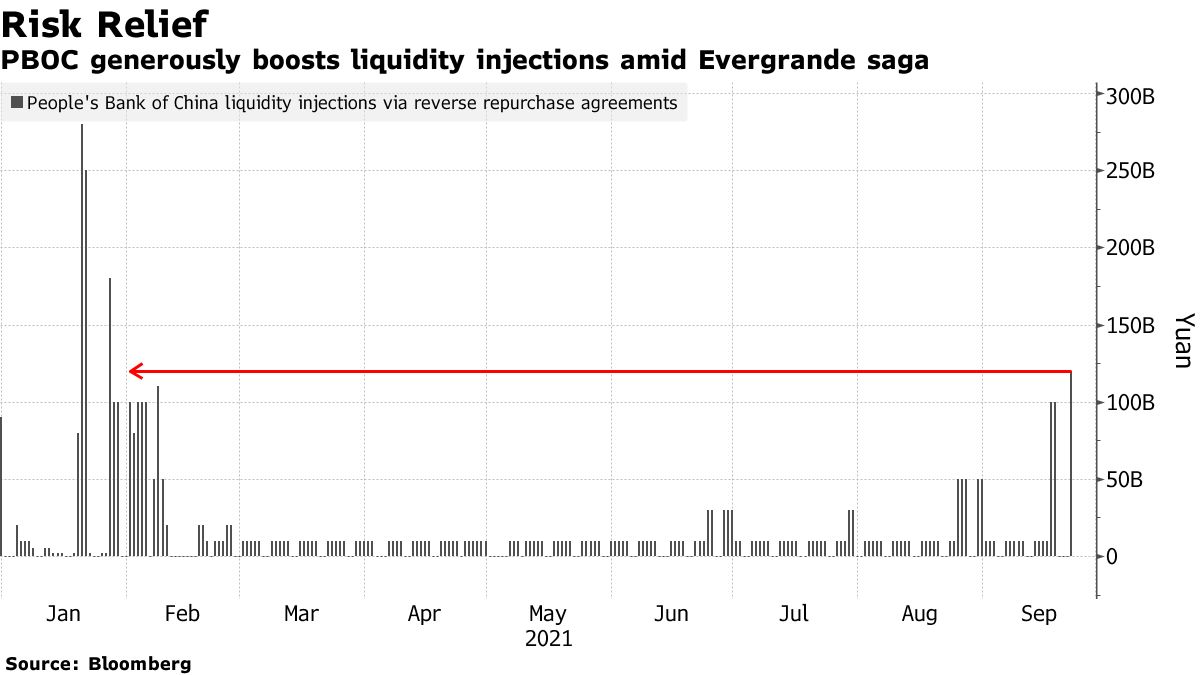

China stepped up quick-phrase liquidity injections into the monetary program following issues above the Evergrande Group’s debt crisis rocked substantially of the international monetary markets.

Specifically, the People’s Bank of China (PBOC) injected 120 billion yuan, or $ 18.six billion, into the banking program via reverse repurchase agreements (RPPs), bringing about 90 billion yuan. The predicament was even further strengthened following Evergrande mentioned it programs to spend curiosity due on September 23 on its bonds.

– See extra: Evergrande’s “real estate bubble” is probably to explode, how does it have an effect on Bitcoin and cryptocurrencies?

Eugene Leow, senior curiosity fee strategist at DBS Bank Ltd. In Singapore, the PBOC net injection was probably meant to ease the mood when the marketplace was concerned about Evergrande.

While the target could be to strengthen existing sentiment, it is also vital to avoid contagion into the serious economic climate or other sectors.

Additionally, Mitul Kotecha, Asia and Europe Emerging Markets Strategist at TD Securities in Singapore, mentioned that “there has been a relief as there has finally been a decent injection of net liquidity., Although some of them will be in demand for regulatory checks at the end of the quarter. “

However, most China-connected stocks are shedding funds all around the globe in latest days due to issues above Evergrande’s debt complications. The benchmark CSI 300 index fell one.9% on September 22 following the Hang Seng China Enterprise Index, a measure of Chinese stocks traded in Hong Kong, fell extra in two months on May twenty. 9.

The losses carry on to be widespread, even as Wall Street analysts consider to reassure traders that Evergrande will not lead to a “moment”. Lehman Brothers, America’s fourth greatest investment banking group, went bankrupt in 2008, a set off in a single of the greatest financial crises in background at the time.

Synthetic currency 68

Maybe you are interested: