BlackRock’s iShares Bitcoin Trust (IBIT) ETF just recorded its largest outflow since launching a year ago, marking a pivotal moment in the Bitcoin ETF market.

The recent outflow surpassed the previous record of $188.7 million, which occurred on December 24, 2024.

Bitcoin ETF records $242 million in outflow as IBIT takes a hit

According to data from SoSoValuethe fund saw a record outflow of 330.8 million USD on January 2, equivalent to more than 3.5 thousand BTC. Following IBIT’s massive outflow event, the total daily net outflow of BTC ETFs reached $242 million.

January 2 also marked the third consecutive day of outflows for IBIT, setting another new record. According to data from Farside InvestorsBlackRock’s Bitcoin Fund recorded a total outflow of $391 million in just the past week.

At the same time, Fidelity, Ark, and Bitwise BTC ETFs recorded net inflows of $36.2 million, $16.54 million, and $48.31 million, respectively, on January 2.

The outflow from IBIT comes as Bloomberg ETF analyst Eric Balchunas noted in December that IBIT was the largest of all newly launched ETFs. He said this as BlackRock grew faster than any other ETF globally.

“IBIT’s growth is unprecedented. This is the ETF that reaches the most milestones quickly, faster than any other ETF in every asset class. At current asset levels and a 0.25% fee rate, IBIT can expect to earn approximately $112 million per year,” states James Seyffart, another top ETF analyst.

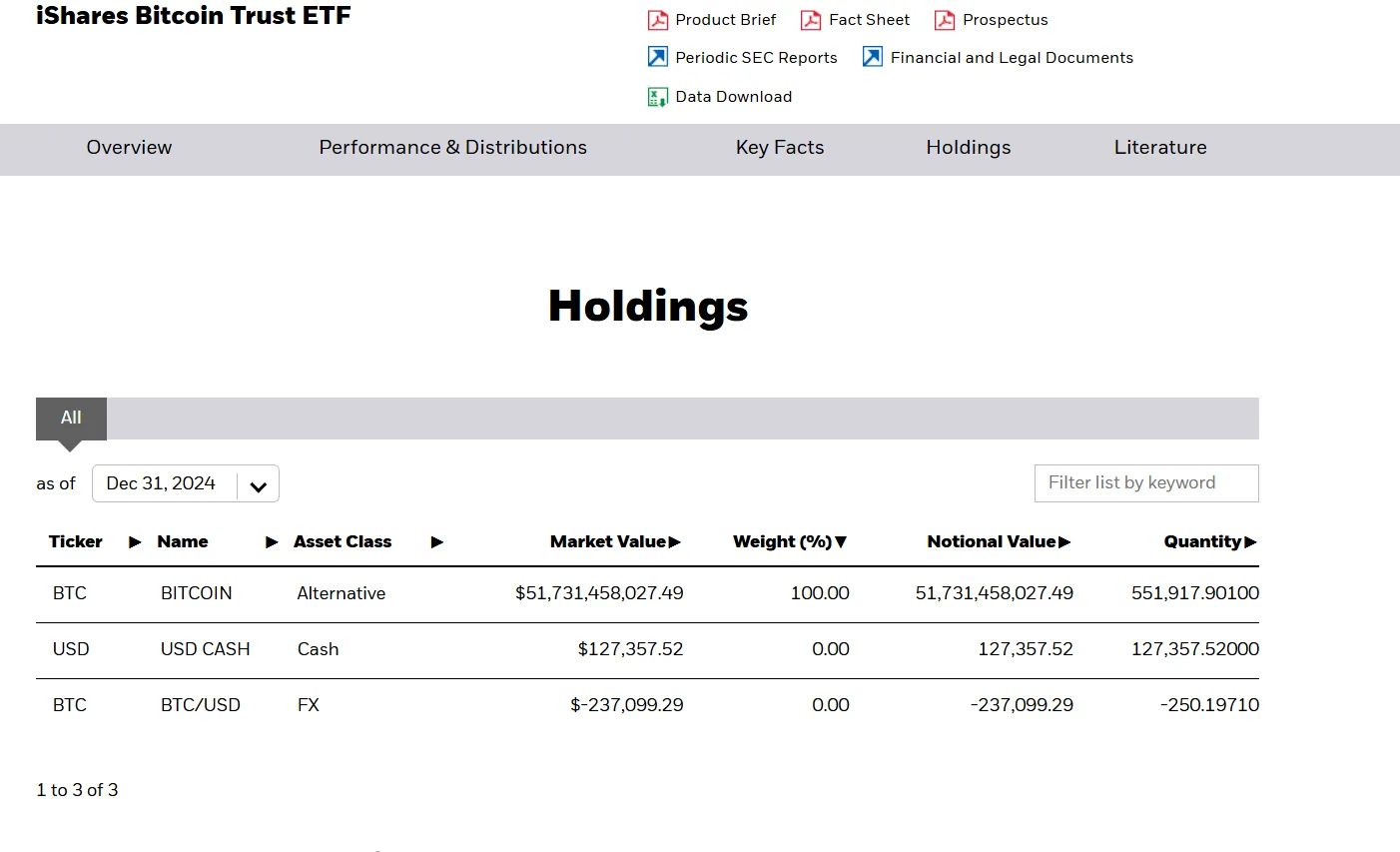

As of December 31, IBIT holds over 551k BTC. Since launch, BlackRock has owned over 2.38% of all Bitcoin that will ever exist.

BlackRock’s confidence in Bitcoin is evident as it said it has no plans to launch any other crypto-focused ETFs, focusing solely on BTC and ETH.

In December, BlackRock’s head of ETFs, Jay Jacobs, emphasized the firm’s intention to focus on expanding the reach of its existing Bitcoin and Ethereum ETFs, which have performed extremely well for up to now. Interestingly, BlackRock analysts also recently suggested that Bitcoin should make up around 1% to 2% of a standard 60/40 portfolio.