China’s foreign exchange regulator has issued a new law requiring banks to warn against risky transactions, including those involving cryptocurrencies.

The State Administration of Foreign Exchange (SAFE) issued a notice last week, stating that banks must monitor and report “risky foreign exchange trading practices.”

China Forces Banks to Report Risky Crypto Transactions

According to report latest, these regulations will make trading Bitcoin and other digital assets more difficult for Chinese investors. Banks must report foreign exchange activities, including shadow banking, cross-border gambling and illegal financial transactions involving cryptocurrencies.

According to the report, these rules will apply to all Chinese banks. The bank will track transactions based on the identity of the individual and entity involved, financial origin and transaction frequency.

The move reflects China’s strict approach to regulating crypto-related commercial activities. Cryptocurrencies are considered a threat to national financial stability.

Liu Zhengyao, a lawyer at the Zhi Hanh law firm in Shanghai, commented on the new regulations via WeChat, according to the South China Morning Post.

“The new regulation will provide additional legal grounds to punish cryptocurrency trading. It can be predicted that mainland China’s regulatory attitude towards cryptocurrencies will continue to tighten in the future,” Mr. Liu said.

Luu also noted that using yuan to purchase cryptocurrencies and then exchanging them for fiat currencies could be considered “cross-border financial activities involving cryptocurrencies,” especially especially if the transaction amount exceeds the legal limit.

China’s Anti-Crypto Stance

Since 2017, China has restricted cryptocurrency trading and banned banks and payment systems from handling digital assets. In May 2021, the People’s Bank of China (PBOC) declared that all transactions involving Bitcoin and other cryptocurrencies are illegal.

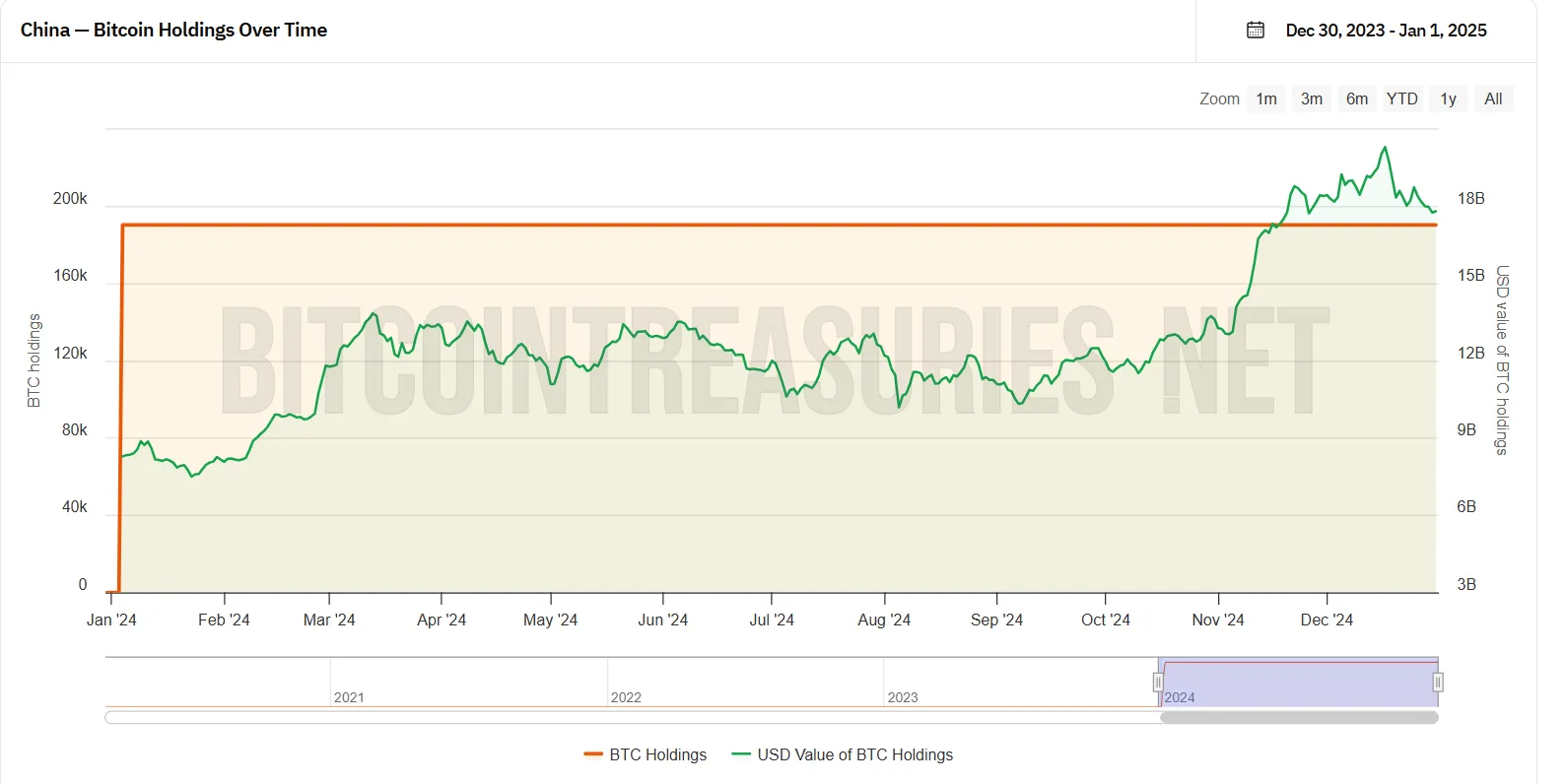

Despite maintaining an anti-cryptocurrency stance, China is holding more than 190,000 BTC. This makes China the second largest government to own Bitcoin, after the United States. China obtained these assets through confiscations related to illegal trading activities.

Interestingly, Justin Sun, founder of the Tron blockchain, has called for China to adopt a more proactive approach to cryptocurrency policy by July 2024.

“China should be more progressive in this area. Competition between China and the United States on Bitcoin policy will benefit the entire industry,” Mr. Sun said.

More recently, a Chinese court ruled that crypto assets have “property characteristics,” and that Chinese law does not ban them outright. However, these protections only exist for crypto as a commodity, not as a currency or trading tool.