Celsius Network, a cryptocurrency loan company struggling with liquidity complications, has paid off $ 95 million of its debt to two lending platforms Aave and Compound.

After having to pay off all debt on Maker, withdrawing just about $ 449 million of WBTC collateral just a handful of days in the past, Celsius made use of a very similar fund management tactic that aims to release all collateral on other lending platforms without the need of repaying any debt. a fault originating from “Chain effect” stETH – Alameda – Celsius.

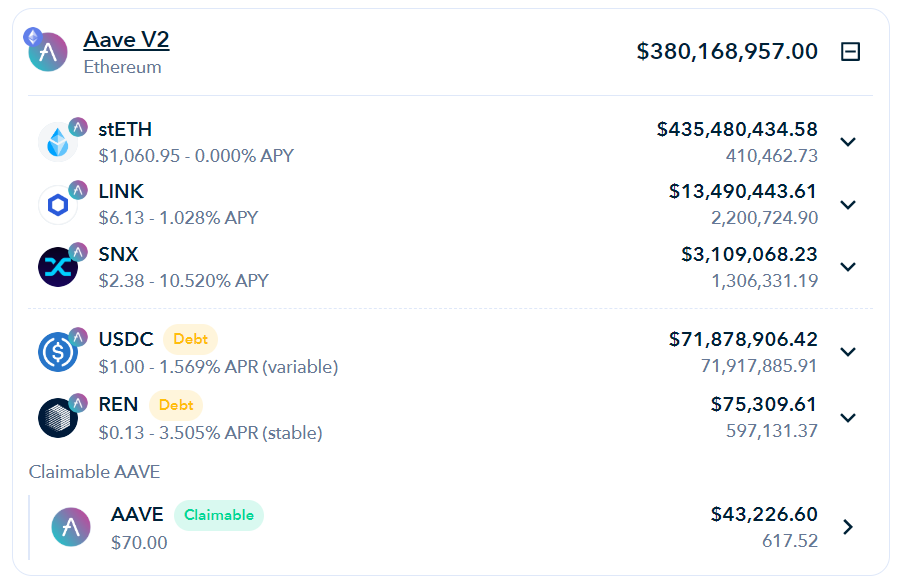

Based on information from blockchain analytics company Nansen, a Celsius-linked wallet has been proven to have transfer 35 million DAI and 40 million USDC of Circle in a variety of transactions. The wallet also paid a different USDC twenty million at the finish of July ten to Aave.

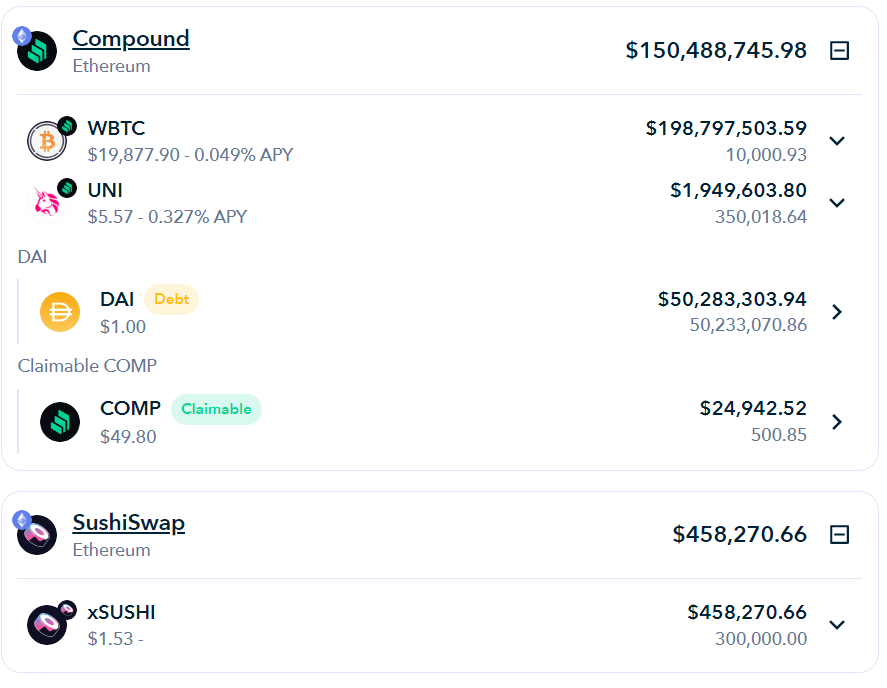

Celsius also traded some curiosity-bearing tokens on Aave for one,647 WBTC (really worth $ 33.four million) and about $ one.six million mixed BAT and xSUSHI. The most up-to-date payments permitted Celsius to invest in back most of the debt collateral. Since the starting of this week, the business has recovered eight,436 WBTCs really worth $ 172 million at marketplace worth. The business also redeemed roughly $ 700,000 in COMP, the native token of the Compound protocol.

@CelsiusNetwork having to pay USDC and withdrawing the last wBTC from Aave (some nonetheless left in the Compound).

+ acquire far more powder (xSushi, BAT).

The place of the Aave of Celsius now appears bad. Only Hyperlink & SNX are missing till all that is left is stETH. https://t.co/tI8aGqMpRo pic.twitter.com/nhGSvzjTuy

– DeFiyst (@DeFiyst) July 11, 2022

As for the giving, the business nonetheless owes Aave and Compound $ 140 million, down from final week’s $ 235 million. The collateral that Celsius blocks with loans is $ 680 million, by means of a variety of tokens this kind of as stETH, Hyperlink, SNX, WBTC and UNI, possessing dropped from the $ 950 million assure mark and will theoretically be launched totally extinguished if Celsius has paid the rest of the debt.

Crucially, the latest liquidity crisis in the cryptocurrency marketplace has hit cryptocurrency lenders difficult, with Voyager Digital filing for bankruptcy and BlockFi in search of relief from trading.

As for Celsius, the business suspended all buyer withdrawals starting up June twelve to discover a resolution to stabilize liquidity, cutting jobs and employing restructuring experts. However, Celsius is at the moment doing work to pay out off the rest of its debt for the DeFi protocols.

However, “storms” repeatedly hit Celsius, the business currently being sued by its former spouse, accusing it of working below a ponzi scheme. Much proof also exhibits that Celsius himself has “lost” up to $ 350 million due to withdrawing dollars from buyers to invest and that the company’s CEO the moment experimented with to “escape” the United States.

Synthetic currency 68

Maybe you are interested: