ARK Financial dedication, a venture capital company founded by Cathie Wooden, is getting ready for the coldest winter in a extended time.

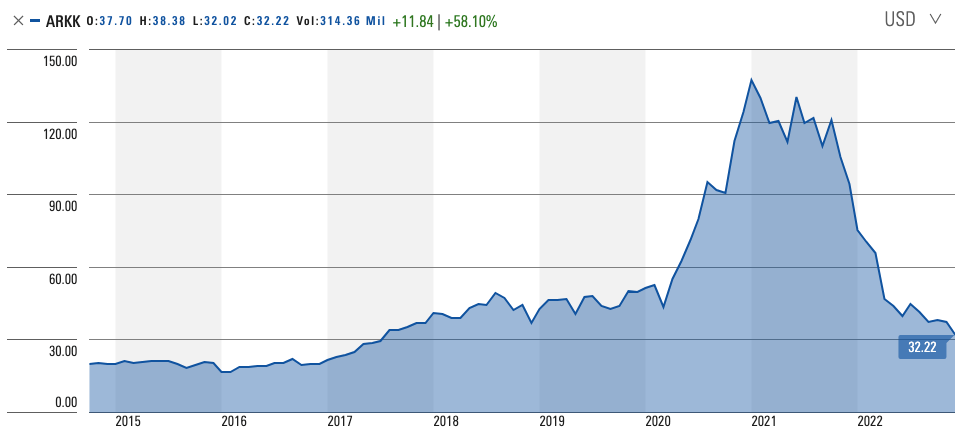

The ARK Fund, a pandemic achievement story that has catapulted Wooden to around the world fame, has noticed just about every stock the fund owns fall to an all-time very low. Shares of the fund have fallen almost 63% this 12 months and are back to their late 2017 ranges.

According to Morningstar Direct, the reduction for ARKK stock, the Innovation ETF, was the greatest drop between a lot more than 230 actively traded diversified ETFs. By contrast, the S&P 500 is down just above 14% this 12 months — such as dividends.

Disgraced ARK

There have been a quantity of things that contributed to the demise of ARK, and its crypto publicity, namely by means of GBTC and COIN, was the largest component.

The $seven.one billion fund holds about thirty stock positions, with Zoom, Tesla, and Coinbase producing up the greatest portion of the fund’s portfolio. ARK noticed exponential development at the commence of the pandemic in 2020, as Wooden jumped into development-oriented tech businesses for the very first time and elevated his crypto publicity. fund.

Wood’s system is heavily invested in technologies that she believes have the prospective to “change the world”. This system paid off inside of months of unprofitable investments in early-stage startups, as Zoom grew to become a home title through the pandemic and Tesla recorded its ideal 12 months given that. so far.

ARK exposed to cryptocurrency

Coinbase also noticed its shares hit an all-time large at the height of the pandemic, producing ARK 1 of the most rewarding money in the area.

ARK also has a big place in Grayscale Bitcoin Rely on (GBTC), holding above six.15 million shares. And while the place accounts for significantly less than .five% of ARK’s portfolio, the reduction GBTC suffered has hit the fund heavily.

Bitcoin’s drop from its all-time large of $69,000 has rocked GBTC, sending its shares down a lot more than 76% for the 12 months. GBTC is at present trading at a 50% price reduction to its NAV, which means it is even underperforming Bitcoin. Coinbase has noticed its stock shed a lot more than 80% of its worth this 12 months, placing additional strain on the presently struggling fund.

While analysts may well disagree on specifically which aspect of Wood’s portfolio hit the hardest, they all agree that ARK is in difficulties. Jon Burkett-St. Laurent, senior portfolio manager at Exencial Wealth Advisors, says that ARK lacks a chance management game strategy. The fund was constructed on stimulus no cost funds and its survival largely depends on it now, he mentioned. told Wall Street Journal.

market point of view

Todd Rosenbluth, head of investigate at VettaFi, told Investors.com that Wooden’s narrow, thematic ETF may well look also concentrated for a lot of shareholders. Its crypto publicity did not aid both.

However, Cathie Wood continued to disregard worries about the fund’s effectiveness. Wooden not only sided with his investments, but doubled down on the riskiest positions in his portfolio.

In November, ARK obtained an more $43 million in Coinbase stock. Another Wooden’s fund, the ARK Upcoming Generation Net ETF, obtained $six million really worth of GBTC in October, drastically raising its publicity to Bitcoin.

Investors even now on Wood’s side look to share her beliefs.

Since the starting of the 12 months, the quantity of accounts holding money has decreased by about eight%. In mid-November, the complete quantity of accounts holding ARKK hit a yearly very low.

However, information from Webull Money LLC demonstrates that clientele truly extra income on a net basis to ARKK in 2022. More than $one.four billion has been poured into the ARK Innovation ETF this 12 months.

Optimism for the potential

This demonstrates that traders are even now assured that the disruptive engineering Wood focuses on has nevertheless to see its heyday. All stocks in ARK’s portfolio have suffered hefty losses that have not shaken investor self confidence, and most look inclined to consider quick-phrase losses.

These quick-phrase losses could worsen in the coming weeks. Anthony Denier, CEO at Webull, says that traders can target their holdings to acquire tax losses – the practice of promoting reduction-producing positions just before the finish of the 12 months to comprehend the losses and compose them off as a tax reduction. Denier advised The Wall Street Journal that if some ARKK holders come to a decision to liquidate, the fund could see its shares fall even additional.