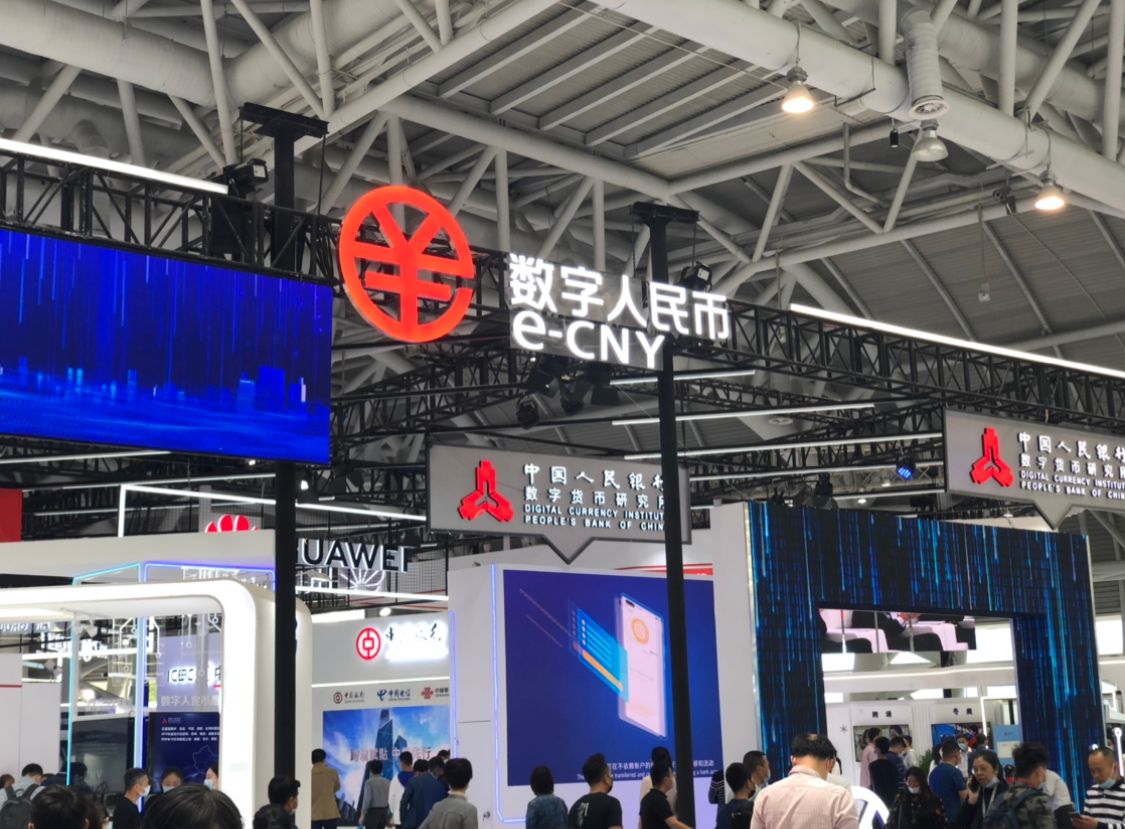

The People’s Bank of China (PBoC) to start with published the country’s CBDC whitepaper (aka e-CNY). This occasion marks an critical stage in the official adoption of e-CNY on a huge scale.

The PBoC publishes the white paper for e-CNY

On July sixteen, the PBoC announced the launch of the official whitepaper for the digital yuan undertaking, also recognized as e-CNY. In specific, it is really worth noting that this CBDC is made to be programmable and compatible with clever contract options. However, the PBoC has nevertheless to set up a certain routine or time for the official launch.

This whitepaper explains that the e-CNY initiative platform, options and developments had been initiated by the PBoC in 2014. According to the report, element of the broader landscape has driven China’s investigation and advancement. the emergence of cryptocurrencies and the hazards and issues they carry to the existing monetary process.

“Thanks to the adoption of blockchain technology and cryptography, cryptocurrencies such as Bitcoin are declared decentralized and completely anonymous. However, due to their lack of intrinsic value, sharp price fluctuations, low trading efficiency, and high energy consumption, they are unlikely to serve as everyday currencies. Furthermore, cryptocurrencies are seen primarily as a speculative tool. Therefore, it poses risks to financial security and social stability, ”the PBoC wrote in the whitepaper.

Not only Bitcoin, but also stablecoins are “named” by the PBoC in its whitepaper. Specifically, there is an excerpt as follows:

“To address concerns about the relatively high price volatility of cryptocurrencies, some commercial institutions have launched so-called” stablecoins “and attempted to stabilize their value by hooking them to fiat currencies, properties or related assets. Some commercial institutions are even planning to launch stablecoins. This will entail risks and challenges for the international monetary system, payment and clearing systems, monetary policy, the management of cross-border capital flows … ”

Support for clever contracts

In a presentation on the style and design options of the e-CNY, the PBoC confirmed that a single of the 7 crucial options of this CBDC is clever contract programmability. This is also the to start with time that the Chinese Central Bank has officially clarified that there will be programmability created into the e-CNY.

“E-CNY derives its programmability from implementing smart contracts without compromising its monetary functionality. Based on security and compliance, this feature enables self-execution of payments based on predefined terms or conditions agreed between two parties, to facilitate the business innovation paradigm. ”- The PBoC describes the digital renminbi in the white paper.

However, to some extent, this description contradicts the rates PBoC officials stated in 2018 and 2019. According to Mu Changchun, head of the PBoC’s digital currency investigation division and Fan Yifei, PBoC deputy governor, expressed a mixed view on the “programmability” benefit of the e-CNY.

They say e-CNY can be extra to clever contracts will assist it execute its part as a currency far better. However, for clever contracts in addition to serving as a currency, they can undermine this CBDC by incorporating social or governance functions.

In truth, exams of the most current e-CNY for some certain functions had been performed in Chengdu, China. In this check, the e-CNY was programmed only to pay out for metro, bus and bike sharing solutions.

The transaction volume of E-CNY exceeds USD five billion

In addition, the PBoC also shared the e-CNY transaction information in the whitepaper. At the finish of June thirty, 2021, e-CNY had registered 70.75 million transactions for a complete worth of 34.five billion yuan (equivalent to five.three billion bucks). These transactions are carried out by way of more than twenty million individual wallets and three.five million corporate wallets.

At the very same time, the central financial institution also offered facts on the planned exams for the 2022 Winter Olympics in Beijing.

Some goods this kind of as driverless trucks, self-services vending machines, unattended supermarkets, payment gloves, payment badges, winter Olympics payment clothes and some other wearable gadgets will be distributed at the upcoming international sporting occasion.

The exams for e-CNY begun additional than a 12 months in the past. Initially, it was constrained to just 4 cities, Chengdu Shenzhen Suzhou and Xi’an. Initially, only these 4 entities had accessibility to the whitepaper manuscript.

Then they attain the public by way of a lottery payout system in the 4 cities over. Subsequently, the system was extended to lots of other cities, like Shanghai and Beijing.

Synthetic currency 68

Maybe you are interested:

.