The price of Cardano (ADA) is on a sustained decline, recently dropping to a multi-week low of $0.84. This prolonged downtrend reflects major market challenges, as investors show less optimism.

ADA’s inability to hold key support levels further contributes to weakening its position heading into 2025.

Cardano Investors Are Doubtful

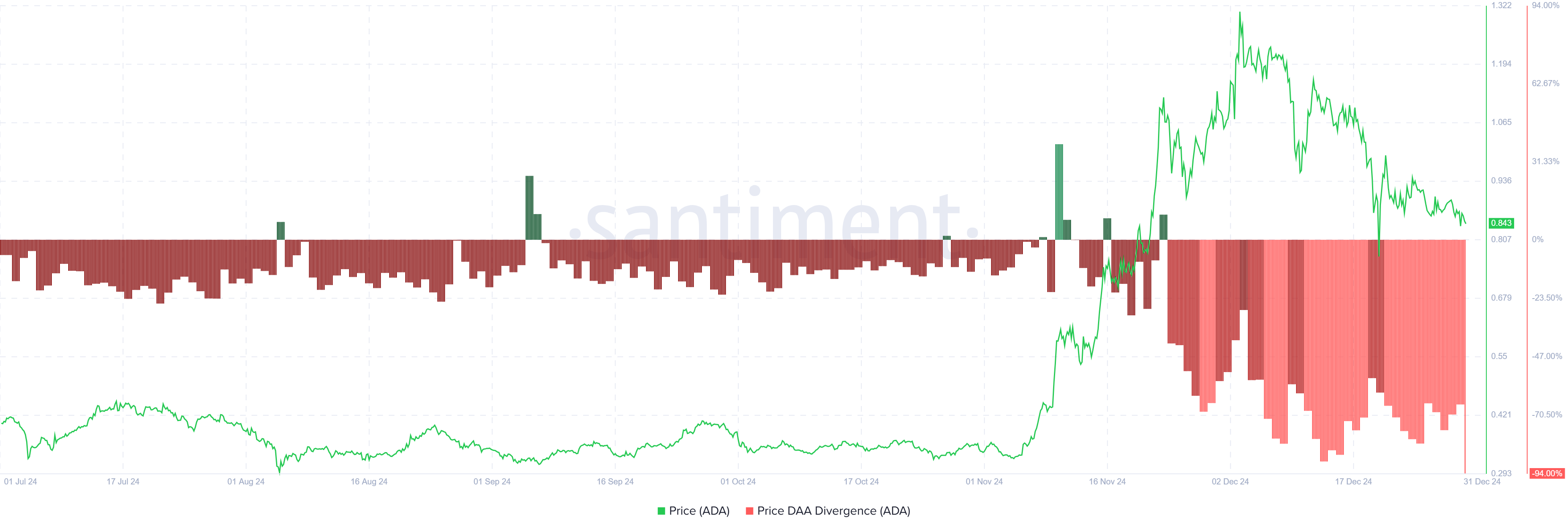

The DAA Price Contradiction Index is currently flashing a sell signal, highlighting Cardano’s bearish market sentiment. This signal arises from a combination of falling prices and decreasing network participation. Such patterns show that investors are losing confidence, as there is much uncertainty surrounding ADA’s ability to recover.

Adding to the negative outlook, ADA’s engagement metrics reveal a shrinking of the active user base. This waning interest reflects broader hesitation among investors. The decline in activity is in line with the downtrend, suggesting that market participants are increasingly moving away from the asset as recovery prospects become uncertain.

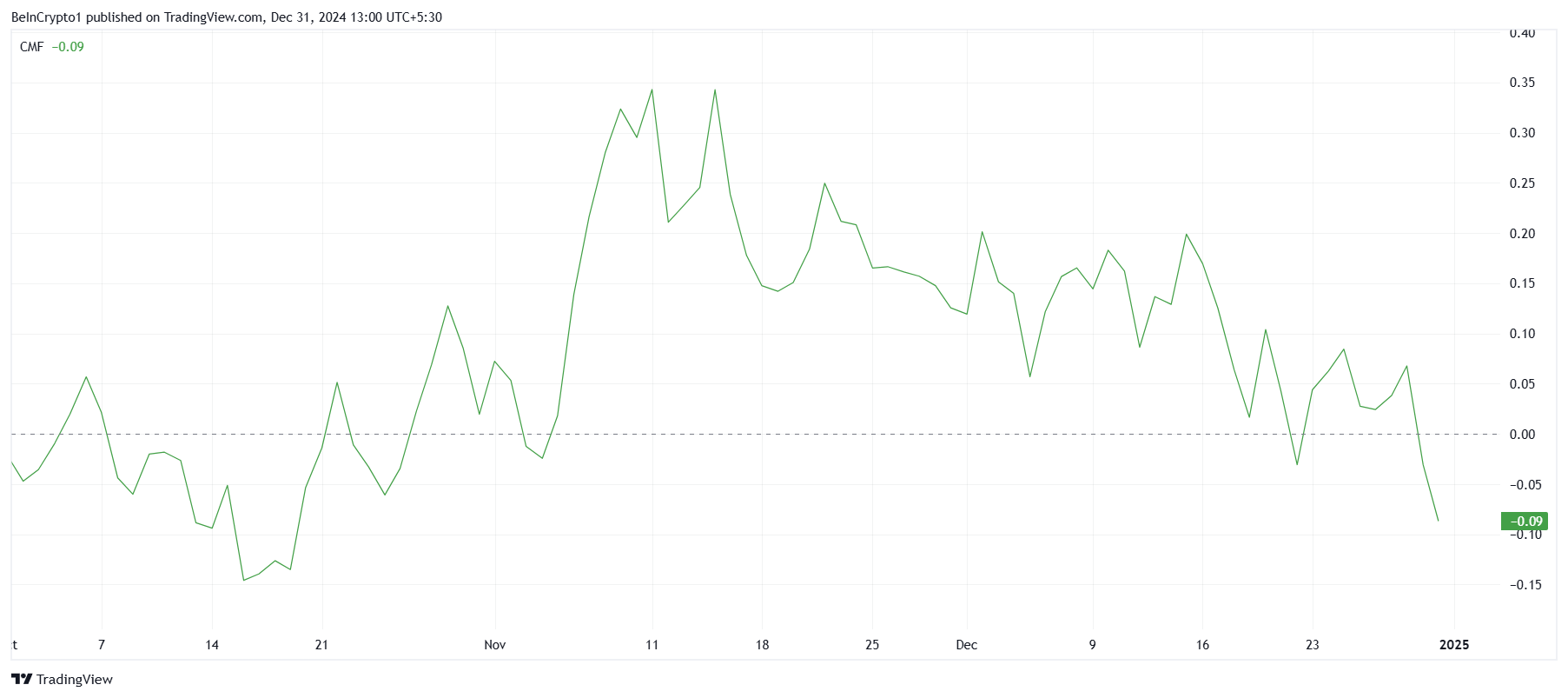

Cardano’s macro momentum shows further weakness, with the Chaikin Money Flow (CMF) index hitting a two-and-a-half-month low. This trend signals that outflows are now dominating ADA’s market activity, reflecting a shortage of new capital entries. The persistent negative CMF highlights the challenges ADA is facing in attracting investor confidence.

Lack of clear price direction is causing ADA holders to exit their positions as selling pressure increases, and the asset risks further decline. Unless macro or network-specific factors change significantly, this trend could continue, exacerbating ADA’s difficulties as outflows remain dominant.

ADA Price Prediction: Towards Recovery

Cardano’s current price of $0.84 has slipped below the critical support level of $0.85. While ADA has at times remained above this level in recent days, the past 24 hours have seen fresh pressure, leading to further losses. This decline puts ADA in a precarious position.

If ADA cannot reclaim the $0.85 support, it risks sliding to $0.77. Such a decline could be enhanced by ongoing high cash outflows, weakening the asset’s price stability. This scenario can increase negative sentiment and make investors even more reluctant to participate.

Conversely, reclaiming the $0.85 level as support could give ADA a chance to recover. A successful reversal of this price level would help ADA target $1 as a base of support once again. However, such a recovery depends strongly on improving market sentiment and reducing cash outflows.