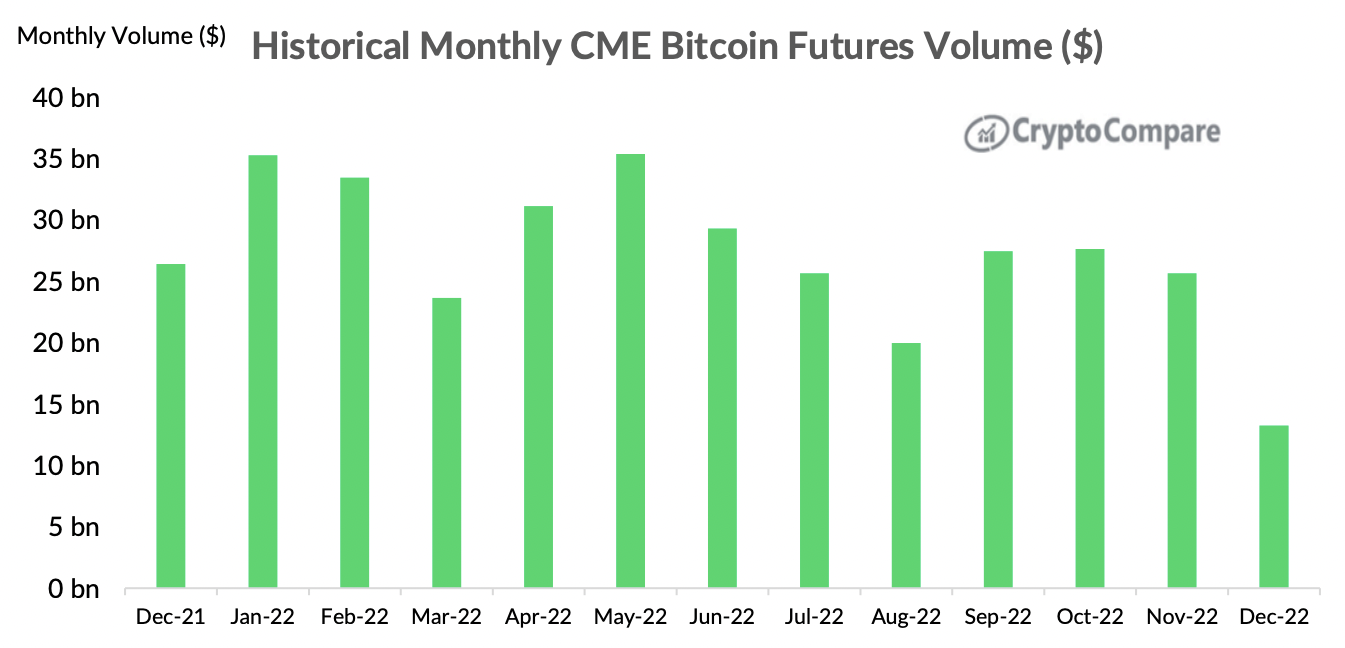

The cryptocurrency trading volume of the giant Chicago Mercantile Exchange (CME) derivatives industry suffered a dramatic decline in the final month of 2022.

Follow CryptoCompareTotal crypto derivatives trading volume on the CME fell 49.two% to $14.two billion in December 2022, the weakest because October 2020. Bitcoin futures volume is down 48, three% to close to $13.two billion, though Ethereum fell fifty five.three% to $481 million.

Fearful industry sentiment and excessive lack of liquidity volatility could be the principal factors behind this decline.

The CME slump information matches spot volume across the sector with very thin liquidity. That volume fell 48.four% to $544 billion, the lowest figure because December 2019, regardless of CME’s efforts to broaden numerous merchandise this kind of as Micro BTC contracts, Micro ETH 2nd just after the very first BTC futures contract in December 2017 and the ETH futures contract in February 2021 to entice traders.

In addition, CME also extra a benchmark charge for a quantity of new altcoins and acquired a $one billion investment from Google below a ten-yr Google Cloud contract which produced the local community incredibly assured on the derivatives section that it will assistance cryptocurrencies get higher resilience. in the following long term. However, the latest outcomes seem to be at an impasse.

Analysts of CryptoCompare She mentioned:

“Users are losing faith in centralized exchanges following the FTX crash, making their investment behavior very cautious due to fears of further contagion.”

This is certainly a unhappy signal reflecting the general “depressed” state of the total cryptocurrency field. As CME is viewed as the main gateway for institutional traders to get publicity to Bitcoin and Ethereum via choices and futures merchandise. If there is any measure of institutional enthusiasm for cryptocurrencies, CME metrics are undoubtedly really worth mentioning.

Synthetic currency68

Maybe you are interested: