What is Comdex (CMDX)?

Comdex is a protocol for issuing decentralized synthetic assets of the Cosmos ecosystem. Comdex consumers can make and trade a range of synthetic commodity assets. Comdex generates answers that democratize finance by offering traders publicity to a broad variety of assets.

Comdex items

Comdex is swiftly evolving into an ecosystem of answers that will democratize finance and in the end act as a bridge among DeFi and CeFi. To date, the platform has raised in excess of $ 160 million in trading, serving traders from 18 institutions based mostly in four jurisdictions. Comdex is proud of the items it has created to date and the options it delivers to the globe:

- Corporate trading platform: It aids remedy believe in and efficiency troubles in commodity trading and SMEs / SMEs have greater accessibility to finance.

- ShipFi: Scheduled to launch in 2022, the app focuses on bringing business fiscal liabilities and credits up the chain for liquidity.

- Synthetic Asset Issuance: It enables for the creation of aggregators so that DeFi traders can obtain publicity to authentic globe assets.

All of these answers have been intended from the commence to function with each other. To greater comprehend how these items function, let us appear at the great workflow:

- Trading is completed on the firm trading platform.

- At the time of credit score creation, traders can request liquidity from ShipFi money, creating the capital of DeFi traders available.

- These money then assure NFTs backed by authentic globe assets and mint the synthetic asset. These synthetic assets can then be offered to DeFi traders, offering them publicity to authentic-globe debt financing derivatives.

Process of issuing synthetic assets on Comdex

The Vault module manages and merchants the creation of vaults.

Secured positions enable the creation of commodity composites by blocking an additional listed asset as collateral.

The Vault module manages and archives the creation of a Collateralized Debt Position (CDP). The collateral is locked in a vault and a new asset can be minted for a fraction of the collateral worth. The consumer need to repay the debt by having to pay the minted great at the vault to unlock the assure. At this stage, the minted great will be burned and the assure supplied will be unlocked.

The price tag of the asset is tracked by oracles like Band Protocol or decentralized pools like Osmosis. The liquidation occasion is triggered when the place collateral falls beneath the minimal threshold worth (liquidation ratio) for a cAsset.

Mortgage fee = (worth of blocked collateral) / (asset worth borrowed)

Settlement prices might differ based on the kind of collateral and the kind of business enterprise borrowed. Furthermore, the liquidation prices can be adjusted and modified as a result of governance proposals for each and every asset. Debt positions can be closed when the borrowed asset is repaid and the borrower pays a charge to near the place. After closing a place, the cAsset will be burned and the frozen collateral returned to the borrower.

cExchange

cSwap enables platform consumers to trade their cAsset by way of an automated industry maker (AMM). AMMs aid set charges and facilitate trading as a result of disallowed liquidity pools. Assets are traded as a result of AMM and transaction costs are charged for each and every executed buy. Platform consumers can deposit their assets in liquidity pools to facilitate trading on cSwap, to earn CMDX token rewards and a portion of the trading costs earned by the pool.

Basic information and facts about the CMDX token

- Token title: Comdex

- Ticker: CMDX

- Blockchain: Atom

- Token normal: Updating

- To contract: Updating

- Token kind: Utility, Governance

- Total provide: 200,000,000 CMDX

- Circulating provide: 17.402.620 CMDX

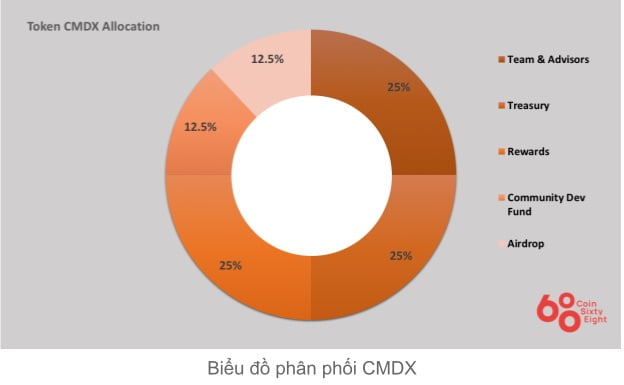

Token allocation

- Team and advisor: 25%

- Treasure: 25%

- Reward: 25%

- Development Community Development Fund: twelve.five%

- Air launches: twelve.five%

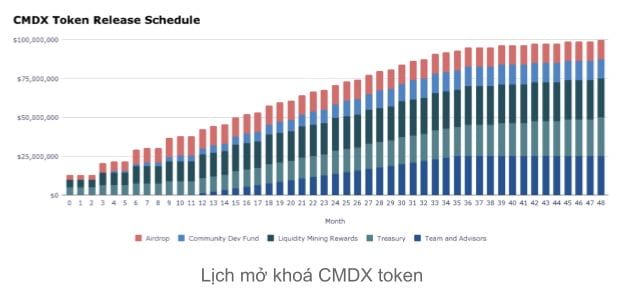

Token release system

What is the CMDX token for?

- Administration: Comdex consumers and CMDX token holders are authorized to use and management several parameters of the platform. The administration also enables the modification of crucial parameters this kind of as commissions, cAsset, and so on.

- Cost of the transaction: To compensate for validators and make network attacks pricey, on-chain transaction costs and several platform costs are levied.

- Reward: Incentives early adopters and people doing vital network functions by giving liquidity to cSwap pools.

- Stabilization: The CMDX will have an algorithmic connection with each and every aggregate asset to sustain the power of the rungs.

CMDX Token Storage Wallet

You can shop this token on Keplr Wallet.

How to earn and personal CMDX tokens

- Buy right on the stock exchange.

- Provide liquidity on cSwap to get rewards

Where to purchase and promote CMDX tokens?

CMDX is at the moment trading on the Osmosis exchange with a complete each day trading volume of roughly USD two million.

Roadmap

Updating

What is the potential of the Comdex venture, should really I invest in CMDX tokens or not?

Comdex is a decentralized synthetic asset issuance protocol based mostly on Cosmos SDK. Through this report, you need to have by some means grasped the primary information and facts about the venture to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you accomplishment and earn a great deal from this likely industry.