Chainlink (LINK) price has increased more than 8% in the past 24 hours, with trading volume skyrocketing 106% to $1.04 billion.

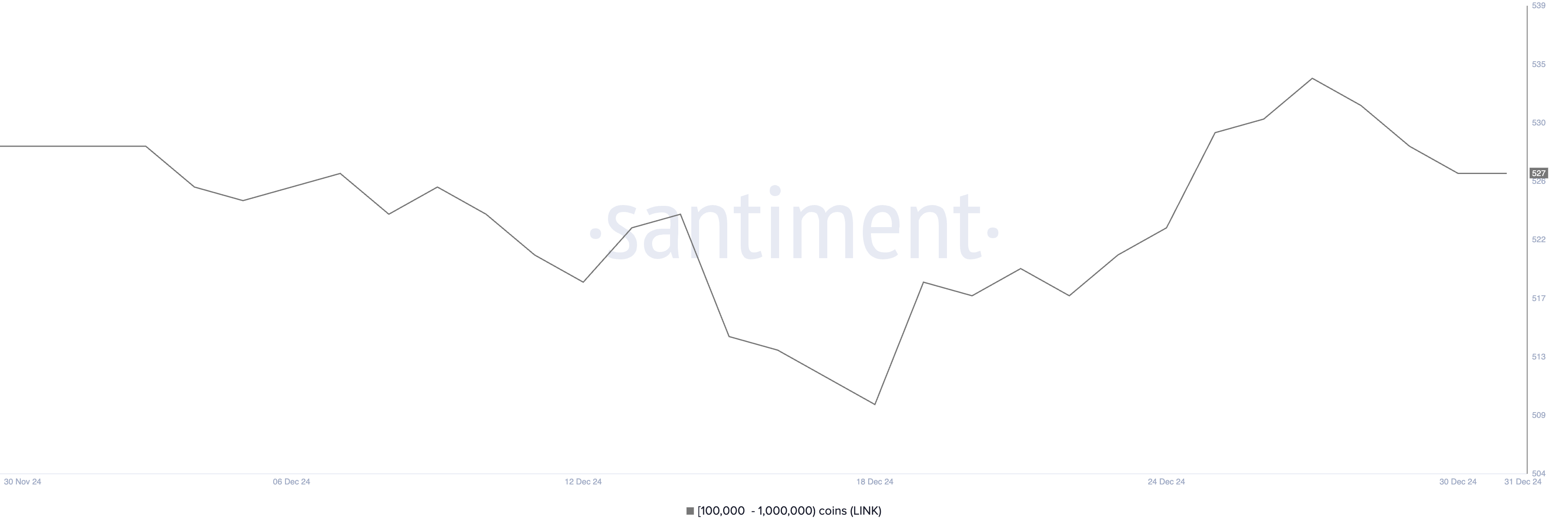

Despite this strong price increase, whale activity remained stable, as the number of addresses holding between 100K and 1 million LINK remained at 527 after peaking at 534.

LINK Whale Maintains Neutral Attitude

The number of addresses holding between 100K and 1 million LINK increased significantly from 510 on December 18 to a monthly high of 534 on December 27. The increase in whale activity highlights a period strong accumulation, reflecting great interest from major investors during that time.

Monitoring the behavior of these whales is important, as their buying and selling patterns can strongly influence price trends. Whale accumulation is often a sign of confidence in the asset, and can spur further price increases as their large transactions create upward momentum.

However, after peaking at 534 addresses, this number began to decrease slightly and has stabilized at 527. The recent stability shows that large investors are not currently accumulating or selling LINK aggressively, suggesting a neutral mentality.

Despite an 8% price increase over the past 24 hours, the continued lack of accumulation from whales may suggest caution about the sustainability of the recent price increase. For LINK price to maintain its upward trend, there needs to be renewed interest and increased activity from these large investors to provide further support.

Chainlink RSI Signals Resilience

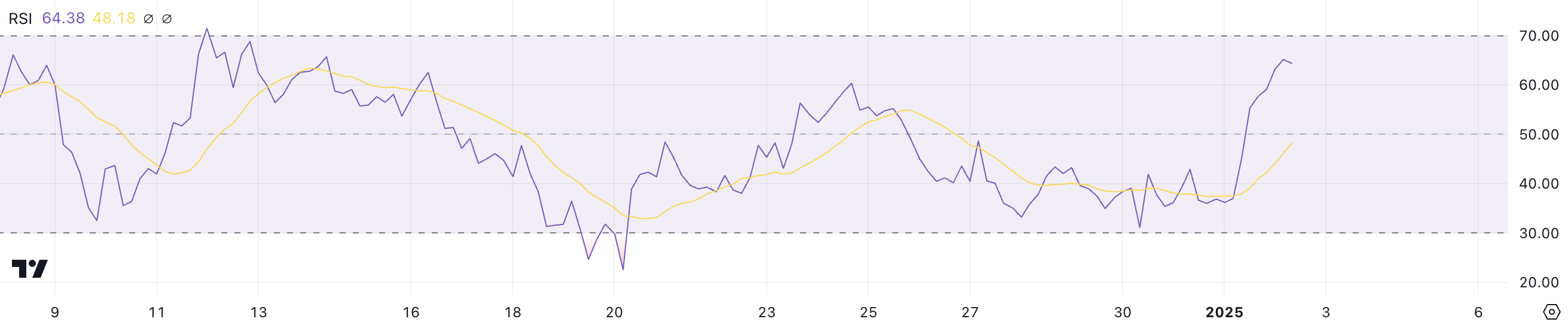

Chainlink’s relative strength index (RSI) has increased sharply, from 36.9 to 64.3 in just one day. This surge reflects a notable shift in momentum, driven by strong buying pressure following recent price increases.

RSI is a widely used momentum indicator that measures the speed and magnitude of price moves on a scale of 0 to 100, providing insights into whether an asset is overbought. or oversold. A reading above 70 indicates overbought conditions, often suggesting the possibility of a correction, while a reading below 30 indicates oversold conditions and the possibility of a recovery.

At 64.3, Chainlink’s RSI is approaching overbought territory, suggesting that while buying momentum remains strong, the asset is reaching a key level where the upward movement may begin to encounter resistance. On the short term, this RSI level suggests that LINK still has space for moderate growth, but traders should monitor for signs of exhaustion as it approaches the 70 level.

If buying pressure continues, RSI could move into overbought territory, signaling the possibility of a temporary consolidation or correction before further price movement. Conversely, a stable or falling RSI can indicate that momentum is starting to weaken.

LINK Price Prediction: Could It Hit $30 Again In January?

Chainlink’s EMA is signaling the possibility of an upcoming Golden Cross. A Golden Cross is a bullish indicator that occurs when the short-term EMA crosses above the long-term EMA.

If this Golden Cross occurs and the current uptrend continues, LINK price could see significant upward momentum. The price could test resistance at $25.99 and a break above this level could pave the way for further profits. Targets at $27.46 and potentially $30.94 could mark significant upside for the asset.

Conversely, recent whale activity and high RSI suggest that the current rally may not be entirely sustainable, leaving room for a reversal.

If the uptrend weakens and selling pressure increases, LINK price could face a correction, testing immediate support at $21.32. If this level fails to hold, the price could fall further to $20.02, marking a larger correction.