CleanSpark’s hash price hit six EH/s on December 21, in contrast to two EH/s on December 31, 2021 — marking a three-fold boost on a 12 months-more than-12 months basis.

The business met its 12 months-finish target for hash price and explained it expects to hit sixteen EH/s by the finish of 2023.

Financial highlights in 2022

CleanSpark mined a complete of three,750 Bitcoin (BTC) throughout the fiscal 12 months 2022 ending September thirty — a 320% boost on a 12 months-more than-12 months basis, in accordance to its yearly monetary report.

Meanwhile, income for the 12 months grew 235% to $131.five million from $39.three million in 2021.

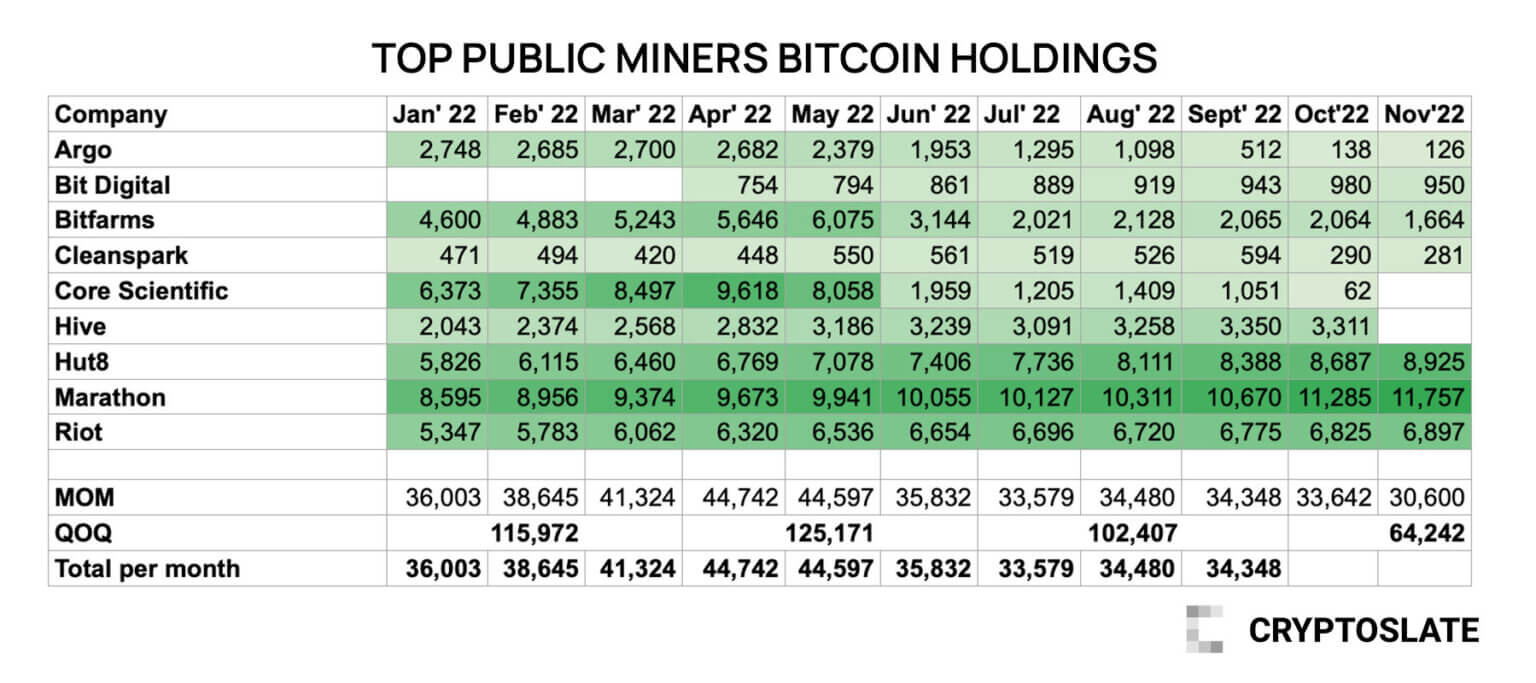

However, in spite of the 2x and 3x boost in income and mining BTC, the company’s BTC reserves fell by forty.three% to 281 BTC on November thirty, in contrast to 471 on January 31, observe CryptoSlate information.

According to the report, CleanSpark holds $twenty.five million in income and $eleven.one million in BTC as of the finish of September 2022. Along with mining assets, CleanSpark’s complete assets are equivalent to $452.six million. la for fiscal 12 months 2022.

BTC reserves down forty.three%

CryptoSlate information exhibits that CleanSpark offered off 304 BTC in October and a different 9 BTC in November, following the finish of the monetary 12 months.

As of November thirty, the business had 281 BTC in reserve, in contrast with 594 at the finish of September and 471 at the finish of January.

According to the numbers, CleanSpark commenced the 12 months with 471 BTC and elevated this to 594 BTC in September, which is the finish of CleanSpark’s fiscal 12 months.

On September thirty, BTC was trading for all over $19,422. At this selling price, 594 BTC equates to about $eleven.one million, which is also stated in the fiscal 2022 report amid CleanSpark assets.

However, the information also exhibits a sharp drop of 51% from 594 BTC in September to 290 BTC in October. This has dropped to 281 BTC in November, which equates to a forty.three% drop from with January’s 471 BTC.