One of the most well known worldwide derivatives exchanges Chicago Mercantile Exchange (CME) has expanded its cryptocurrency supplying by launching an Ether micro futures merchandise.

In an announcement on December six, CME Group stated it has launched a micro Ether (ETH) futures contract in the dimension of .one ETH, supplying institutional and personal traders a exceptional merchandise. developed in February of this 12 months.

The newest member of CME Group’s cryptocurrency merchandise family members has arrived. Micro Ether futures are out there for trading. https://t.co/bJoZWA7qZz

– CME Group (@GruppoCME) December 6, 2021

CME Group very first launched Bitcoin futures in December 2017 through a significant bullish cycle. The exchange’s micro Bitcoin futures merchandise launched in May 2021, with three.three million contracts traded to date.

Genesis Global Trading, one particular of the liquidity companies for CME Group’s crypto derivatives providers, stated it entered into a micro Ether futures contract in partnership with cryptocurrency investment company XBTO.

Tim McCourt, CME Group’s worldwide head of alternate investment items, says supplying micro Ether will enable traders to hedge towards ETH spot costs or execute tactics. Ether transactions are quicker and much more effortless.

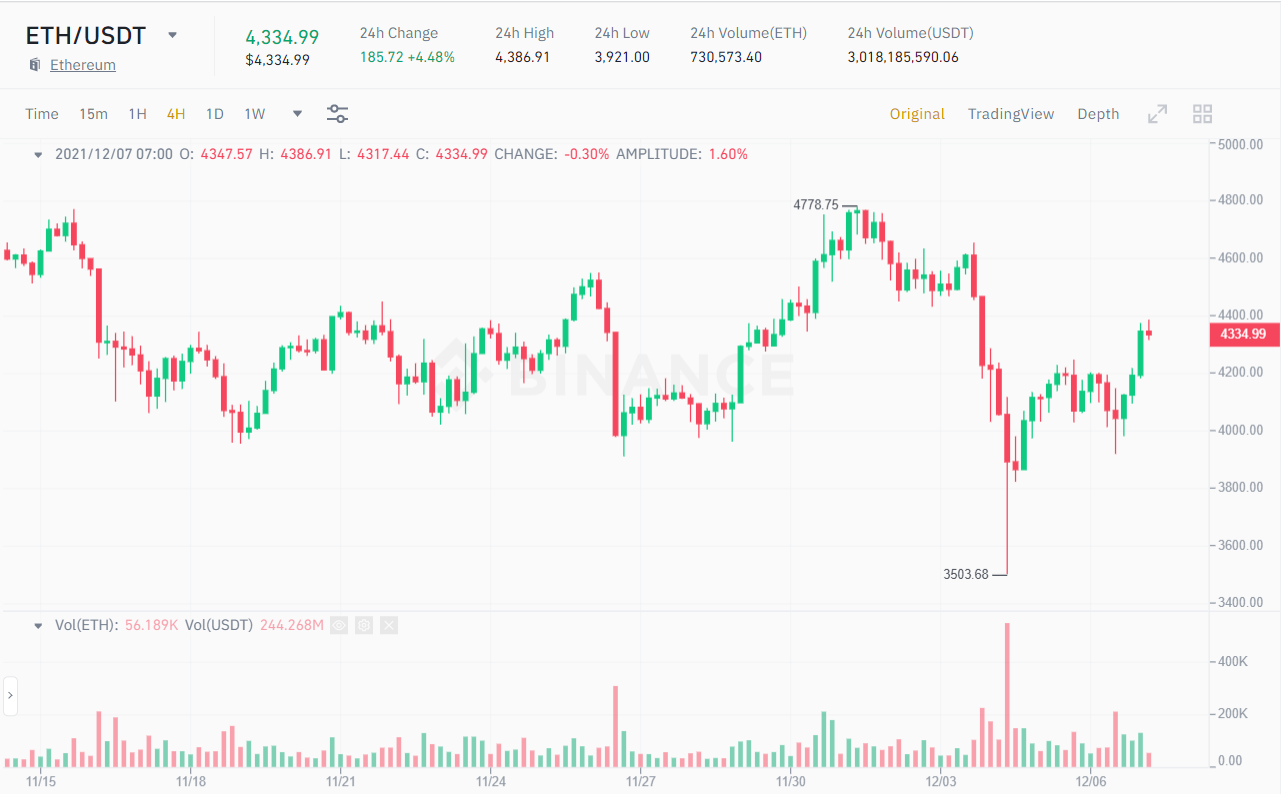

The announcement comes right after Bitcoin (BTC) “bottomed out”, dropping as significantly as $ 42,000 above the weekend, leaving Ethereum (ETH) and most other altcoins heavily impacted.

However, as of this creating, ETH is recovering impressively, bouncing into the $ four,334 rate zone in the previous 24 hrs prior to a good indicator of Bitcoin’s return to $ 50,600.

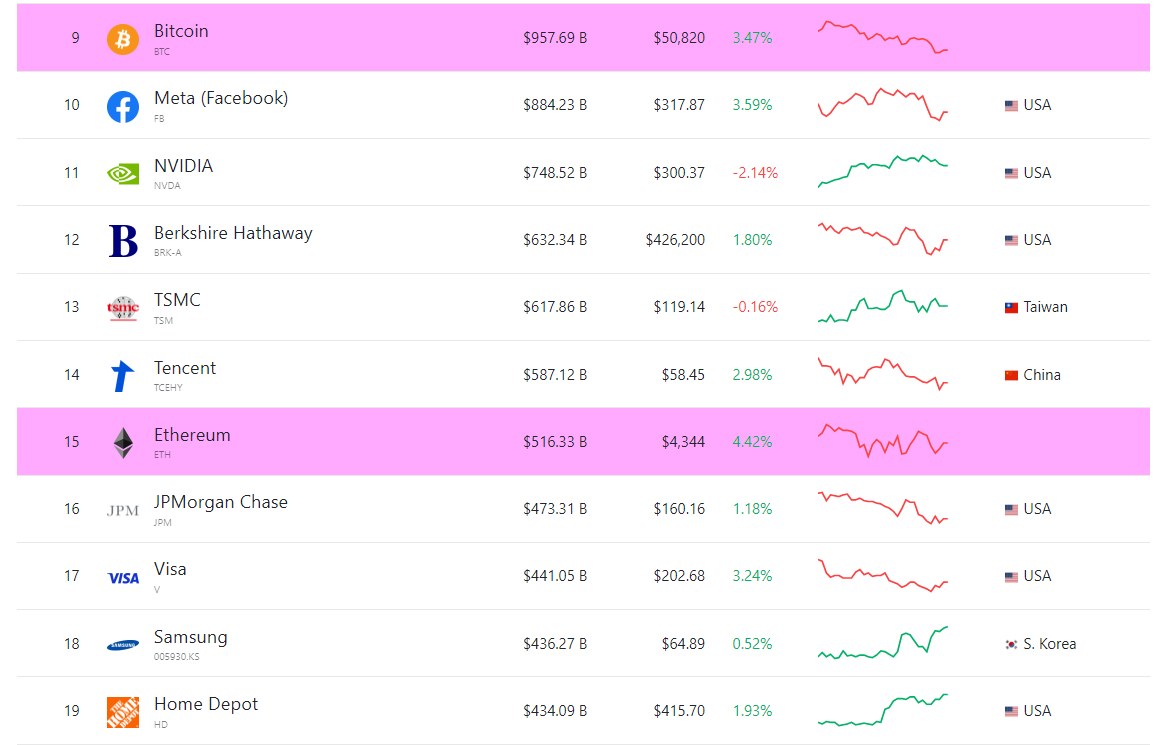

More exclusively, Ethereum’s market place cap is all around $ 516 billion right after a just about five% drop, while ETH is nevertheless in the major 15 assets by market place cap in the planet, beating banking institutions, the greatest JPMorgan in the planet. planet, the payment giant Visa and Samsung. ETH is at present only behind Meta (formerly Facebook), Tesla, Amazon, Bitcoin, Apple, Microsoft and other well known assets.

Synthetic Currency 68

Maybe you are interested: