Inflows into the cryptocurrency marketplace from primary cryptocurrency investment money in 2022 reached their lowest degree given that 2018.

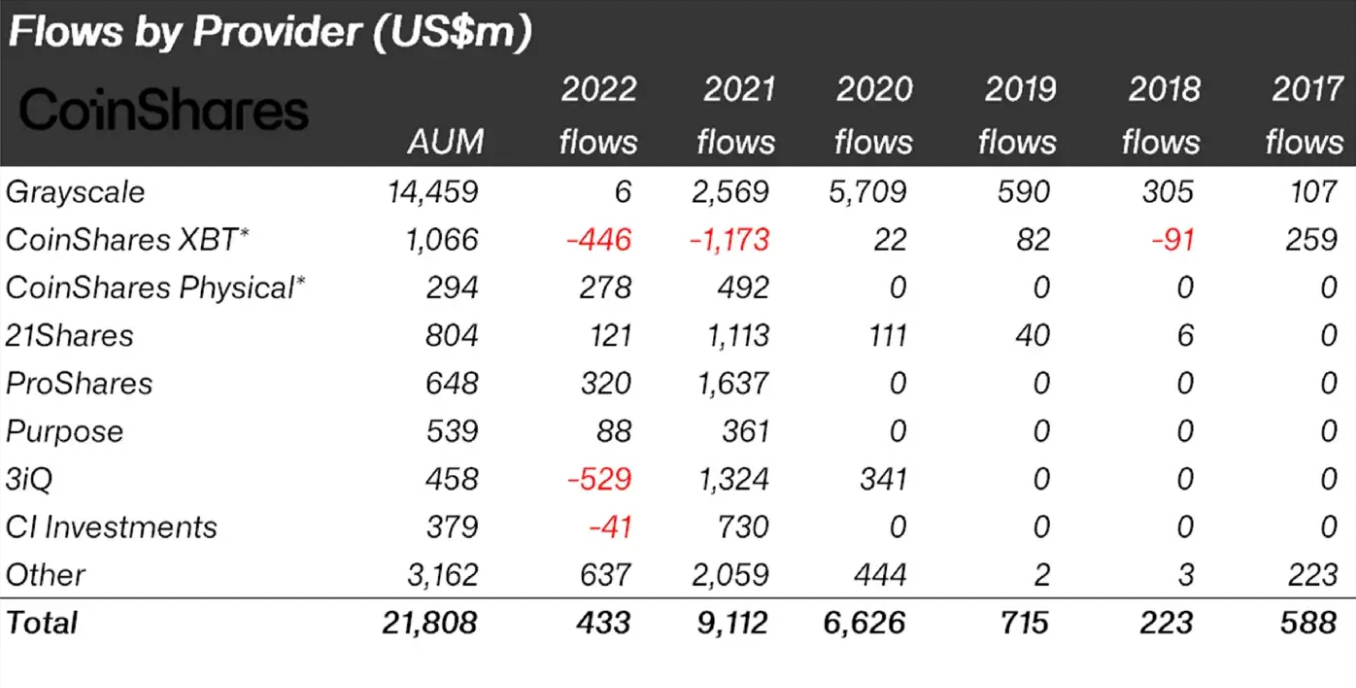

According to a report from CoinShares, big cryptocurrency investment money noticed complete capital inflows into the marketplace with a complete worth of just $433 million in 2022, the lowest degree given that 2018 at close to $223 million.

This signifies the funds’ publicity to the marketplace has decreased substantially, not as well salty from the $9.one billion figure in 2021, a 95% decline. Since then, the selling price of bitcoin has also dropped about 60% yr-on-yr as the crypto winter engulfs the marketplace amid continued Fed curiosity price hikes to battle inflation and numerous liquidity crises and bankruptcies across the marketplace.

CoinShares study director James Butterfill stated it was tough to predict what 2023 would be like. He even more stated that the FTX crash brought on a deep wound in believe in in cryptocurrencies.

“Unfortunately, we feel it will consider many years for investor self confidence to boost to attain the amounts viewed in 2021 and early 2022.

We think the US dollar continues to weaken and that a pivotal move by the Fed in the 2nd half of 2023 is possible to be remarkably supportive for Bitcoin as it is a price delicate asset, but till that comes about, the marketplace is unlikely to see a considerable inflow of investment.

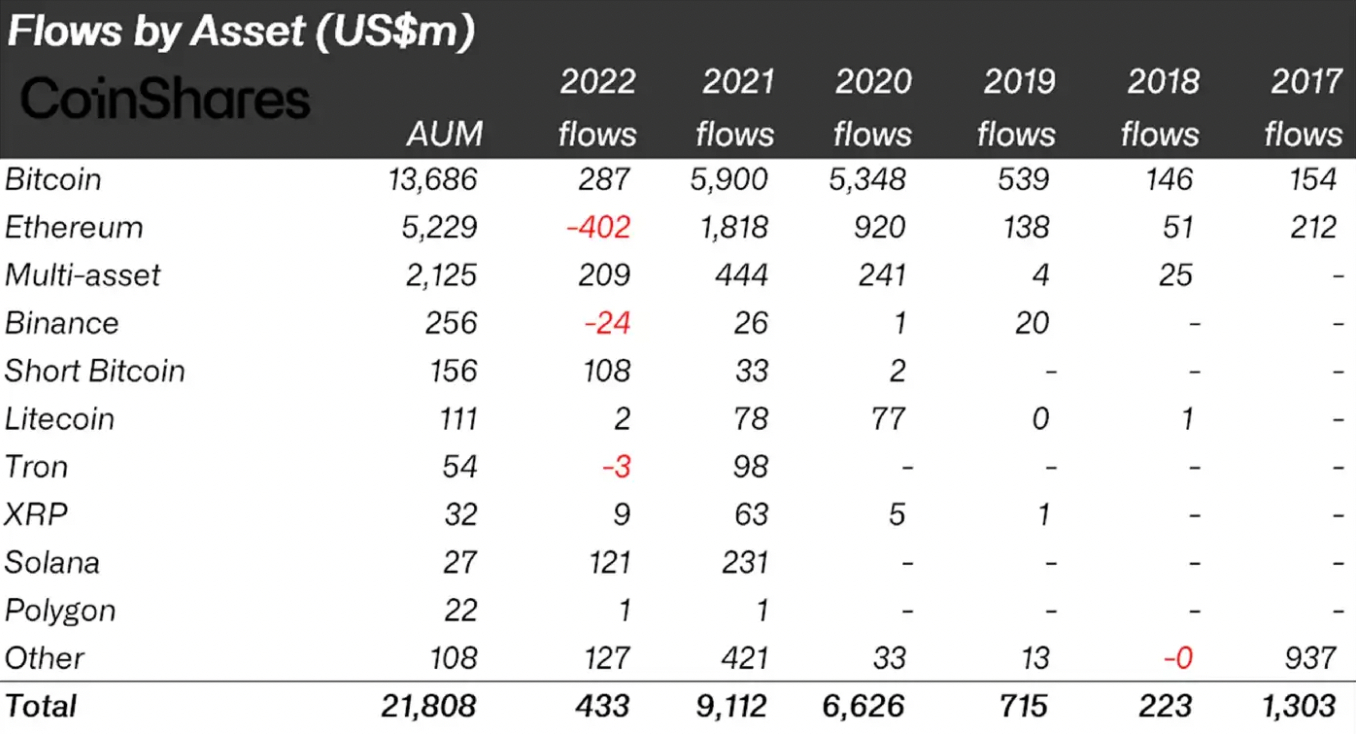

Despite this kind of a dramatic drop in worth, Bitcoin stays the top rated cryptocurrency in the fund’s sights, with inflows of $287 million. Not currently being as fortunate as Bitcoin, Ethereum had its worst yr ever with an off-asset sum of $402 million.

CoinShares explained that disappointment with Ethereum’s effectiveness may perhaps come from investor worries about the transition to the new Proof-of-Stake consensus mechanism and ongoing troubles with time lags. ETH’s staking breakpoint, as the Shanghai challenging fork, has been moved to March 2023.

Synthetic currency68

Maybe you are interested: