Bitcoin ETFs (exchange-traded funds) broke a 15-day streak of positive inflows on Thursday, recording the largest single-day withdrawal since their launch in January. Ethereum also shares this sentiment, breaking an 18-day streak of relying on positive inflows.

This comes as markets continue to be stunned by Federal Reserve Chairman Jerome Powell’s comments on Wednesday.

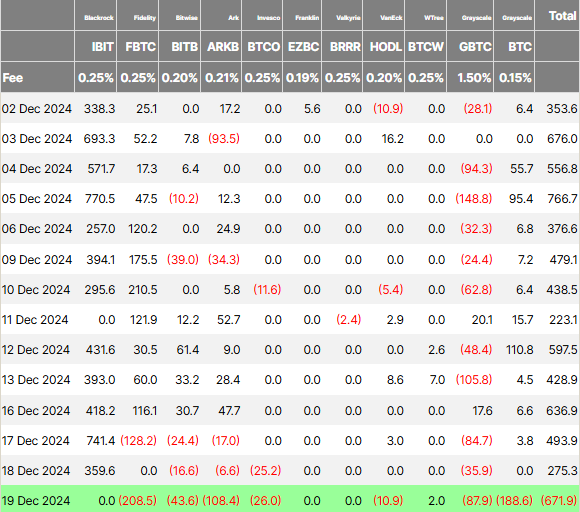

Bitcoin ETF divestments hit new high at $671.9 million

According to data from Farside, Bitcoin ETF divestments reached a new peak on Thursday at $671.9 million. This surpasses the previous highest divestment of $564 million recorded on May 1, 2024.

Based on these data, Fidelity’s FBTC fund led the selling volume in the December 19 trading session with a divestment of up to 208.5 million USD. Notably, this is the highest level of fund performance since January 11, when these financial instruments first came to market.

Grayscale’s BTC fund recorded a $188.6 million divestment, marking its worst performance since launch. Ark Invest’s ARKB fund also contributed more than $108 million in total divestments in Thursday’s trading session. BlackRock’s IBIT fund bucked the trend, along with Franklin Templeton’s EZBC and Valkyries’ BRRR, not recording inflows or out.

Data from Farside also shows The picture is similar in the Ethereum ETF market, which broke an 18-day streak of relying on positive inflows as divestments reached $60.5 million. Crypto enthusiast Mark Cullen attributed the change to the news that the Fed is not allowed to hold Bitcoin, a stance that could threaten the prospects of a Bitcoin reserve fund in the US.

“It looks like US Bitcoin ETFs are all retreating after news that the Fed is not allowed to hold Bitcoin. So does that mean there is no strategic reserve for Bitcoin? Total divestment -$671.9 million,” Cullen share.

In fact, during Wednesday’s press conference, Jerome Powell said the Federal Reserve is not allowed to hold Bitcoin, implying that it can only advise and regulate. The FED Chairman also implied that he would not continue to cut interest rates in 2025 as previously expected. This change in tone comes after data showed inflation in the US was not cooling as Federal Reserve officials hoped.

In this context, the large divestments on December 19 may represent a reaction from investors on Wall Street, with only two rate cuts expected next year.