As the amount of layer one or layer two blockchains grows strongly, the will need for customers to move and exchange assets across various chain walls also explodes. To remedy this trouble, several protocols and SDKs have been launched to help interoperability involving blockchains.

Although bridges have appeared and are viewed as the very first piece of cross-chain infrastructure, the goods nevertheless have difficulties and limitations that have led to several main cyberattacks in current instances.

So will the new infrastructure protocols for cross-chain performance seriously deliver several enhancements to the blockchain sector? Through this posting, Coinlive will synthesize and analyze the info out there from the 3 most preferred protocols right now: Chainlink CCIP, Circle CCTP, and LayerZero to get an goal point of view on the potential hybrid blockchain marketplace.

Compare cross-chain remedies from LayerZero, Chainlink CCIP, and Circle CCTP

Compare cross-chain remedies from LayerZero, Chainlink CCIP, and Circle CCTP

What is “Cross-Chain Layer 0”?

Cross-chain Layer is a information transfer protocol that enables good contracts to be executed across several various chains, with a transaction from any supply chain capable of cross-chain interaction for Dapps, bridges and tokens (launched on native blockchain ).

The idea of “cross-chain Layer 0” will be obviously demonstrated in the 3 protocols LayerZero, Chainlink CCIP and Circle CCTP that Coinlive would like to mention in this posting in comparison to uncover what the variations and the most capable prospective are.

LevelZero

overview

LayerZero is a reduced-degree messaging protocol/communication primitive that Dapps (as a cross-chain DEX or multi-chain yield aggregator) can establish on, hence working on several blockchains at when, also recognized as Omnichain.

Note: LayerZero is not a blockchain, but it is a protocol.

LayerZero demands applications to establish on its protocol and not basically connect present applications on present blockchains. However, compatibility should then be assured across all blockchains with LayerZero Endpoints.

Knowledge: An endpoint is an accessibility gateway that enables applications and customers to use the LayerZero protocol to send and get cross-chain messages and sources, permitting them to complete the multi-chain functions supported by the protocol.

LayerZero does not rely on an intermediary manager or exchange and does not call for an intermediary blockchain or token. Using infrastructure technologies, LayerZero permits token and message transfers without having replicating cross-chain server state.

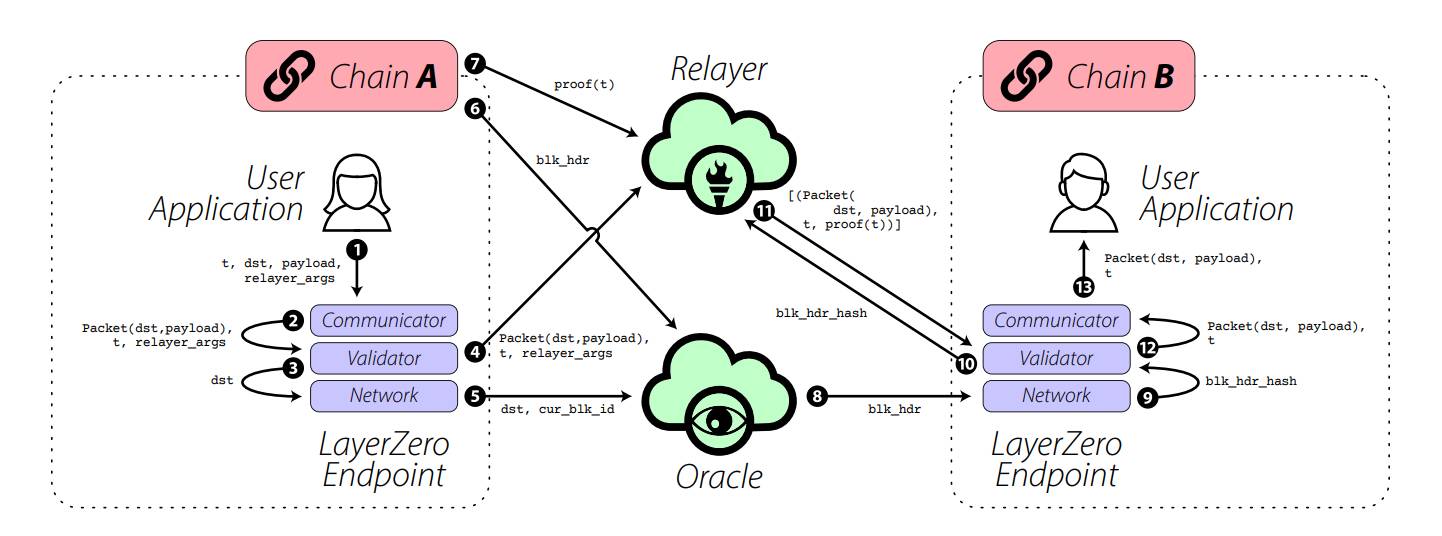

Details on how LayerZero operates

The LayerZero working model. Source: LayerZero White Paper

The core component of LayerZero is a messaging protocol that offers evidence of transaction validity without having requiring third-get together authentication.

LayerZero Endpoint is a specific function of LayerZero’s infrastructure to optimize blockchain customers. Each blockchain that integrates with LayerZero has a LayerZero Endpoint deployed as a series of good contracts on the chain. The function of an endpoint is to enable customers to send messages making use of the LayerZero protocol backend to make sure the validity of the transaction.

LayerZero Endpoint is divided into four modules: Communicator, Validators, Network e Thư viện.

The Communicator, Validator and Network modules constitute the core performance of the Endpoint, though for every single new blockchain supported by LayerZero a new Endpoint is additional as a Library. This style and design enables us to help new blockchains without having shifting the other 3 core modules.

Additionally, LayerZero has two independent entities that confirm the validity of transactions in every single chain:

-

Oracle: Using third events like Chainlink (DON) will present a mechanism to read through the block header from 1 chain and send it to a different chain, entirely independent of other LayerZero elements.

-

Relay: An off-chain transaction evidence recovery support presently presented by LayerZero.

To make sure legitimate delivery, the only necessity is that for any message sent making use of the LayerZero protocol, Oracle and Relayer should be independent of every single other. The protocol itself does not call for any precise Relayer implementation, and in concept LayerZero customers could put into action their personal Relayer support. This style and design enables customers to make sure that Relayer can not be mixed with Oracle, and this independence is what enables LayerZero to confirm the validity of the transaction without having requiring a third get together.

In addition to the core modules, LayerZero Endpoint can be extended by way of Libraries, which are auxiliary good contracts that define how interactions are dealt with for a precise blockchain. Each chain in the LayerZero network has an connected Library, and every single Endpoint incorporates a copy of every single Library.

This modular style and design enables LayerZero to have no distinction involving EVM or non-EVM, so it can be swiftly and effortlessly expanded so it can be integrated with any blockchain. Furthermore, the interaction involving two chains only demands that their respective libraries exist at each ends, generating LayerZero a entirely interconnected network with the skill to coordinate transactions involving blockchains.

LayerZero compatibility of EVM and non-EVM, Layer one and Layer two. Source: LayerZero whitepaper

At the very same time, LayerZero’s cross-chain asset transfer mechanism operates with each lock-mint and burn up-mint techniques. This generates versatility in how LayerZero operates to optimize compatibility with all kinds of assets on any blockchain and also improve the protection of transactions.

CCIP chain

overview

To improved recognize Chainlink Cross-Chain Interoperability Protocol (CCIP), you can refer to this posting: What is Cross-Chain Interoperability Protocol (CCIP)?

However, to make it less difficult to recognize, Chainlink CCIP is a protocol that supports cross-chain operations, which includes sending, obtaining, and transferring tokens and information involving various blockchains. The aim of CCIP is to present a straightforward and safe way to connect blockchains by way of a single interface.

Safety Information: Chainlink CCIP will emphasis on the improvement of the “mint and burn” mechanism. It is a mechanism for burning and reissuing tokens through good contracts to make sure protection in the transfer of tokens involving chains. However, mint consumption usually has its limitations, so the CCIP mint blocking mechanism will nevertheless be current.

=> This usually means that customers can flexibly transfer tokens involving chains with the unique token rather of encapsulated tokens or synthetic/bridged token versions.

Furthermore, CCIP has the following principal capabilities:

- Arbitrary messages: CCIP enables arbitrary information (encoded as bytes) to be sent to good contracts on various blockchains. This tends to make it achievable to complete complicated, multi-stage interactions across several chains.

- Token Transfer: CCIP enables token transfers involving good contracts or consumer accounts on various blockchains.

- Programmable token transfer: CCIP enables the simultaneous transfer of tokens and arbitrary information in a single transaction. This aids customers assign precise actions to transferred tokens.

However, to improved recognize the idea of CCIP, you will need to know sections this kind of as:

- Accounts: You should really be mindful of the big difference involving Externally Owned Account (EOA) and Contractual Account.

- Smart contracts: Basic know-how of good contracts.

- Dapp: Decentralized applications.

- ERC20: ERC20 token conventional.

- Merkle tree: This framework aids to check out the consistency and written content of the information.

Details on how Chainlink CCIP operates

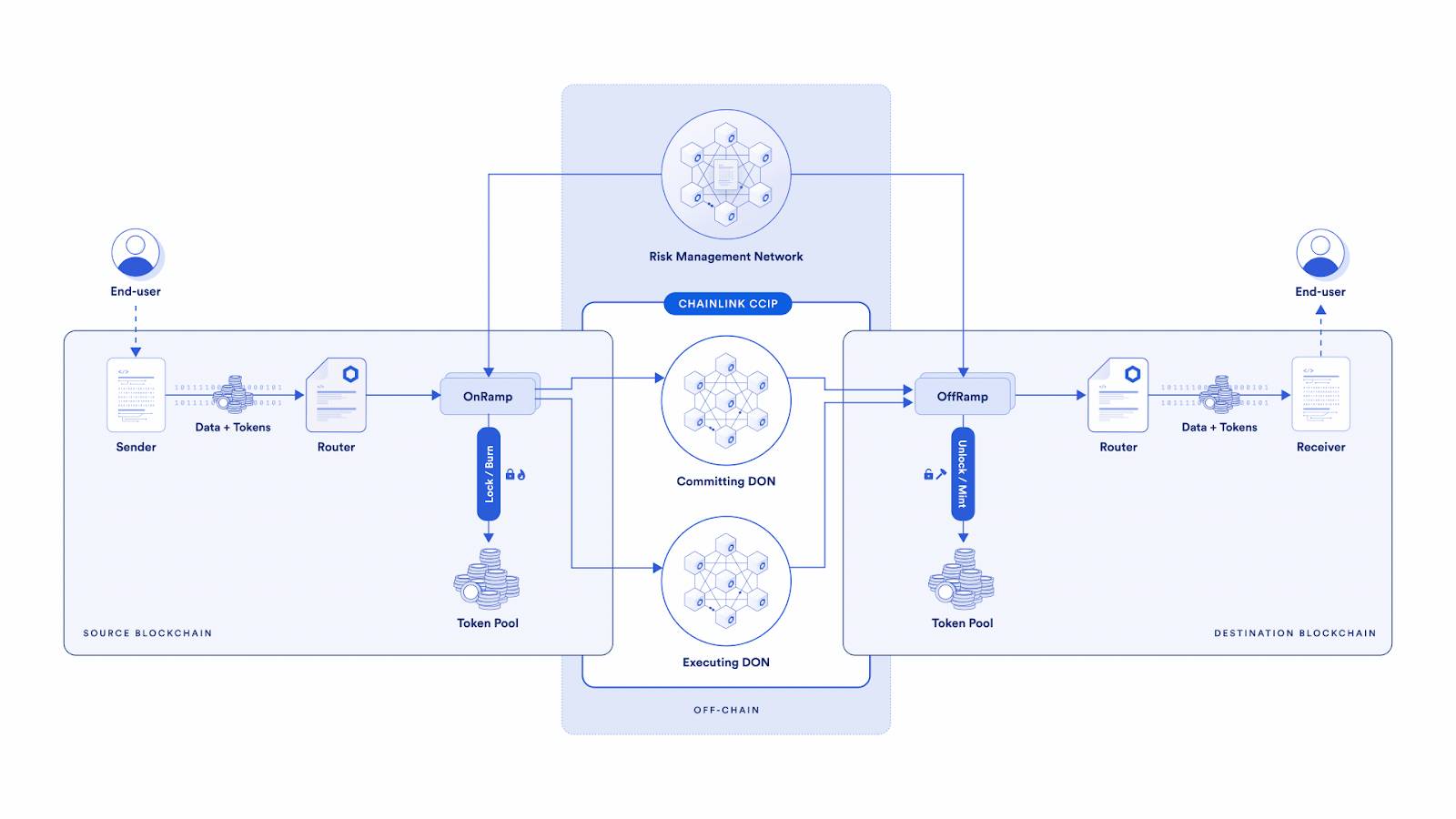

CCIP architecture

The framework of CCIP is divided into two principal elements: on-chain and off-chain:

Components on the chain

– Routers: This contract initiates cross-chain interactions and exists on every single blockchain. Route messages from supply to location.

– Commitment store: Decentralized Oracle Network (DON) commit makes use of Commit Store to shop the Merkle root of finished messages on the supply in advance of Executing DON can execute them on the target.

– On the ramp: This contract controls and manages the info relevant to the message, as effectively as interacts with the Token pool (if any).

– Ramp disabled: This contract verifies messages and executes cross-chain transactions.

– Token group: Each sort of token has its personal pool to deal with the actions relevant to them.

– Risk Management Network Agreement: This contract maintains a record of addresses of possibility management nodes that can be validly or fraudulently censored.

Off-chain elements

– DON Commitment: Track cross-chain transactions and bundle them into Merkle root.

– Running DON: Perform cross-chain transactions just after auditing and censorship.

– Risk Management Network: A set of independent nodes monitors the Merkle roots and validates them.

How the CCIP operates

Users transfer tokens from the supply to OnRamp to burn up or lock in the Token Pool based on the token sort.

The DON commit reads information from OnRamp and passes it to the Commit Store for validation.

Risk Management Network double-checks OnRamp information and then validates it.

Running DON reads info from the Commit Store and OnRamp, then mints new tokens or unlocks tokens in the pool to transfer them to the user’s wallet tackle on the target blockchain.

CCTP Circle

overview

Circle Cross-Chain Transfer Protocol (CCTP) is a cross-chain protocol produced by Circle, which enables the transfer of cryptocurrency in the type of stablecoins. USDC from 1 blockchain to a different by way of the “burn and mint” mechanism. This protocol was produced by Circle to remedy difficulties this kind of as liquidity fragmentation and simplify the consumer encounter in the Web3 area.

Details on how it operates

The core of Circle CCTP lies in the burning and minting mechanism. CCTP’s “burn and mint” mechanism operates by burning native USDC on the supply chain and producing the very same native USDC on the location chain. This is carried out by way of two principal contracts: “MessageTransmitter” and “TokenMessenger”.

Message transmitter: Responsible for sending and obtaining messages on each the supply and location chains.

Token Messenger: Perform precise message transfers to burn up USDC on the supply chain and develop USDC on the location chain.

In addition to two good…