[ad_1]

CHEX, the native digital currency of the Chintai Network, recently exited a consolidation period that lasted throughout October.

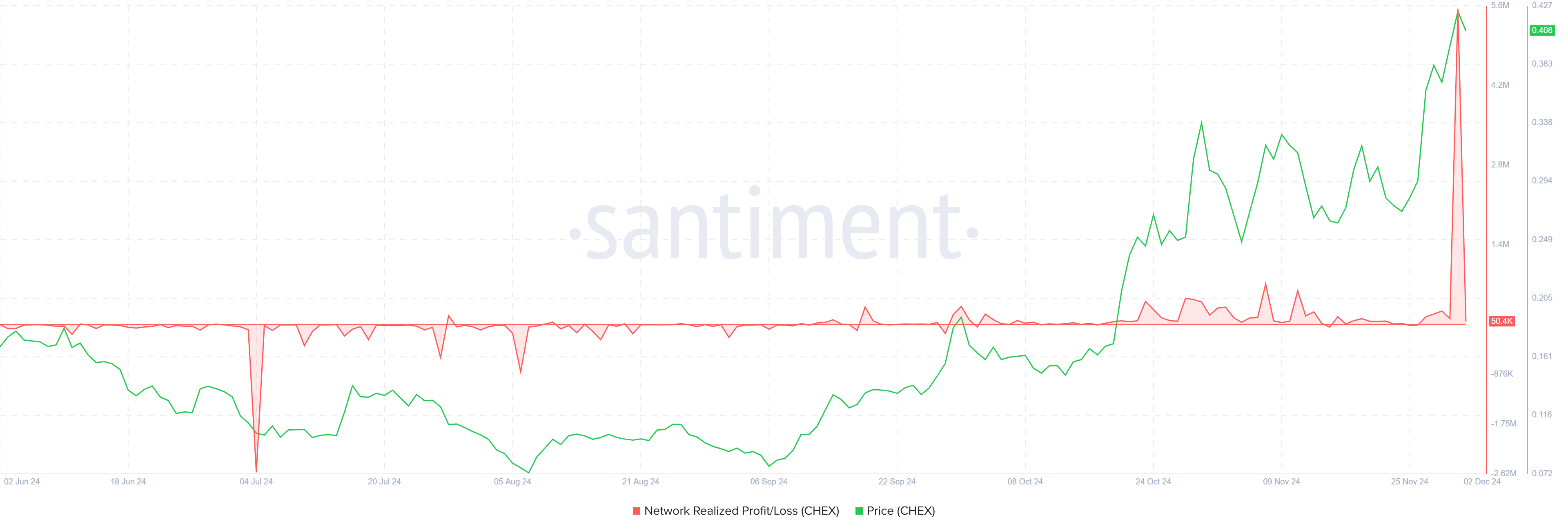

This outbreak led to the setting of a new historical high, marking a milestone for the altcoin. The spike in prices has excited investors, leading to record profit-taking.

Chintai Network (CHEX) Celebrates Historic High

As CHEX reached this new high, profit-taking spiked to the highest level in its history. Many investors took this opportunity to sell their holdings, securing profits from the recent price rally. While this increase in selling raises concerns about a possible short-term price decline, the situation could stabilize if profit-taking slows.

Despite the initial selling, the broader market remained optimistic. It is a natural market reaction for many investors to withdraw their profits after a large price increase. If selling pressure begins to subside, CHEX may be able to avoid a significant decline, allowing it to maintain its growth momentum.

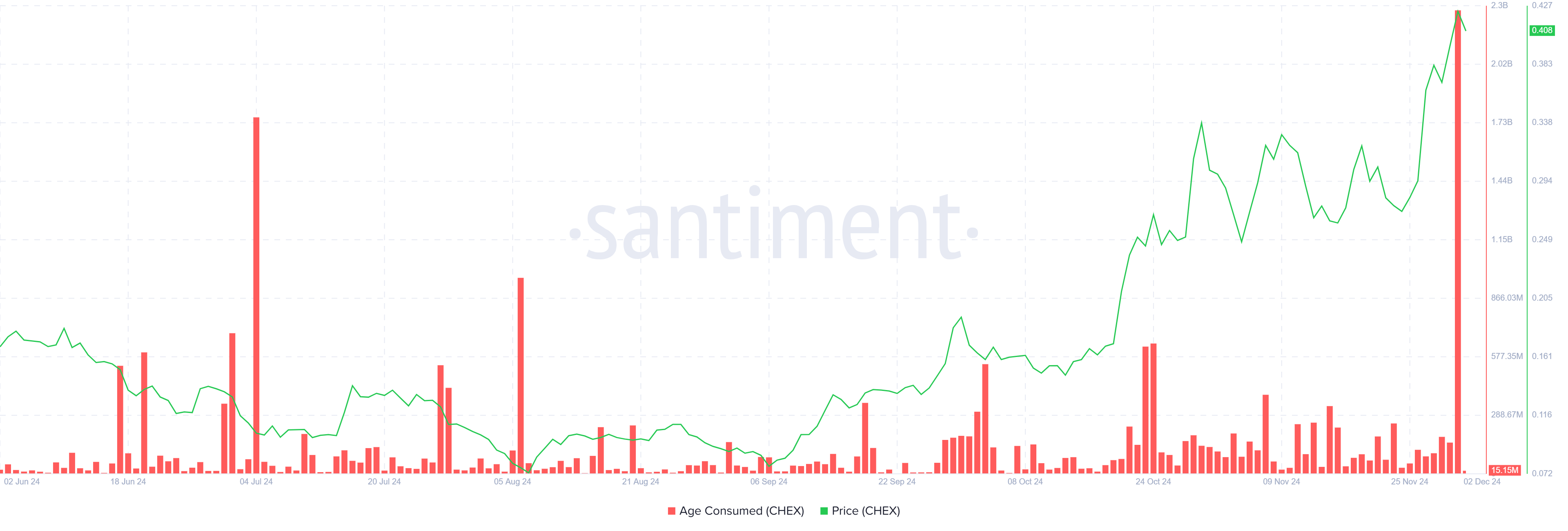

The “age consumed” index has also skyrocketed along with profit-taking activities. This shows that long-term investors (LTHs) are seizing the opportunity to benefit from the price rally. Since LTHs are often considered the backbone of any crypto asset, their selling behavior carries weight and can influence the market.

An increase in selling on the part of long-term investors could signal the end of the uptrend if it continues. However, if LTHs start holding back on their coins, CHEX could regain momentum. It is important for the market to observe whether the selling continues or whether there is a transition back to accumulation.

CHEX Price Prediction: New Highs Next

CHEX’s price recently hit a new historic high of $0.49, close to the psychological mark of $0.50. This achievement signals a strong uptrend, but the cryptocurrency is likely to encounter resistance above $0.49. However, positive market sentiment and high investor interest could support further price increases in the near future.

CHEX’s price is expected to hold above the $0.33 support level, which has historically served as an important base. This support level provides a cushion against a potential price correction.

As long as the altcoin remains above this key level, the optimistic outlook will continue. A sustained move above $0.49 could pave the way for CHEX to target $0.50 and beyond in the coming days.

However, if the price falls below the $0.33 support level, this could signal a shift in market sentiment. A breach of this level could delay the formation of a new historical high and could invalidate the bullish hypothesis for CHEX.

In this scenario, the price could correct to $0.24, retesting the lower support levels. A drop below $0.33 would indicate a weakening in investor confidence and could trigger further price corrections, creating concerns among traders.

General Bitcoin News

[ad_2]