Trading volume on decentralized exchanges (DEXs) hit $32 billion inside of 7 days in mid-November, recording an additional large given that early June of this yr. This comes immediately after an explosive, tumultuous week in the crypto market that has led numerous traders — seasoned and novice alike — to seek out refuge in self-regulatory trading platforms, not permissioned and decentralized.

Currently there are numerous DEX versions on the market place constructed on the rules of decentralization and fiscal freedom for all devoid of restrictions, DEXs have been welcomed for the following causes:

- Eliminate transaction monitoring intermediaries, wherever traders execute their trades primarily based on immutable clever contracts

- Greater protection and privacy as only traders have privacy more than their information and these information can’t be shared/viewed by other folks

- Traders very own their money and assets, with numerous choices to withdrawing money in the occasion of platform support suspension or disruption.

- No entry restrictions primarily based on geo-area or profile, which means no KYC

- Community target, wherever stakeholders share the platform’s income to supply liquidity, staking, and so on.

DEXs like Uniswap dominated the November 2022 spike, and traders are spoiled for selection when it comes to selecting a DEX to depend on, offered the broad selection of possibilities on the market place. For seasoned traders searching for a derivatives alternate to capture trading possibilities and make the most of any trading signal, a single can flip to a derivatives DEX — wherever Margin and leverage trading possibilities for customizable orders on a variety of well-known contracts.

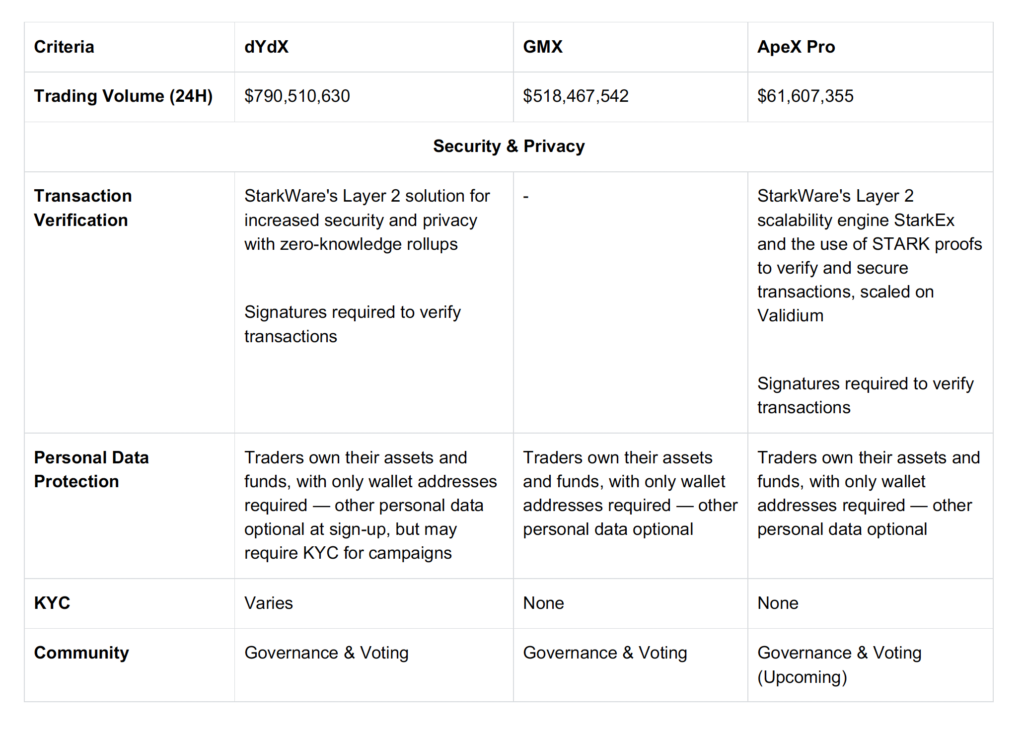

Here’s a comparison of 3 derivative DEXs that have hit traders’ radars a short while ago, two of which are acquainted to most traders — dYdX and GMX. The final DEX we’ll search at is the newly launched ApeX Professional, which is gaining far more and far more awareness following its beta launch in August with a recorded six,000% development in trading volume.

Let’s go into the particulars

dYdX is a primary decentralized exchange that supports spot, margin and perpetual trading. GMX is a decentralized spot and perpetual exchange that supports lower swap costs and priceless trading and operates on a multi-asset AMM model. And eventually, ApeX Professional is a non-custodial derivatives DEX that delivers limitless perpetual contract entry with an purchase guide model.

comparison criteria

For this report, we’ll consider a holistic search at the following 3 measures: (one) protection and privacy, (two) transaction and value-effectiveness, and eventually, (three) ecosystem tokens and rewards providers.

The over is a non-exhaustive checklist of notable highlights from the respective DEXs. dYdX and GMX are trader favorites for great causes, so let us see how the new ApeX Pro compares to the other two DEXs.

(one) Security & Privacy

All 3 DEXs are primarily based on a rather equal footing in terms of privacy protections, wherever self-management of money is a widespread denominator — the significance of a non-custodial trading platform can’t be overstated. denial in light of latest occasions.

In distinct, the two dYdX and ApeX Pro have additional protections with the integration of StarkWare’s Layer two scalable device, StarkEx, which permits consumers of the two DEXs to entry expected prerequisites to consider their dollars even when the DEXs are not lively. In addition, STARK evidence is utilised in the two dYdX and ApeX Professional to facilitate the right verification of transactions, even though GMX relies on Arbitrum and Avalanche safe terms.

DEXs are recognized for their privacy protections, which is why GMX and ApeX Professional are, in a certainly decentralized style, totally KYC-cost-free. On the other hand, dYdX, on a past event, implemented KYC to obtain rewards for a chosen campaign.

Another notable component is the guidelines governing local community discussion and governance — on dYdX and GMX, voting and discussion web sites are out there. For now, nevertheless, ApeX Professional is nevertheless doing work in direction of making a committed area for their local community for people to do pursuits like voting and producing ideas.

(two) Cost & Transaction Efficiency

ApeX Pro has made a decision to use the most well-known purchase guide interface in CEX and like dYdX, this trading model functions mainly because it removes the barrier to entry for standard and aspiring crypto traders. Thirsty to enter DeFi. It also makes use of 3 kinds of costs that aid protect against market place manipulation. However, it is up to the trader’s preference to see Mid-Market Price (dYdX) or Last Deal Price (ApeX Professional) for far more exact trades.

With the integration of StarkWare, it is no shock that ApeX Professional increases transaction velocity to course of action about 10 transactions and one,000 purchase positions per 2nd with no gasoline costs, along with lower maker and taker costs. dYdX’s tiered costs are exceptionally extensive and cater to diverse trade sizes of diverse traders devoid of any gasoline costs, it is no shock that derivatives DEX traders mainly search at contemplate dYdX.

These tiered costs are also acquainted to derivatives traders on CEX. On the other hand, GMX costs a network execution charge, which signifies that the gasoline costs that traders pay out for their trades can differ dependent on market place elements.

ApeX Professional isn’t going to presently have a tiered charge but taking into consideration it just launched in November, the spread could quickly drop with the approaching VIP plan, wherever the volume of APEX deposited will decide the price reduction utilized. utilised for maker-taker costs.

For traders searching for possibilities in trading pairs, dYdX stays the DEX with the biggest amount of perpetual contracts even though offering entry to spot and margin trading at the very same time. on Ethereum Layer one. ApeX Professional and GMX do not provide as numerous perpetual contracts as dYdX. However, with new trading pairs currently being launched on a regular basis, it is only a matter of time prior to traders attain entry to the multitude of assets and trading pairs on the remaining DEXs.

What may well be notable for all is ApeX Pro’s assistance for cross-chain deposits and withdrawals on EVM-compatible chains which is certainly a plus for traders concerned in the Dynamic trading across numerous platforms, chains and asset classes in cryptocurrencies.

(three) Coins & Rewards

Of all the elements, this is likely the a single that most traders care about — how just about every DEX aids make tons of rewards and revenue even though guaranteeing that these rewards are nevertheless legitimate. with just about every trader more than time.

With dYdX and GMX, the good results and recognition of trading occasions to earn rewards and inspire staking is clear. It is paramount for DEXs to make it possible for entry to income sharing schemes for their local community members and token holders, which normally will involve the distribution of accumulated trading costs more than a time period of time. time. Rewards and incentives are normally distributed working with the platform’s native tokens.

dYdX’s offerings are easy, with the Trading Rewards plan distributing two,876,716 $DYDX to traders primarily based on their trading volume more than 28-day epochs. In addition, consumers can also bet $DYDX on a pool for extra staking rewards. This double earning track is nevertheless a good results for traders. On the other hand, GMX has taken the local community rewards forward by working with margin tokens in its staking plan to even further stabilize and sustain the worth of the reward tokens that traders obtain. their translation obtained.

ApeX Pro follows in the footsteps of GMX by enriching the token ecosystem with escrow and liquidity tokens, permitting for far more dynamics in maximizing token worth and sustaining token use situations for the extended phrase. local community rather than working with a single token for all DEX initiatives.

With a complete provide of one,000,000,000 $APEX, 25,000,000 $APEX was minted to make $BANA. With ApeX Pro’s yr-extended Trade-to-Make occasion and weekly reward distribution in $BANA, traders can exchange rewards for tangible incentives in USDC, even though also redeeming tokens. $APEX immediately after the occasion ends. Traders can also include liquidity to the $BANA-USDC Pool in exchange for LP Tokens, which they can then exchange for extra $BANA.

In addition, ApeX Professional maintains stability in the worth of $BANA with a Buy and Burn Pool, guaranteeing that its consumers holdings of both token are maximized at any time. $190,000 well worth of BANA will be distributed weekly for a yr — a speedy and effortless alternative that every single trader is positive to value.

Inference

There is a good deal of innovation in the DEX architecture in the nascent DeFi market as DEXs obtain their spot in a globe dominated by CEX. This is great information for traders as they can decide on the DEX primarily based on the terms that perform finest for them or pull out their favored advantages across a wide range of platforms. With the development witnessed in the very first week of mainnet launch and an ecosystem that combines the finest characteristics on current DEXs, ApeX Pro is a products to view in 2023.

End with a quote as normal.

“Blockchain-based projects should go back to their roots – decentralization. Decentralization is here to stay and it is the future.”

– Andy Lian

Guest Post by Andy Lian from Mongolia Productivity Organization

Andy Lian is a small business strategist with more than 15 many years of knowledge in Asia. Andy has worked in a wide range of industries for regional, worldwide and publicly traded providers. His latest foray into the blockchain area has assisted him control some of Asia’s most prominent blockchain providers. He believes that blockchain will transform standard finance. He is presently the President of BigONE Trade and the Chief Digital Advisor at the Mongolian Productivity Organization.