On the afternoon of July seven, the Celsius loan platform closed the “huge” loan on Maker and withdrew all collateral.

As reported by Coinlive, Celsius has started off paying out off its loans on significant DeFi platforms due to the fact early July.

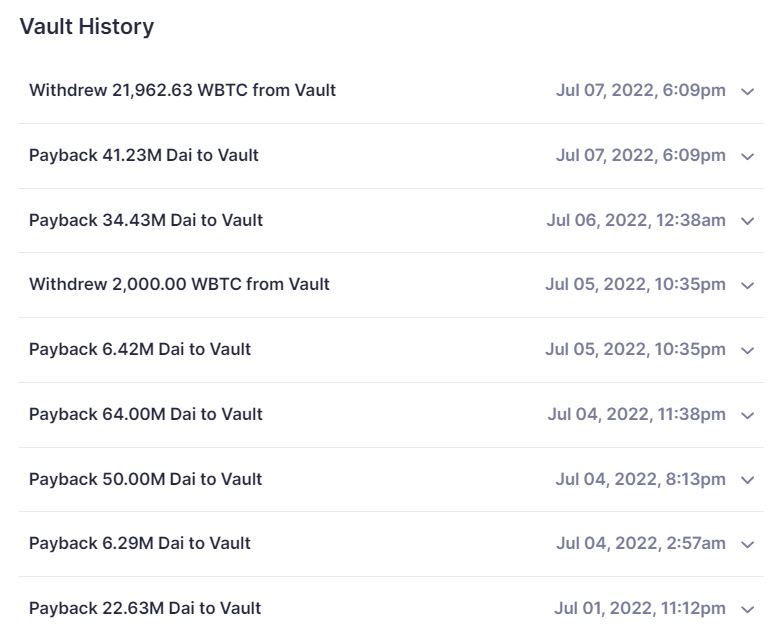

By the afternoon of July seven, this lending business had finished the return of $ 41.23 million of DAI stablecoins to Maker and closed the vault by borrowing cash from this DeFi protocol. At its peak at the finish of June, Celsius’ loan buy on Maker amounted to 224 million DAI, backed by 23,962 WBTC, which is Bitcoin tokenized on Ethereum.

In parallel with the debt repayment move, Celsius also withdrew 21,962 WBTC mortgaged for a loan buy to a personal portfolio. This quantity is really worth up to $ 449 million at the time of creating. In addition to the two,000 WBTCs previously withdrawn, the business also recovered all of its collateral WBTCs.

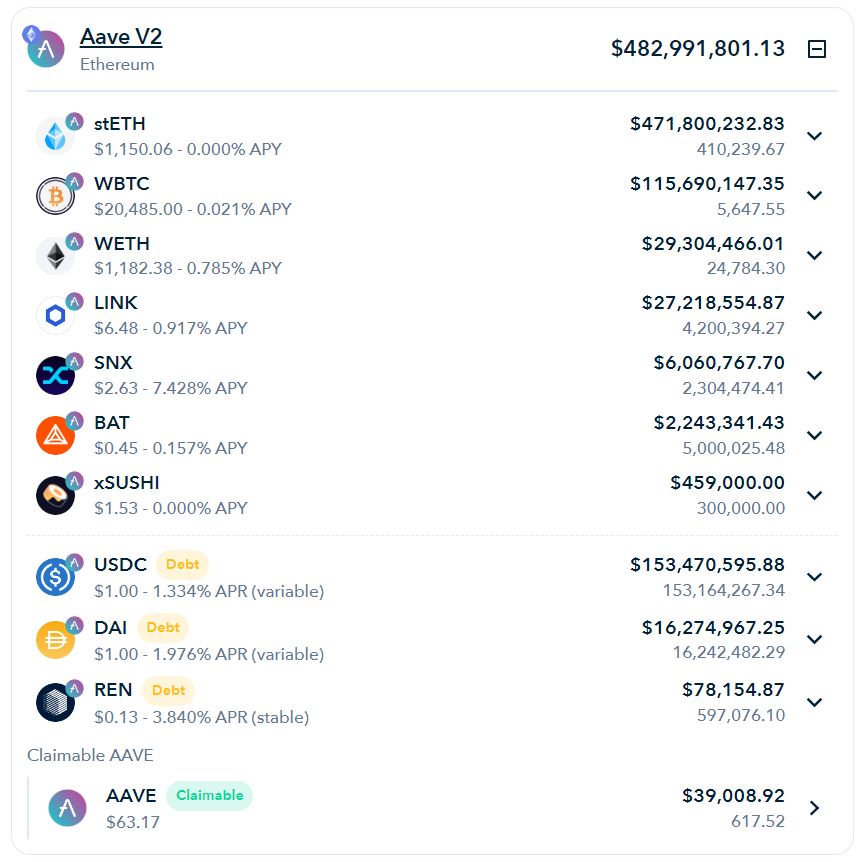

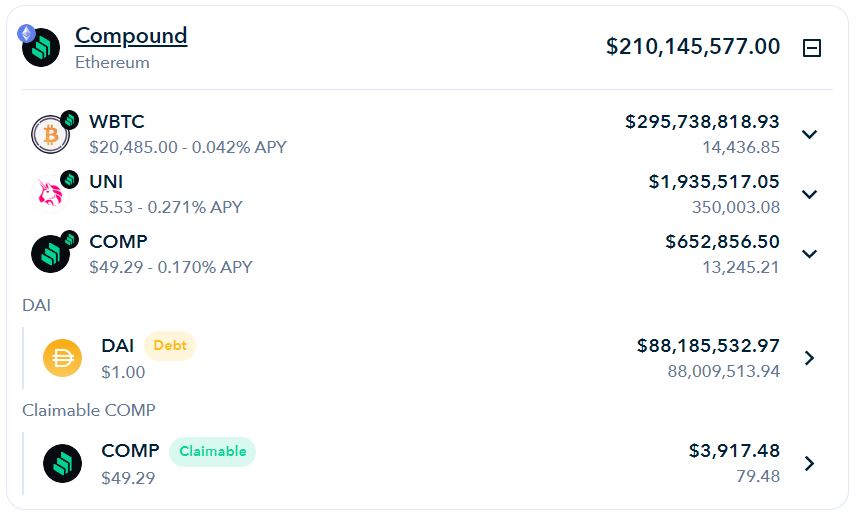

Even so, Celsius nonetheless is keep the loan order 88 million DAI, assured by virtually 298 million bucks WBTC and UNI, on Compound and a USD 169 million, USDC and DAI loan buy collateralized with in excess of USD 650 million of stETH, WBTC and numerous other tokens.

Celsius loan orders have been the “big concern” of the cryptocurrency market place in late June due to the company’s predicament. If loan orders are cleared, massive quantities of tokens will carry on to be discharged, threatening to carry down each Bitcoin and Ethereum by means of the WBTC and stETH vaults.

It is unclear what the motive behind Celsius’ repayment action is, as effectively as the company’s up coming move right after the aforementioned mortgage loan withdrawal.

As reported by Coinlive, Celsius is the 1st lending platform to enter the “liquidity crisis” which is negatively affecting the complete cryptocurrency market place.

The explanation why Celsius has difficulties comes from the truth that they convert most of the users’ deposits into stETH, the token that blocks ETH on Lido Finance, which has reduced liquidity. When the cryptocurrency market place underwent a violent correction in early June, along with the steep drop in the price tag of stETH, Celsius was massively withdrawn by customers and had to cease all trading / deposit / withdrawal action from June 13th. until finally now.

Over the up coming time period, Celsius offered tiny details on the latest scenario, only stating that it nonetheless requires additional time to stabilize liquidity and asking customers to be patient. Rumors surrounding the incident this kind of as the company’s CEO was about to flee the US, Celsius was refused the bailout from FTX mainly because he was accused of “losing $ 2 billion” or the company’s shareholders have been lobbying for this to get worse the issues.

Synthetic currency 68

Maybe you are interested: