The growth of sidechains (subchains) is the favored model of huge blockchains searching to remedy the trouble of targeted visitors overload and increase their networks. The target is the similar but each and every blockchain will have a distinct implementation, this write-up will clarify the distinction in between Avalanche’s “Subnet” sidechain and Polygon’s “Supernet” and examine the pros and cons of these two subnets.

Compare Avalanche Subnet and Polygon Supernet

About the function

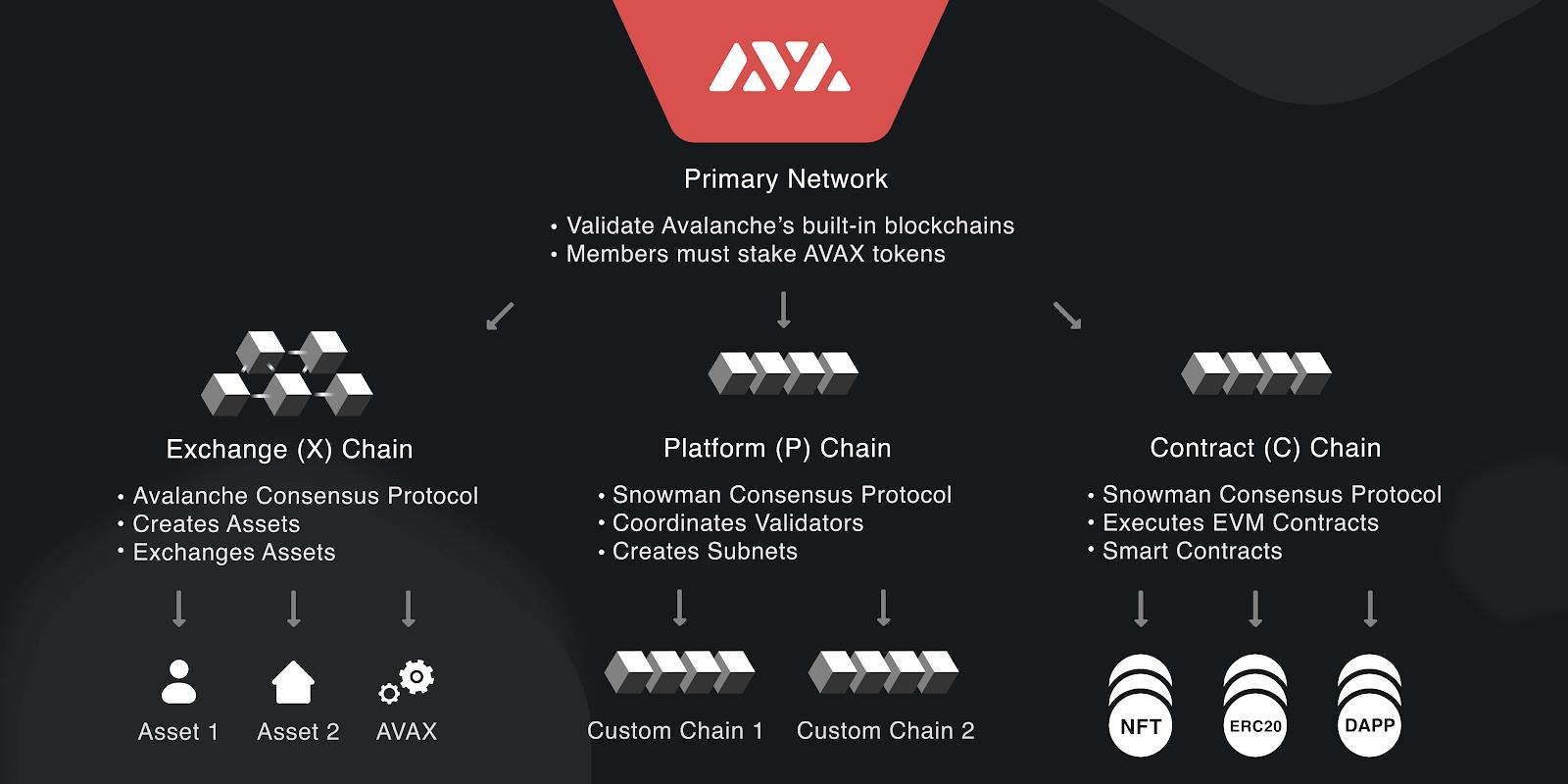

The subnet acts as the smallest “slice” of Avalanche. Instead of developing a single blockchain themselves, developers will create many parallel blockchains whilst inheriting capabilities like protection, velocity, and local community from Avalanche.

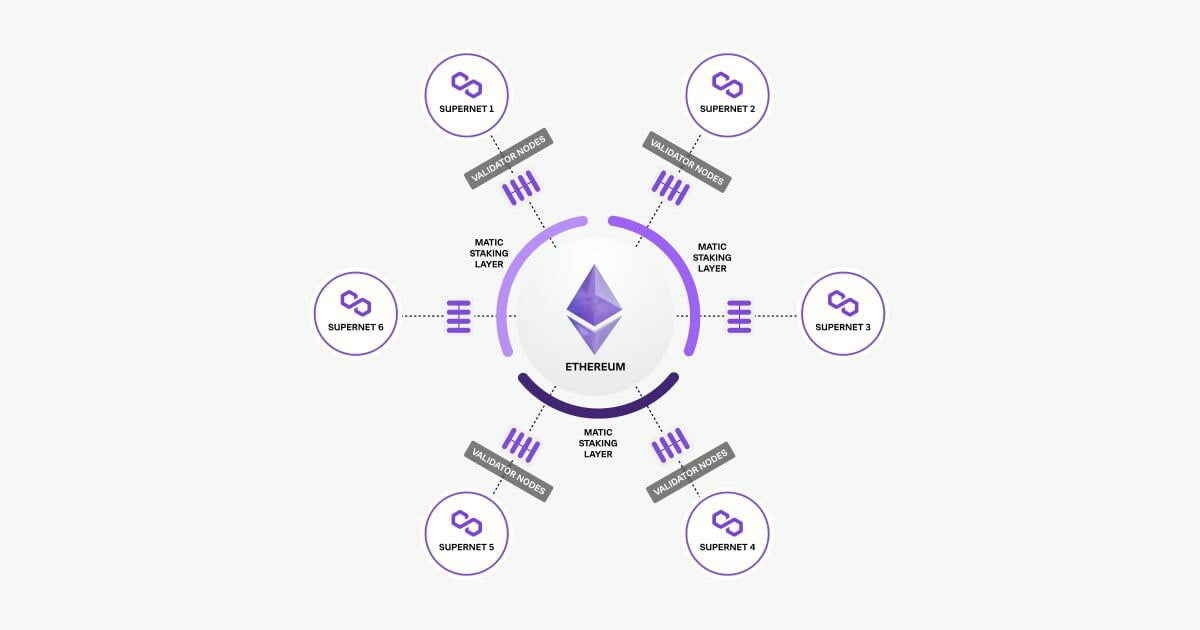

Meanwhile, the Polygon Supernet serves an fully distinct function. A Supernet developed to connect crypto applications – from DeFi, GameFi and even Web3 – out there with each other and assistance interoperability in between networks, whilst the authentic blockchain will grow to be the main spot for transaction processing.

About the scale

As talked about over, the subnet will be a smaller sized chain cloned and hosted inside of the Avalanche framework. To produce a subnet, developers will use Avalanche’s exceptional network handle.

The Supernet, on the other hand, is known as the “network of the network”, in the sense that it can consist of subnets and several other networks, each and every Supernet can exchange values and messages with other Supernets and with the Ethereum mainnet.

About protection

Even from the scope and scale of the two styles of subnets, their protection abilities also have their respective benefits and drawbacks, namely:

– The subnet is valued extra in terms of protection since it is managed individually, in situation a little something goes incorrect, it will not effect the complete significant chain.

Conversely, the Supernet is extra vulnerable to assault due to its multi-network interconnection model, which increases the problems of process servicing.

About technologies

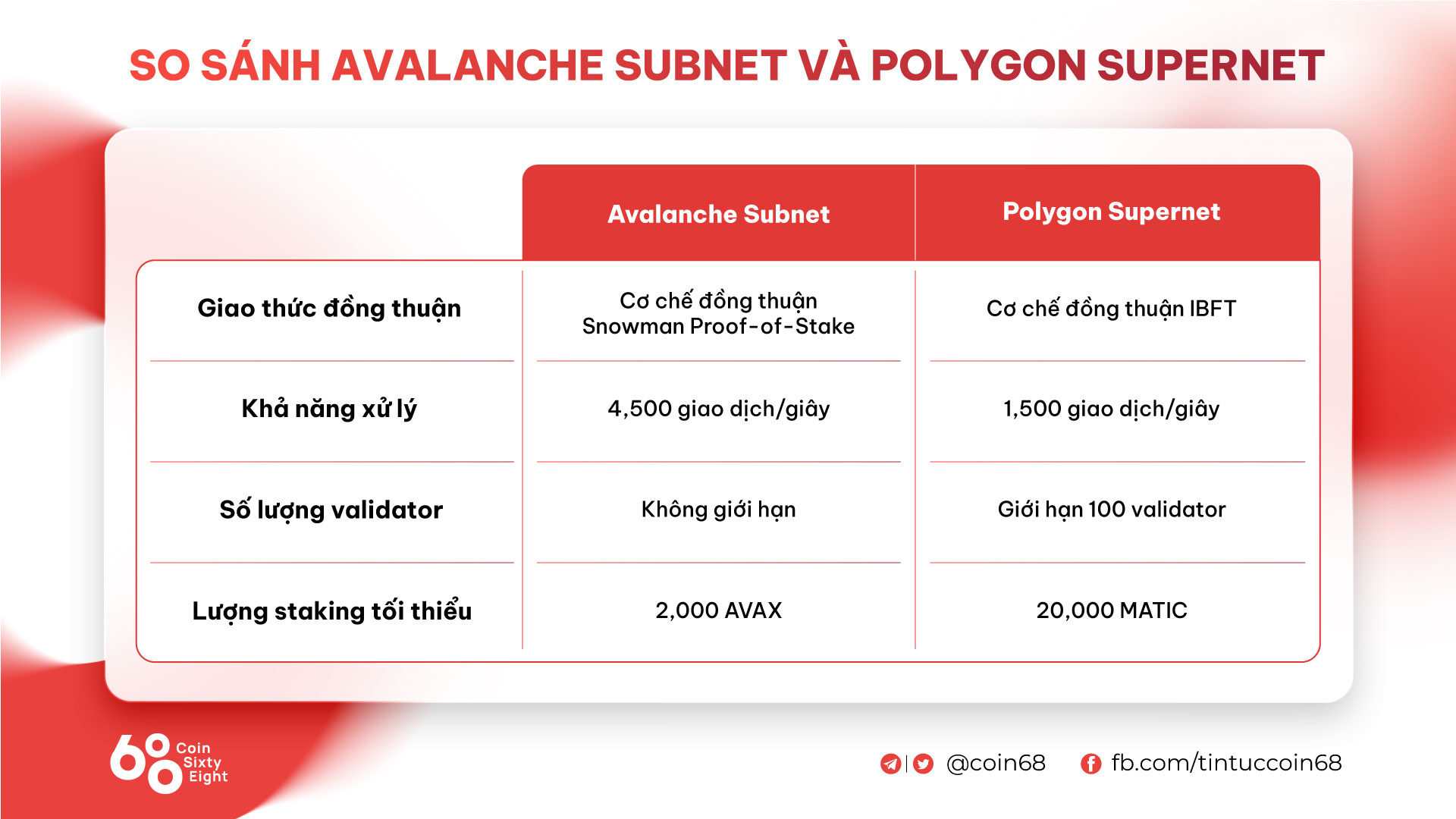

Although created with each other to assistance scalability, Subnets and Supernets are programmed with really distinct principles, from consensus protocol, to processing capability, variety of validators… Some comparisons are summarized in the table under.

Using the Avalanche subnet muscleSnowman Proof-of-Stake Consent let the Smart contracts have higher throughput, infinite scalability, and even now have decentralization.

On the other hand, Polygon Supernet makes use of IBFT (Istanbul Byzantine Fault Tolerance) consensus protocol. This mechanism will randomly pick a validator, and consensus can be reached even if some validators are down or offline, the variety of validators is constrained to a hundred. Therefore, the This mechanism inadvertently sacrifices chain decentralization.

It can be noticed that Avalanche is also superior in transaction processing velocity, 3x speedier than Polygon.

Additionally, the two Avalanche and Polygon aim to enhance the demand for AVAX and MATIC stakes by specifying a minimal staking volume to safe their networks.

Update Avalanche Subnet and Polygon Supernet now

Avalanche subnet

According to the statistics of Core Portfolio by Avalanchethis network presently has sixteen subnets that have been developed and created from a wide variety of fields, together with:

- GameFi: Crabada, DeFi Kingdom, MetaDOS, Pulsar, DOS, Loco Legends.

- DeFi: DEX Dexalot, Inside Market.

- NFT/Metaverse: WrapTag, XANA, Step Network, Protocol Numbers, XPLUS.

- Infrastructure: D-chain, WAGMI, Green Dot.

Additionally, some of the game tasks scheduled to launch on the Avalanche subnet consist of Shrapnel, Ascenders, Castle Crush, Wild Life, and Ragnarok.

However, the Subnet model in 2022 is viewed as ineffective due to the collapse of the cryptocurrency market place, as effectively as not bringing any breakthrough inventions or new goods.

Polygonal supernet

In the Supernet launch announcement In April 2022, Polygon presented a $a hundred million assistance fund for tasks searching to create the Supernet.

Now out there 9 projects integrated Supernet on Polygon come from conventional fintech and blockchain, together with: Ankr, AE Studio, Gateway, Stardust, Blockgen Studio, Nethermind, Ethernal, SettleMint and MVP Workshop.

Refer to CoinTelegraph

Maybe you are interested: