The two most well-known cryptocurrency aggregators and statistical platforms now, CoinMarketCap and CoinGecko, grew to become the following representative to “say” in the FTX crash.

According to ProChain Capital CEO David Tawil, offered what took place final week – seven “terrifying” days exactly where FTX modified the whole cryptocurrency planet, it is incredibly very likely that the two CoinMarketCap and CoinGecko have “smelled” the vulnerability that FTX is dealing with.

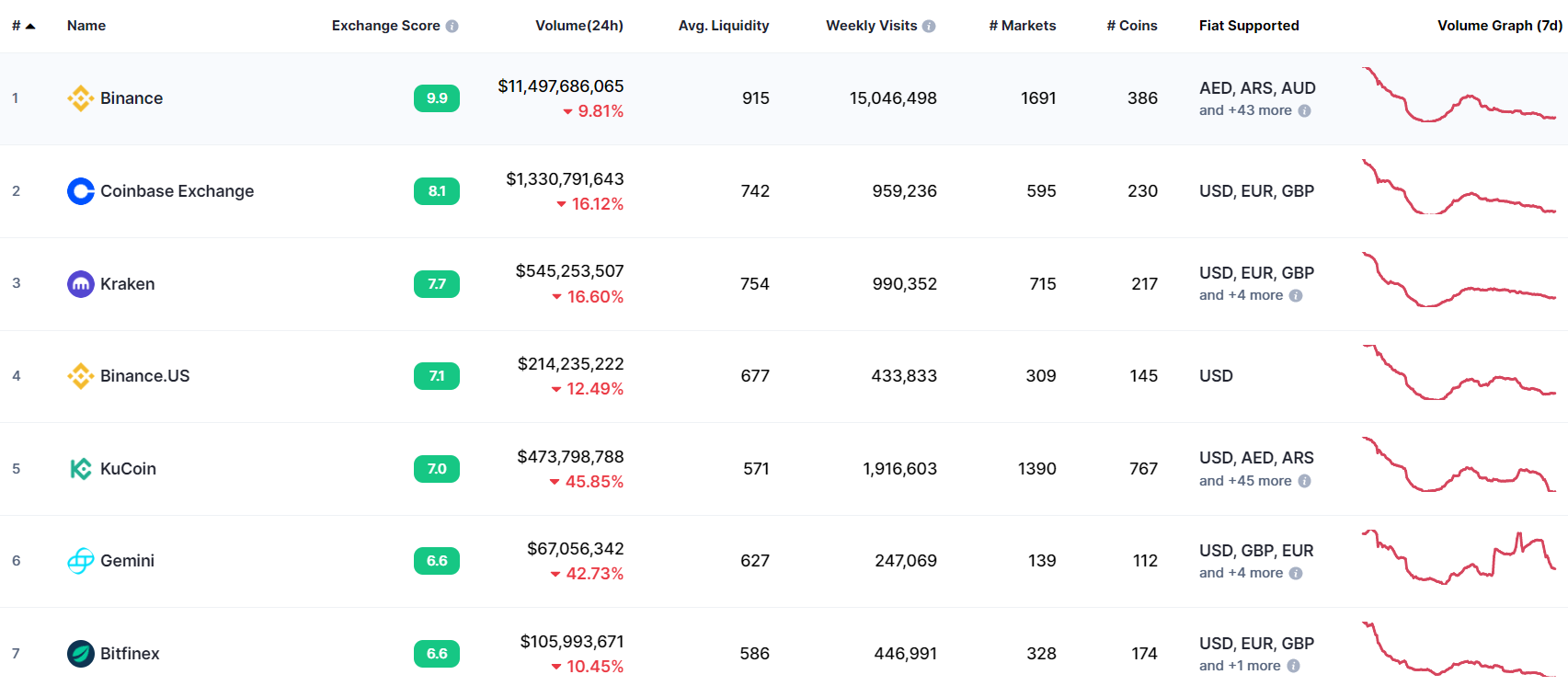

However, as of early November 2022, CoinGecko nonetheless ranked FTX as the third very best cryptocurrency exchange in the marketplace, with a believe in score of ten. At the similar time, CoinMarketCap also ranked FTX as the 2nd very best exchange of Binance and Coinbase.

David Tawil argues that CoinGecko and CoinMarketCap are the most correct “answers” for the crypto planet, in contrast to credit score rating companies in the regular economic planet (TradFi), this kind of as Moody’s, S&P and Finch.

Credit scores will perform a major component in the investment approach of stock or bond traders. And of program, for cryptocurrencies, traders do not look to forgive and fail to remember the business leaders who promoted FTX all through the liquidity crunch the exchange left on the marketplace.

Therefore, Mr. David Tawil believes that the “liberation” in statistics and the censorship of CoinMarketCap and CoinGecko will slowly sink these two platforms into oblivion.

“I do not imagine their support will carry a lot worth to any individual in the prolonged run. Their popularity has wholly vanished.

In reality, CoinGecko and CoinMarketCap rank exchanges primarily based on variables like liquidity, safety, and utilization for the score.

When asked how FTX is viewed as trustworthy in spite of currently being unreliable, Zhong Yang Chan, the head of investigation at CoinGecko, replied rather blurry, only sharing that the problem of regardless of whether an exchange’s assets are liquid or not has not been mentioned a lot ahead of. .

“Only with the current controversies surrounding FTX has there been a concerted push in direction of centralized exchanges to adopt extra transparency about their holdings. Even so, our program by the finish of 2022 is to improve only exchanges that look for to show transparency to score large.”

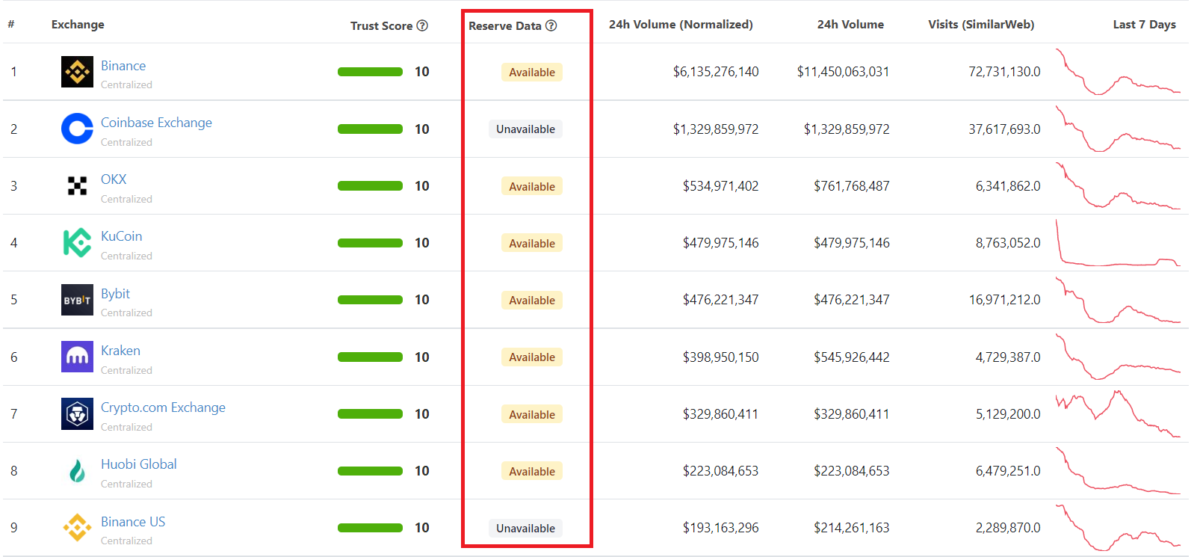

As of press time, CoinGecko has started off monitoring liquidity by incorporating a stock information segment exactly where consumers can see how numerous assets exchanges have obtainable, primarily primarily based on information from DeFiLlama and Nansen.

As for CoinMarketCap, the organization did not immediately comment on how FTX attained this kind of a placement on its platform. A CoinMarketCap spokesperson uncovered that the company’s precise measurement process is currently being stored beneath wraps to avert exchanges from misleadingly ranking.

Unlike CoinGecko, CoinMarketCap does not at this time help exchange reserve query information on its web-site, but the organization says it intends to do so as quickly as feasible.

Synthetic currency68

Maybe you are interested: