The complete provide of USD Coin (USDC) stablecoins has dropped from $ fifty five.fifty five billion to $ 46.57 billion in the previous 90 days.

To stick to data by DeFiLlama, broadcaster USDC Circle has burned about $ 9 billion of its stablecoin in the previous three months.

This is the greatest volume destroyed in 90 days for the 2nd greatest stablecoin on the marketplace. USDC burning is accomplished when customers trade USDC stablecoin in fiat currency as USD. To do this, the enterprise sends the redeemed tokens to a burning deal with, completely deleting these coins from the blockchain program.

The move coincides with a sharp drop in curiosity costs made available by significant DeFi platforms for lending stablecoins. LoanScan information demonstrates that USDC loan costs on Compound and Aave have fallen by additional than 70% because the starting of the 12 months.

DeFi costs even drop beneath individuals made available by classic monetary markets, specially when the US Federal Reserve boost in curiosity costs from two.five% to three.25% final month.

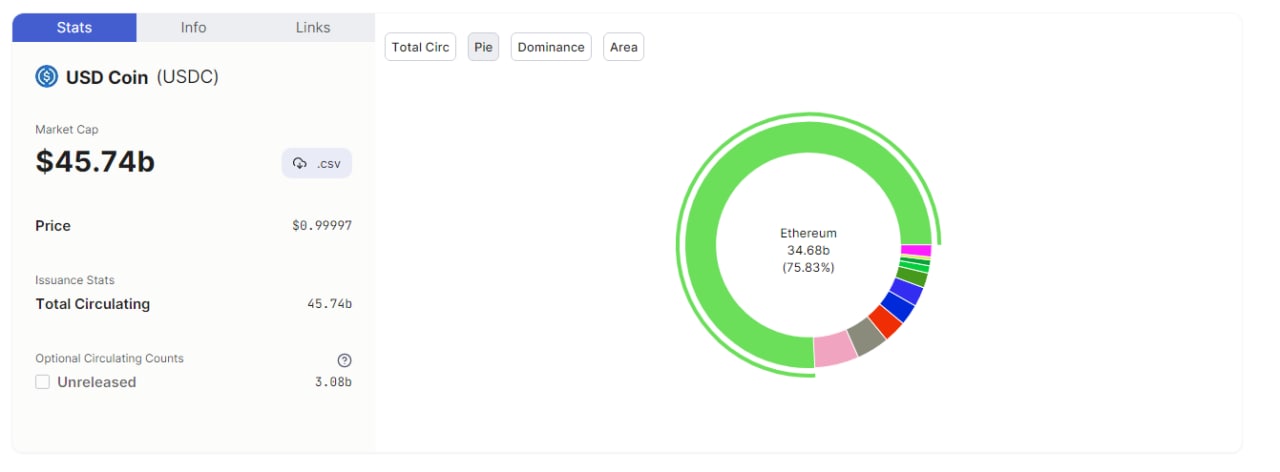

While USDC’s provide has decreased, Tether’s (USDT) provide has greater in excess of the identical time period. USDT’s circulating provide has grown by additional than $ two billion because the starting of July. Tether’s dominance in the stablecoin marketplace share pie has also greater to a 3-month substantial of 45.9%.

Circle not too long ago announced its strategies enhance capability consumer transactions in USDC across various chains. The enterprise has launched a protocol that will allow customers to effortlessly transfer USDC across supported networks.

Synthetic currency 68

Maybe you are interested: