- CFTC’s significant move in crypto regulation.

- CME and Cboe among key exchanges involved.

- Potential impact on Bitcoin and Ethereum markets.

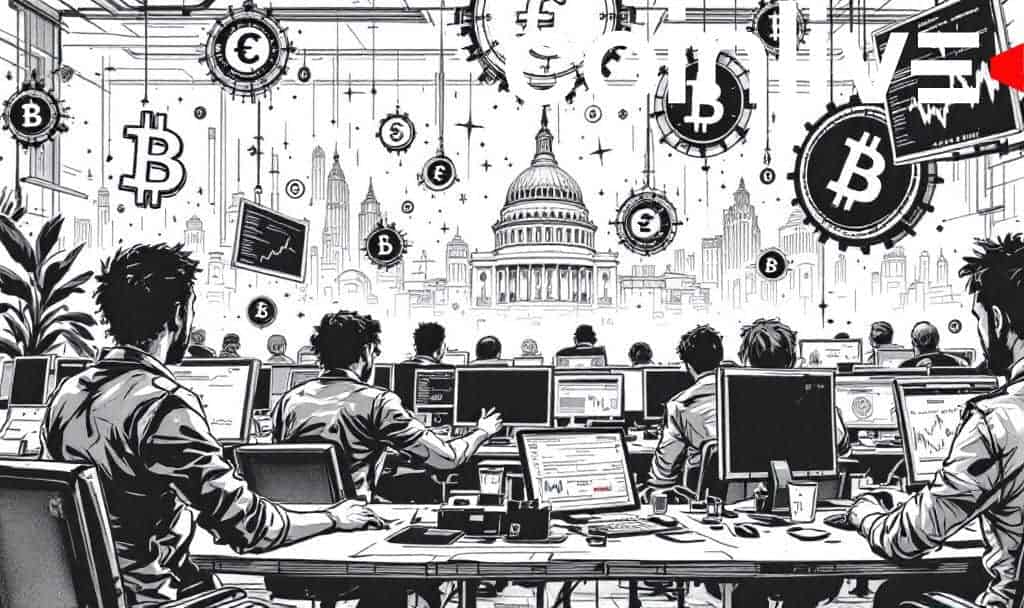

The Commodity Futures Trading Commission, led by Acting Chair Caroline Pham, plans to launch leveraged spot crypto trading in collaboration with U.S. exchanges, potentially starting next month.

This regulatory initiative could significantly affect Bitcoin and Ethereum markets, impacting retail traders and increasing institutional involvement.

The Commodity Futures Trading Commission (CFTC) has announced plans to introduce leveraged spot crypto trading on registered US exchanges. This initiative follows regulatory pushes to incorporate digital assets under existing US commodities law.

The initiative is spearheaded by Acting Chair Caroline Pham. It involves collaboration with leading exchanges like CME and Cboe to broaden access to margin and financing options for retail traders interested in cryptocurrencies.

This move aims to expand retail access to Bitcoin and Ethereum trading. Engaging these major exchanges signals a shift in market dynamics, likely enhancing institutional involvement in the crypto markets.

Financial implications include increased trading flows and potential impacts on market liquidity. Key cryptocurrencies like BTC and ETH are expected to see changes, while regulatory oversight seeks to maintain market stability under existing legal frameworks.

Crypto and financial markets are closely watching this regulatory initiative. Its implementation could reshape trading strategies and market participation for both institutional and retail investors.

Potential outcomes include enhanced market participation and increased regulatory clarity for crypto trading. This initiative may pave the way for broader acceptance and integration of digital assets in conventional financial systems.

This marks a significant regulatory initiative to bring leveraged spot cryptocurrency products under existing US commodities law. — Caroline D. Pham, Acting Chair, CFTC, CoinDesk