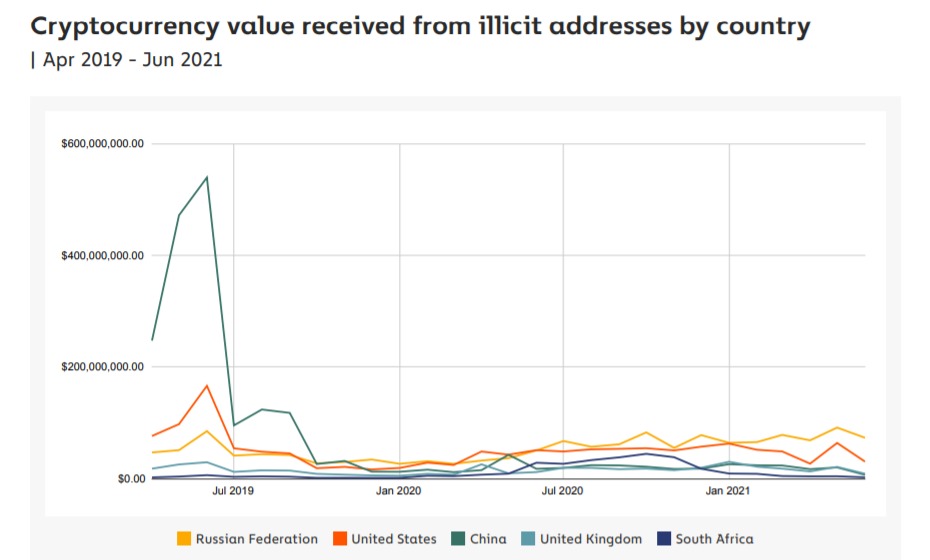

Chinese wallets sent and obtained more than $ two billion well worth of cryptocurrencies associated to unlawful actions in between April 2019 and June 2021.

A new report from Chainalysis identified that despite the fact that China’s share of the international movement of criminal cryptocurrencies has declined given that Q3 2019, the nation even now exhibits a disproportionate variety of fraudulent exercise and revenue laundering.

In its Crypto and China report of August three, Chainalysis states that more than $ two.two billion well worth of cryptocurrencies was sent from Chinese wallets to addresses concerned in unlawful exercise from May, April 2019 to June 2021.

Chinese addresses have also obtained more than $ two billion well worth of digital assets associated to nefarious actions this kind of as scams and darknet markets. Even so, the report says crime has dropped drastically:

“The volume of China’s trade with unlawful addresses decreased drastically more than the time period studied, each in terms of raw worth and in relation to other nations. Much of the decline is due to the absence of big-scale Ponzi schemes like the 2019 PlusToken scam. “

Chainalysis extra that:

“While China remains one of the top countries in terms of volume of illicit trade, it has beaten all others by a wide margin, showing money-related crimes. Home crypto has declined.”

The report’s authors cite “historical trading data” displaying Chinese more than-the-counter (OTC) Bitcoin brokers “played an overwhelming role in facilitating money laundering for those involved in cryptocurrency-based crimes. “

The report adds that “the vast majority” of China’s illicit cryptocurrency flows are fraud-associated, despite the fact that digital asset-primarily based revenue laundering stays. “made disproportionately in China“.

Chainalysis mentioned that China’s central government manufactured a lot more than one,a hundred arrests associated to digital asset-primarily based revenue laundering in June, displaying its willingness to crack down on the market.

“It will be interesting to see if the arrests lead to a decrease in illicit cash flows for China-based cryptocurrency firms and OTC traders.”

However, Chainalysis speculates that China’s rising moves to crack down on classic decentralized cryptocurrencies could weaken the country’s place as a international cryptocurrency superpower in the long term.

The report attributed China’s renewed hostility to decentralized crypto assets due to its ideas to broadly adopt the digital yuan.

Synthetic Currency 68

Maybe you are interested: