychological barrier.

Turning $1.00 into support is key to starting a recovery. If ADA reaches this milestone, it could begin to reverse recent losses, with a target of $1.23 to establish a stronger position in the market. This level will mark a significant step forward in restoring investor confidence.

However, losing the $0.87 support could have serious consequences for Cardano’s price trend. A decline to $0.77 or lower would invalidate the growth outlook, prolong losses and increase investor skepticism. Holding above this support level is essential to avoid an extended downtrend.