Leading US cryptocurrency exchange Coinbase is following in the footsteps of FTX and Crypto.com in the futures marketplace by obtaining the FairX derivatives platform.

On January 13, Coinbase announced the acquisition of FairX, a derivatives exchange regulated by the Commodity Futures Trading Commission (CFTC). Buying Coinbase could set up a regulated cryptocurrency marketplace for Coinbase’s hundreds of thousands of customers.

Creating a transparent derivatives marketplace will unlock even more participation in the crypto economic climate for retail and institutional traders.

Read more👇https://t.co/Mb2Ybdmr2t

– Coinbase (@coinbase) January 12, 2022

Coinbase also shared that the selection to include derivatives trading to the company’s merchandise framework is eventually aimed at bringing good added benefits to traders.

“This move will unlock even greater participation in the cryptocurrency industry for retail and institutional investors.”

Furthermore, Coinbase believes that FairX is the ideal selection to pursue its mission. FairX’s engineering is uncomplicated and easy, which will enable Coinbase provide a uncomplicated consumer expertise to its clients. The acquisition is even now topic to sure disorders, but is anticipated to near in the 1st quarter of 2022.

Currently, only a handful of exchanges make it possible for US traders to participate in Bitcoin (BTC) and Ethereum (ETH) futures contracts, but that is very likely to modify as centralized exchanges attain horizon dimension, even if they are listed right on an exchange. values such as Coinbase, has begun to intervene.

While this is an crucial milestone for Coinbase, Crypto.com and FTX have the two taken equivalent actions in the previous. FTX acquired LedgerX in August 2021 and with Crypto.com as the Nadex platform in December 2021.

Exchanges like Binance, Bybit, Huobi or OKEx on the spot marketplace also have their personal derivatives marketplace. However, the move will enable Coinbase quickly leap to the major of key derivative exchanges as Coinbase presently has 56 million energetic customers, eight.eight million of whom execute at least 1 transaction per month.

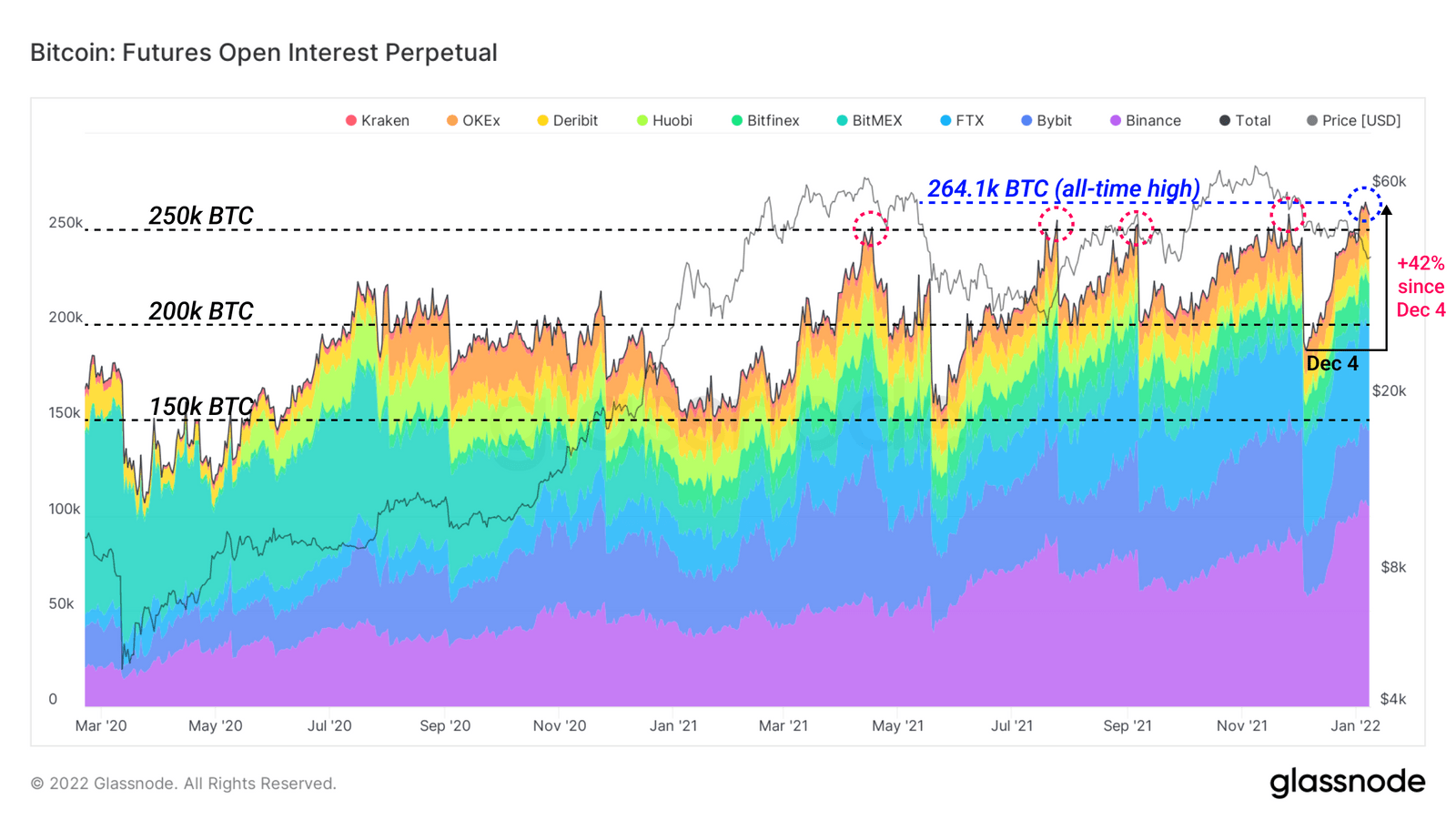

Coinbase’s most current move is understandable even offered the typical ground of direct rivals. According to the most current Glassnode report, on the other hand, open curiosity has reached an all-time large of 264,000 BTC, up 42% given that December four, the derivatives index has reached its peak, greater than all of 2021 even if it is only a minor now, spanning about two weeks into 2022. Therefore, futures trading is very likely to be a trend that continues to increase and of program Coinbase does not want to miss this chance.

Synthetic currency 68

Maybe you are interested: