- Main event, leadership changes, market impact, financial shifts, or expert insights.

- China lifts tariffs on some U.S. imports.

- Crypto markets see modest movements post-announcement.

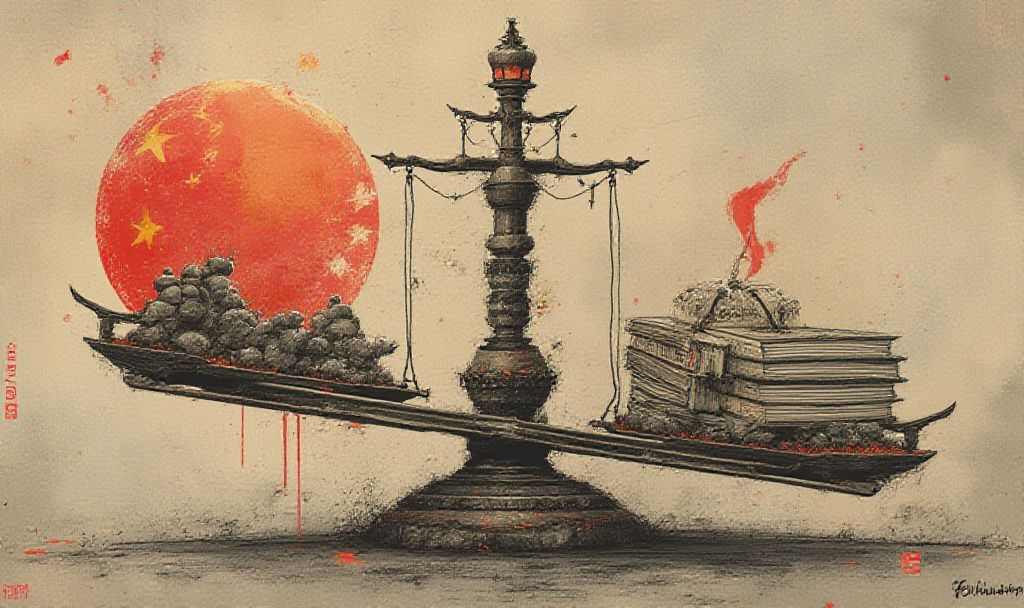

China has exempted certain U.S. imports from a 125% retaliatory tariff, potentially easing ongoing trade hostilities. This decision involves leadership actions from both the United States and China, first reported on April 26, 2025.

The People’s Republic of China, through its State Council Tariff Commission, has officially rescinded a 125% retaliatory tariff on selected U.S. imports. The exemption, announced without specific details from Chinese officials, marks a significant development amidst ongoing trade disputes. President Donald J. Trump continues to enforce reciprocal tariffs, as stated in an April 2025 order, intensifying the situation.

“In recognition of the fact that the PRC has announced that it will retaliate against the United States in response to Executive Order 14257, the [U.S. tariff schedule] shall be modified… to effectively address the threat to the national security and economy of the United States.” – Donald J. Trump, President of the United States, White House

The ripple effects of these exemptions are being closely monitored within global markets. The immediate response witnessed slight volatility in equities and cryptocurrency prices. Bitcoin traded from $63,900 to $65,200, while Ethereum ranged between $3,150 and $3,250 during this period. Although market fluctuations were observed, there were no significant on-chain activity changes on DeFi platforms.

Organizations in sectors influenced by China-U.S. trade are under scrutiny regarding potential shifts in tariff strategies. While the decision did not directly impact specific cryptocurrencies, it reflects the broader macroeconomic environment’s uncertainty. Historical data from 2018–2019 suggests such trade events can temporarily increase demand for “risk-off” assets like Bitcoin.

Analysts anticipate further developments following this tariff exemption. Remaining vigilant to shifts in institutional sentiment and broader market trends is crucial. The exemption may serve as a step toward de-escalation, though it is too early to predict long-term outcomes. Blockchain analytics will continue to provide insights into liquidity movements and market stability.