Bitcoin (BTC) has experienced a 5% drop over the past week. As of this writing, the leading coin is trading at $96,905, below the key price threshold of $100,000.

Interestingly, the recent decline did not trigger a major sell-off. This shows that optimism remains strong, and market participants hope the price of the currency will soon return above the $100,000 level.

Bitcoin Reduces Sell-Off

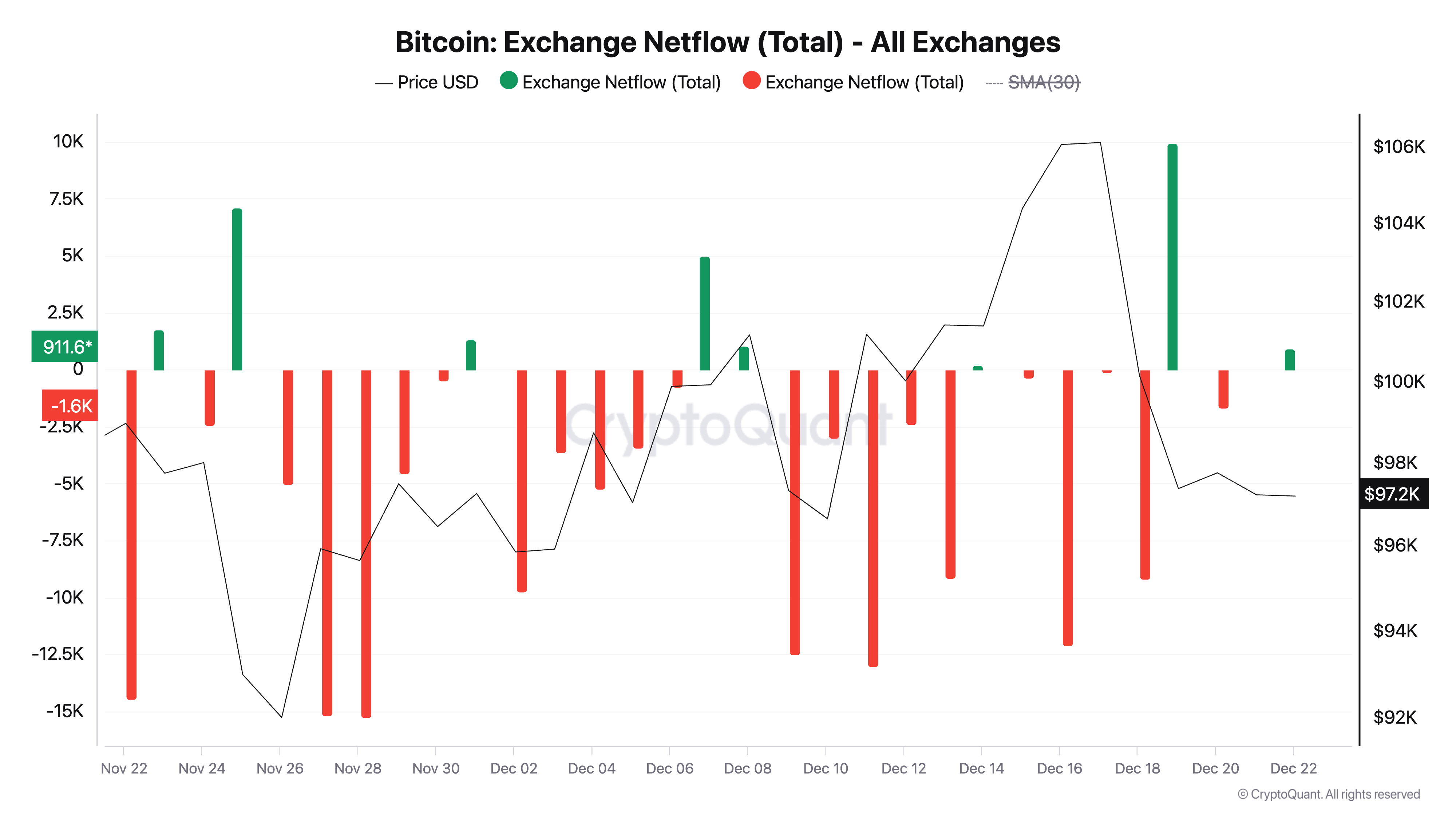

According to data from CryptoQuant, net BTC outflows from cryptocurrency exchanges over the past week exceeded $2.5 billion. Net outflow from the exchange tracks the amount of coins or tokens withdrawn from exchange wallets.

As exchange outflows spike, it points to a shift toward holding assets in personal wallets rather than trading or selling. This often indicates an optimistic sentiment, as investors may expect prices to rise.

Commenting on what it means for Bitcoin, anonymous CryptoQuant analyst KriptoBaykusV2 noted in a report recently:

“If the Bitcoin outflow trend continues, this could reduce selling pressure in the market. With less Bitcoin available on exchanges and demand flat or increasing, prices could trend upward.”

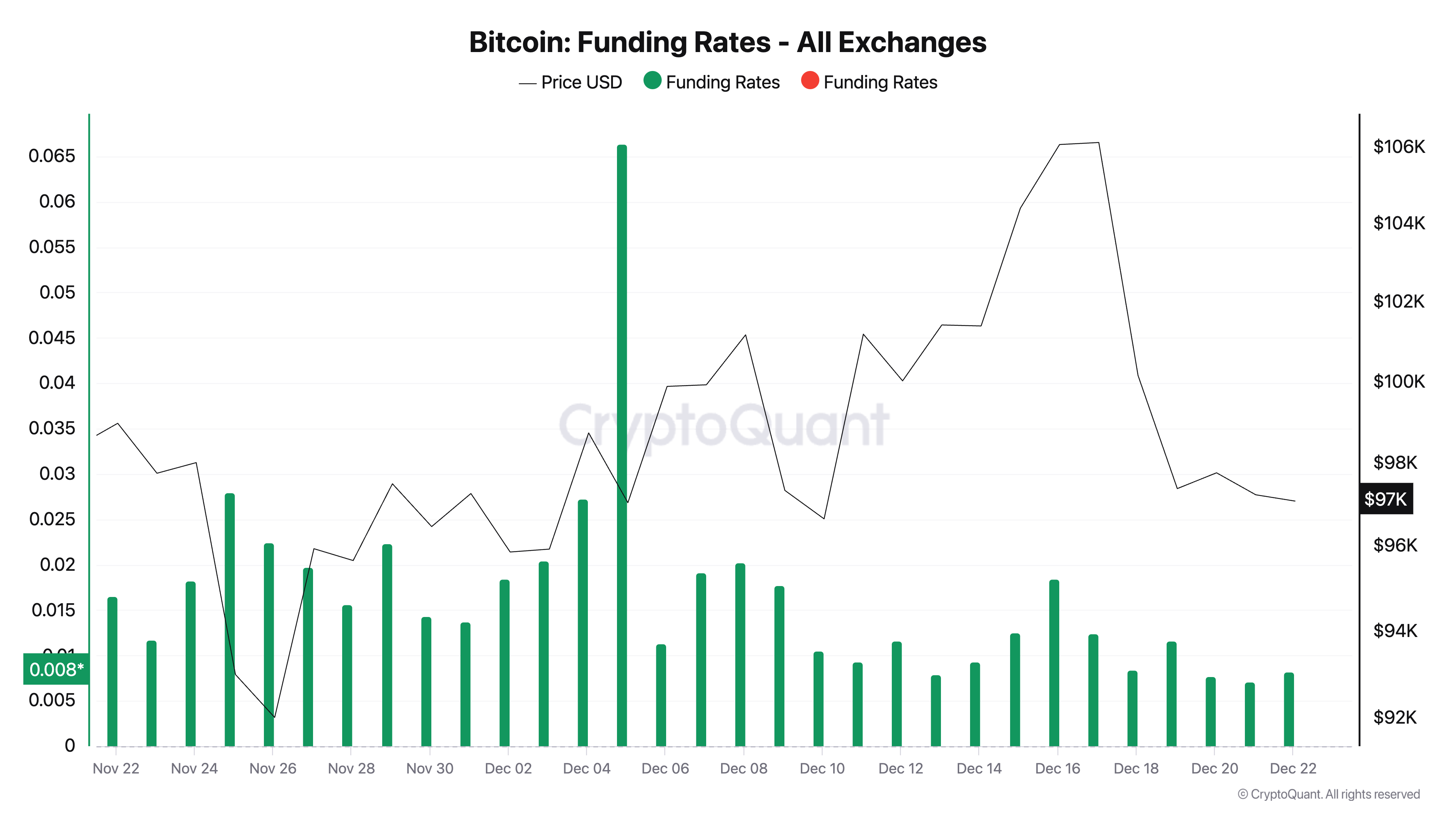

Additionally, the coin’s positive funding rate is favoring the possibility of an uptrend in the near term. Currently, the funding rate in the perpetual futures markets is at 0.0081.

When an asset’s funding rate is positive, it means long positions are paying short positions. This indicates that market sentiment is bullish, with traders expecting prices to rise.

Bitcoin Price Prediction: Coin Faces Dynamic Resistance at $100,000

The market-wide price drop has caused BTC price to fall below the Ichimoku Cloud, forming a dynamic resistance at $100,160. This indicator tracks the dynamics of an asset’s market trend and identifies potential support/resistance levels.

When the price of an asset trades below the Leading Span A zone of the Ichimoku Cloud, this indicates a downtrend where selling pressure is strong and buyers are having difficulty pushing prices higher. This scenario usually signals the potential for further declines unless the price breaks back above the clouds.

A successful break of this level for Bitcoin price would push it towards its all-time high of $108,388. Conversely, if it fails to break this resistance, Bitcoin price could drop to $95,690.